Analysis

April 20, 2016

US vehicle sales and NAFTA vehicle production, March 2016.

Written by Peter Wright

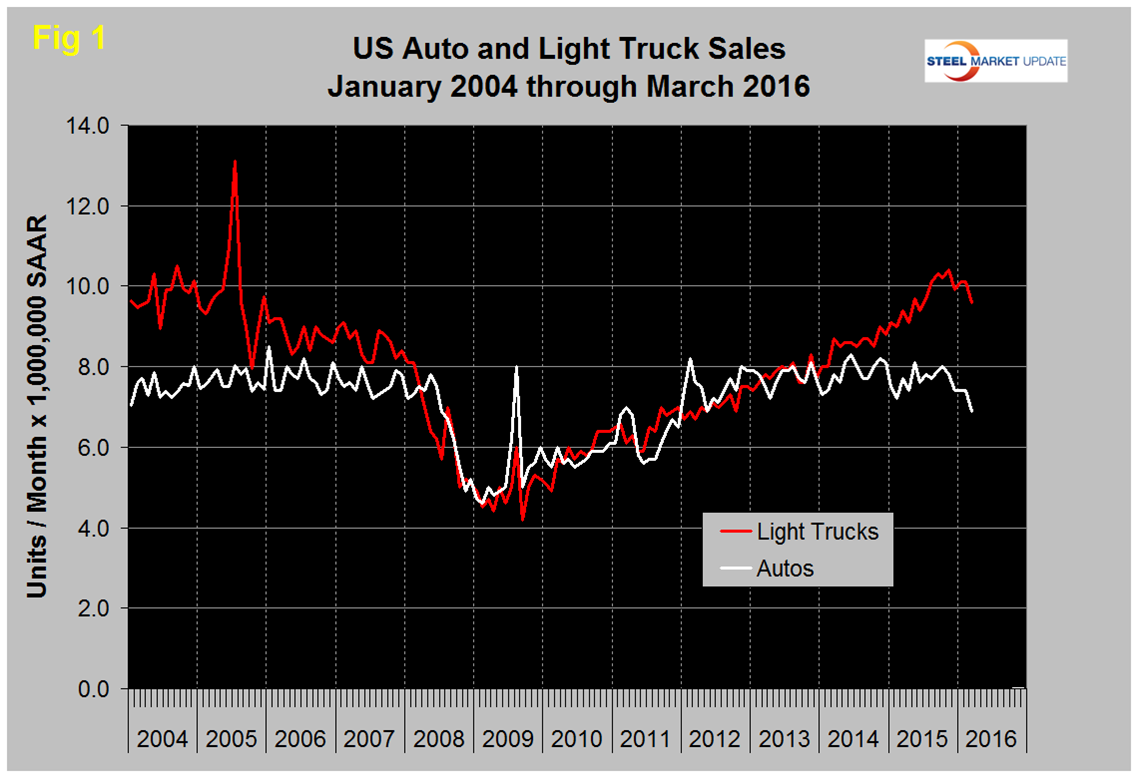

Both auto and light truck sales in the US dropped abruptly in March to a seasonally adjusted annualized rate (SAAR) of 16.5 million units, down from 17.5 million in February, Figure 1. Auto sales fell by 11 percent, while light truck sales rose 3 percent. Year-to-date sales are 3 percent higher than for the first quarter of 2015. This is not likely to be the start of a trend as consumer fundamentals continue to improve. Moody’s Analytics has expected vehicle sales to ease once pent-up demand was satisfied, because a pace above 17 million units exceeds the approximately 16.5 million units consistent with underlying fundamentals, including the size of the driving population, income and wealth. Light truck sales which include crossovers have been doing much better than autos since mid-2014. In March auto sales were 6.9 million units or 41.8 percent as light trucks were 9.6 million units or 58.2 percent. In March, import market share was 20.6 percent. On April 4th Macro Analyst had a negative slant on future auto sales; “with such a huge amount of auto loan debt outstanding, auto lenders will have to slow loan growth and increase the costs and barriers for an auto loan. Auto lenders already start to be more aggressive in their pricing – which signifies worries about the credibility of borrowers. With more auto loan debt per borrower than ever before I expect a slowing loan growth. Just a slow-down or flat numbers won’t hurt the automobile industry that much. As long as the consumers can pay back their debt in time, everything seems to be fine. But the bigger problem is that we have a bubble here which will have its sudden negative impact once it bursts.”

