Market Data

April 21, 2016

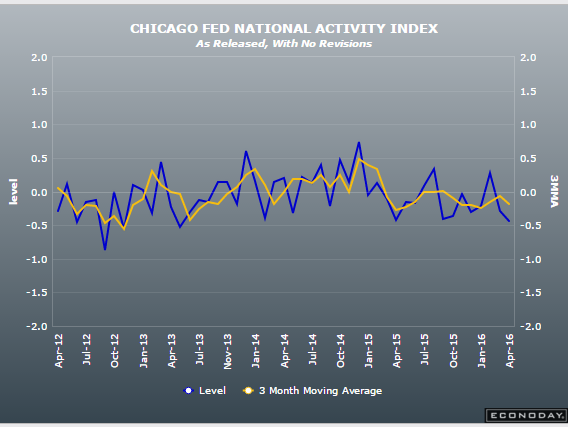

March CFNAI Shows Weakening Economic Activity

Written by Sandy Williams

The Chicago Fed National Activity Index (CFNAI), a gauge of economic activity and inflation, decreased to-0.44 in March from -0.38 in February. The three month moving average for the index also moved downwards to -0.18 from the revised February reading of -0.11 indicates national economic growth was below trend and suggest subdued inflationary pressure in the coming year. A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

The Index measures activity within four categories: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories. The first three categories declined in March while sales orders and inventories made a neutral contribution to the CFNAI by increasing slightly from February’s reading of -0.03.

Of the 85 individual indicators of the Index, forty-two indicators improved from February to March, while 42 indicators deteriorated and one was unchanged. Of the indicators that improved, 21 made negative contribution. The breakdown of components was as follows:

“The contribution from production-related indicators to the CFNAI ticked down to –0.31 in March from –0.30 in February. Industrial production declined by 0.6 percent in March for the second straight month. The sales, orders, and inventories category made a neutral contribution to the CFNAI in March, up slightly from –0.03 in February.

“The contribution from employment-related indicators to the CFNAI moved down to –0.04 in March from +0.02 in February. The civilian unemployment rate edged up to 5.0 percent in March from 4.9 percent in February. Moreover, nonfarm payrolls increased by 215,000 in March after rising by 245,000 in the previous month.

“The contribution of the personal consumption and housing category to the CFNAI ticked down to –0.09 in March from –0.07 in February. Housing starts decreased to 1,089,000 annualized units in March from 1,194,000 in February, and housing permits moved down to 1,086,000 annualized units in March from 1,177,000 in the previous month.”

Bloomberg writes, “This report, at least in March, may be over-stating the weakness in the economy, specifically employment which, though slowing from February, remains very strong.”