Prices

April 26, 2016

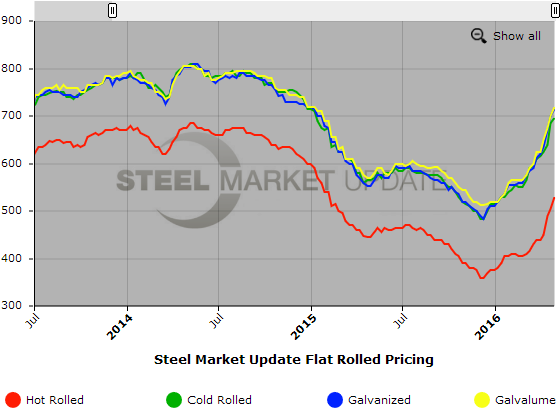

SMU Price Ranges & Indices: Is the Next Stop $600 Hot Rolled?

Written by John Packard

What makes indexing flat rolled steel prices so difficult right now is you have steel mills quoting lead times that may be in May, June or even July for the same product. A hot rolled order placed on SDI last week is actually being produced at the same time as one placed on AK Steel a month or two ago. The base prices will be radically different when the steel is produced and shipped. OK, so we have to look at “new” orders and offers that are coming out of the domestic mills right now. Well, the other issue we have is a number of mills have opened and closed their order books, some are waiting for the new scrap prices to be announced for May while others may be taking spot orders but only on an allocated basis. This has created a very frustrated group of steel buyers.

The prices below are a snapshot in time taken with a grain of salt. There are offers to sell hot rolled as high as $580 per ton and we don’t think it unreasonable for those offers to go up to, or exceed, $600 per ton after the next round of price increases (which are expected by the end of next week). On the coated front we were told today that AK Steel had base price offers for spot out there at $38.00/cwt and NLMK USA was reported to have $37.00/cwt base numbers out there. The question is how long before coated base price levels reach the magical $40.00/cwt level (which seems to be a historical sticking point – not impossible to broach as we found out during 2008).

You will note that we have changed the verbiage we have after each item regarding lead times. With almost every mill either having a controlled order book or on allocation lead times become less important. What is important is when the order book opens, at what price, how many tons does the buyer have and how much time does the buyer have to place orders.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $520-$540 per ton ($26.00/cwt- $27.00/cwt) with an average of $530 per ton ($26.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago while the upper end increased $20 per ton. Our overall average is up $25 per ton over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: All mills on controlled order entry or allocation

Cold Rolled Coil: SMU Range is $680-$710 per ton ($34.00/cwt- $35.50/cwt) with an average of $695 per ton ($34.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week while the upper end remained the same. Our overall average increased $10 per ton over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: All mills on controlled order entry or allocation

Galvanized Coil: SMU Base Price Range is $35.50/cwt-$36.00/cwt ($710-$720 per ton) with an average of $35.75/cwt ($715 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average is up $15 per ton over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $770-$780 per net ton with an average of $775 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: All mills on controlled order entry or allocation

Galvalume Coil: SMU Base Price Range is $35.50/cwt-$36.50/cwt ($710-$730 per ton) with an average base of $36.00/cwt ($720 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to last week. Our overall average increased $20 per ton over one week ago. Our price momentum for Galvalume steel is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1001-$1021 per net ton with an average of $1011 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: All mills on controlled order entry or allocation

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.