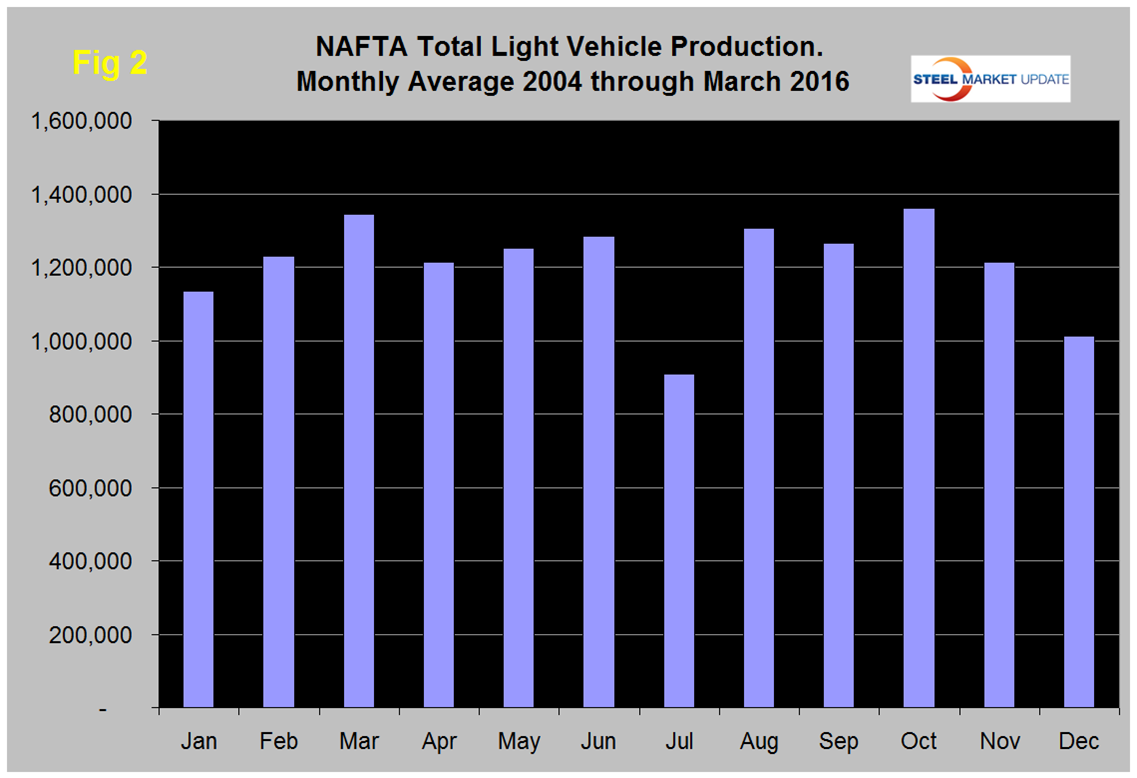

Total light vehicle, (LV) production in NAFTA in March was at an annual rate of 18.849 million, up from 18.216 million units in February. Total production in 2015 was 17.361 million units. In cases where seasonality is more than a weather effect we like to compare the monthly result with the monthly norm over a number of years. On average since 2004, March’s production has been 9.4 percent more than February. This year March was 3.5 percent more than February. To some extent this was a give back since the growth in February / January was more than normal, (Figure 2). Note: these production numbers are not seasonally adjusted, the sales data reported above are seasonally adjusted. On a three month moving average basis, (3MMA) March production was up by 4.5 percent year over year. March production was the second highest for that month since March 2000. History tells us that we can expect assemblies to contract in April.

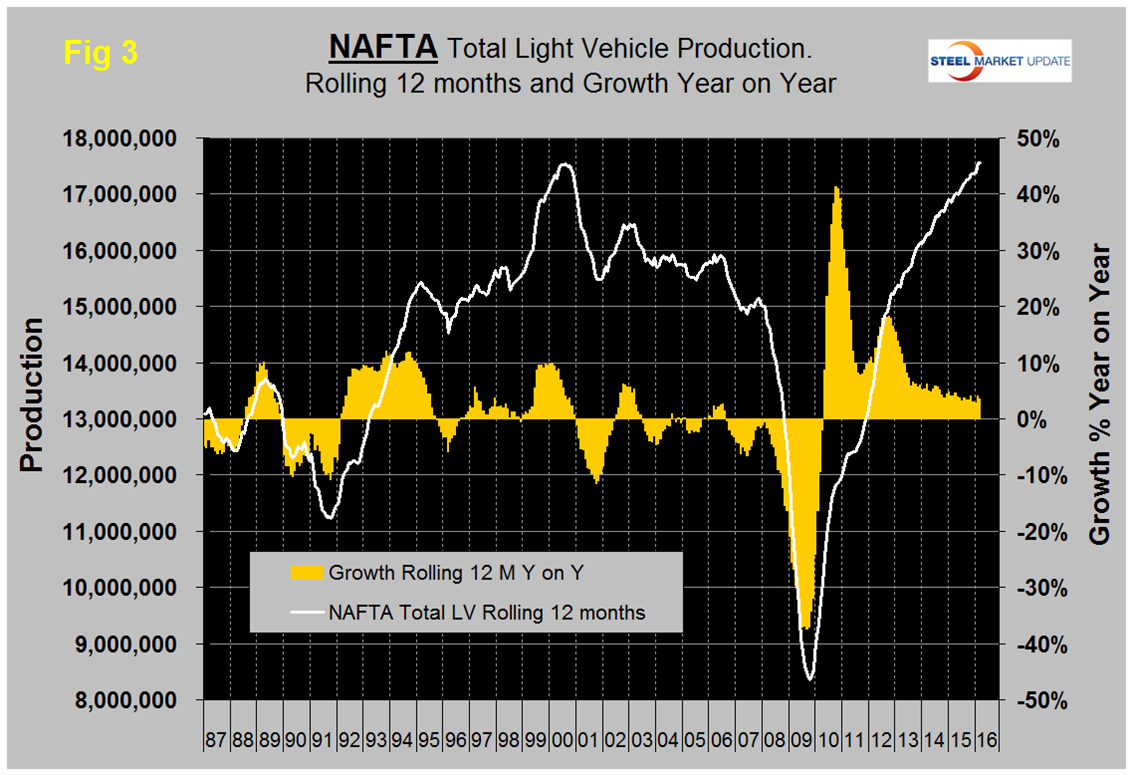

On a rolling 12 months basis y / y through March, LV production in NAFTA increased by 3.6 percent down from 4.1 percent in 12 months through February. LV production in NAFTA on a rolling 12 month basis in March was 17.550 million units, only 841 units less than February which was an at an all-time high, (Fig 3).

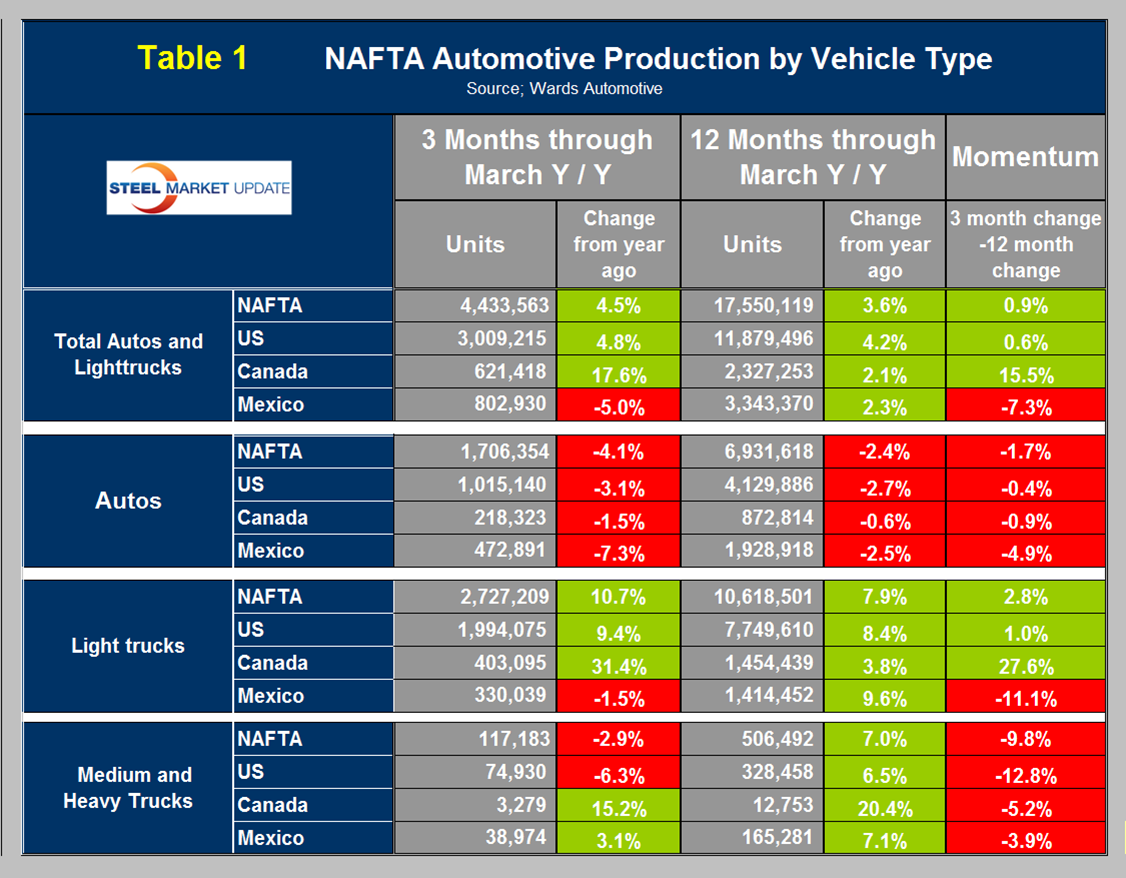

On a rolling 12 months basis y / y the US is up by 4.3 percent with positive momentum, Canada is up by 2.1 percent with positive momentum and Mexico is up by 2.3 percent with negative momentum, (Table 1).

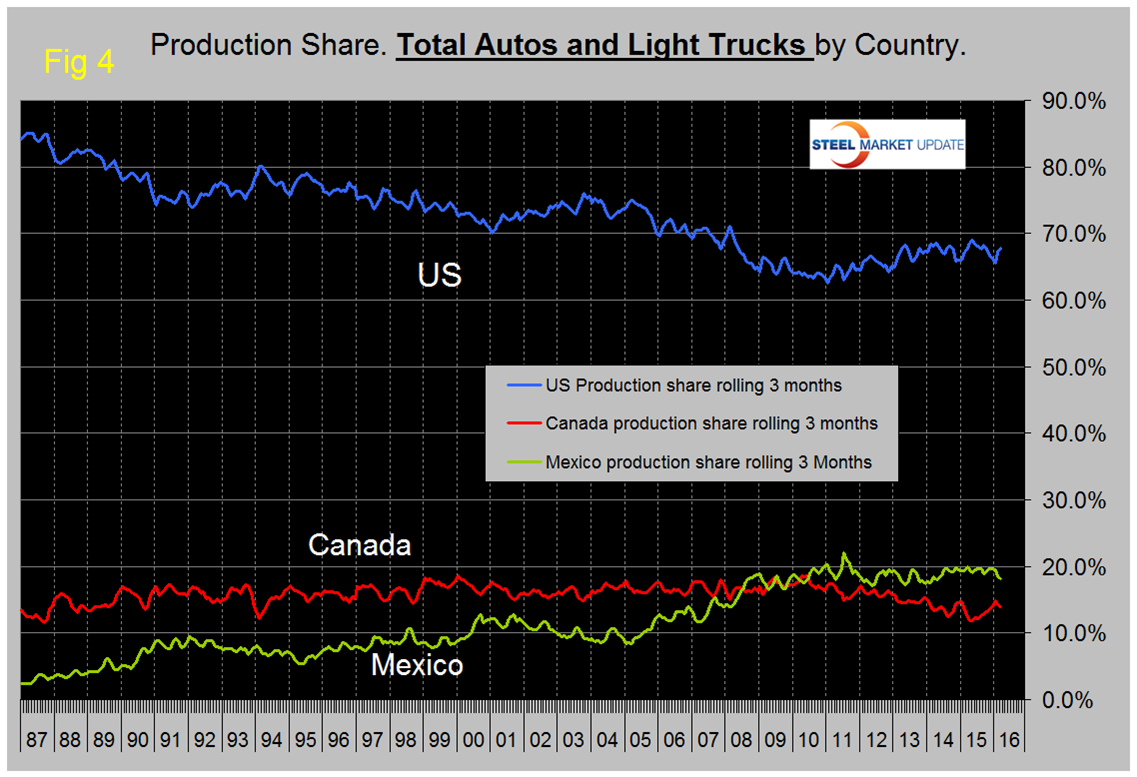

Mexico has had negative momentum for eleven straight months. The US has gained production share in the most recent 3 ½ years, (Fig 4) at the expense of Canada though that trend has slowed in the last 12 months when Canada picked up the pace. Mexico’s share has been fairly flat for five years and has declined in the last two months. In March on a rolling three month basis, the US production share of total light vehicles was 67.9 percent, (up 0.7 percent), Canada’s was 14.0 percent, down (0.2 percent), and Mexico’s was 18.1 percent, (down 0.5 percent).

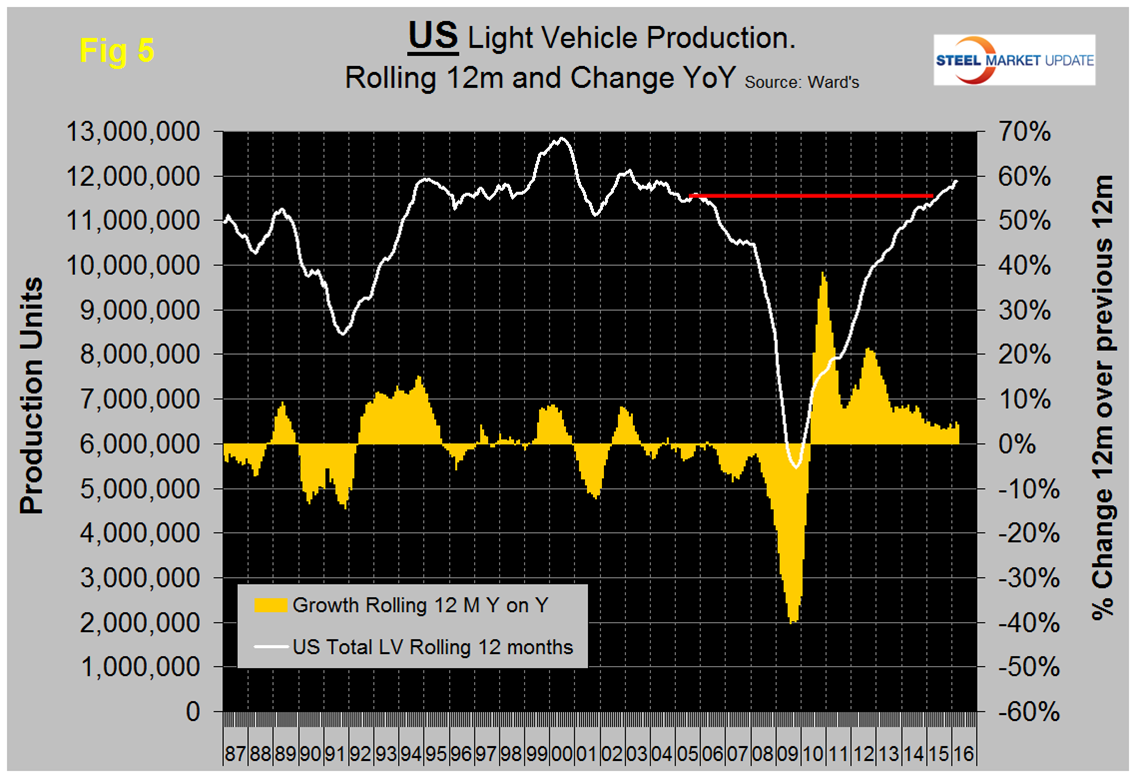

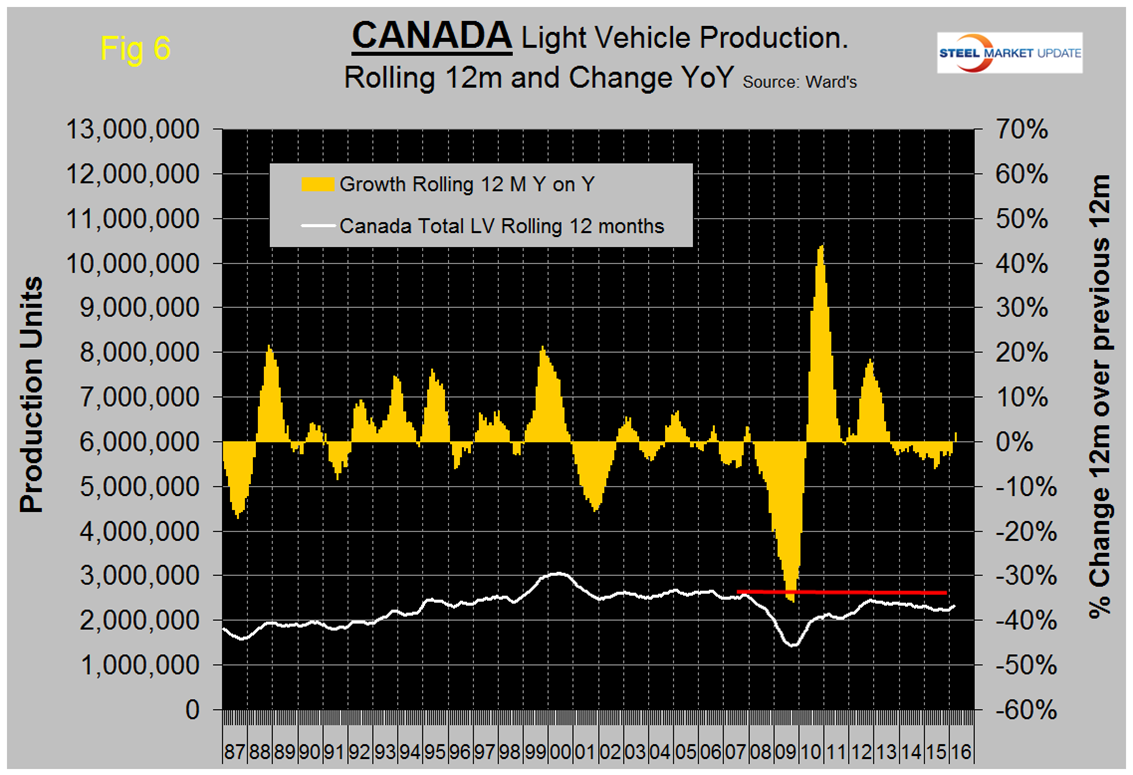

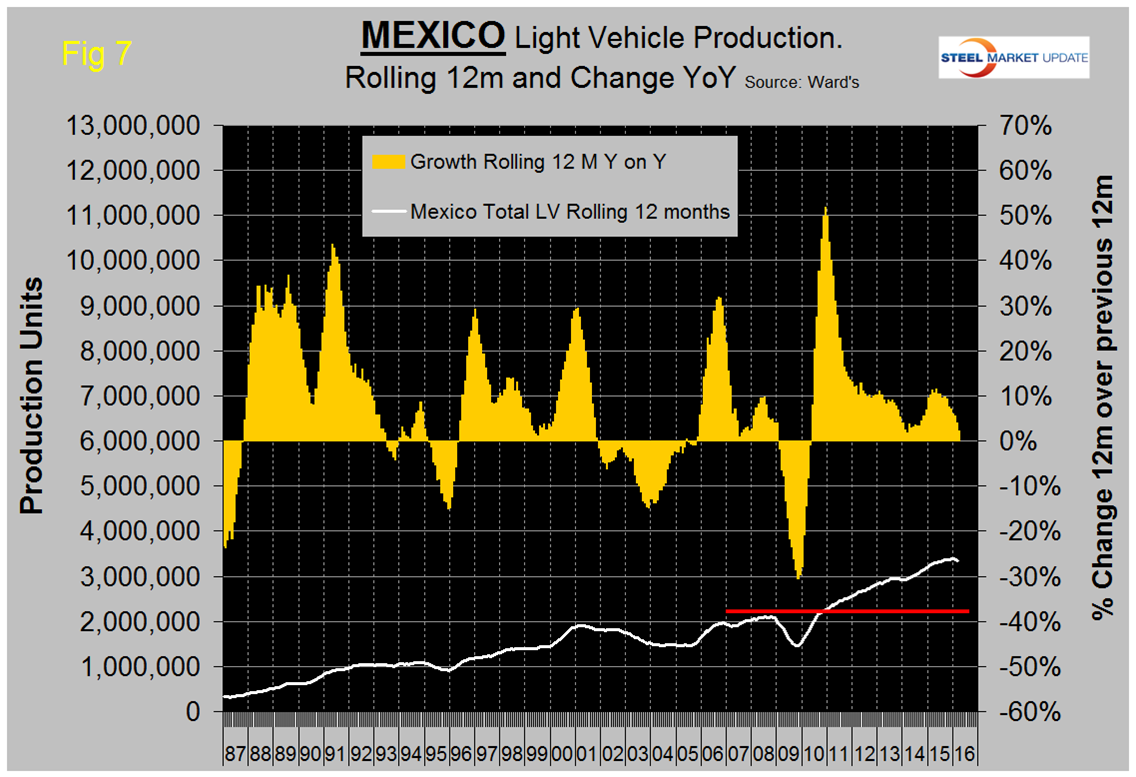

Figures 5, 6 and 7 show total LV production by country with y / y growth rates and on each the red line shows the change in production since Q2 2006. Note the scales are the same to give true comparability and that Mexican growth has slowed significantly this year and is now less than US. Canada had the first positive growth since July 2013. During the recession Mexico declined by less than the US and bounced back by more during the recovery. This caused Mexico’s production share to surge until Mid-2011 at the expense of the US.

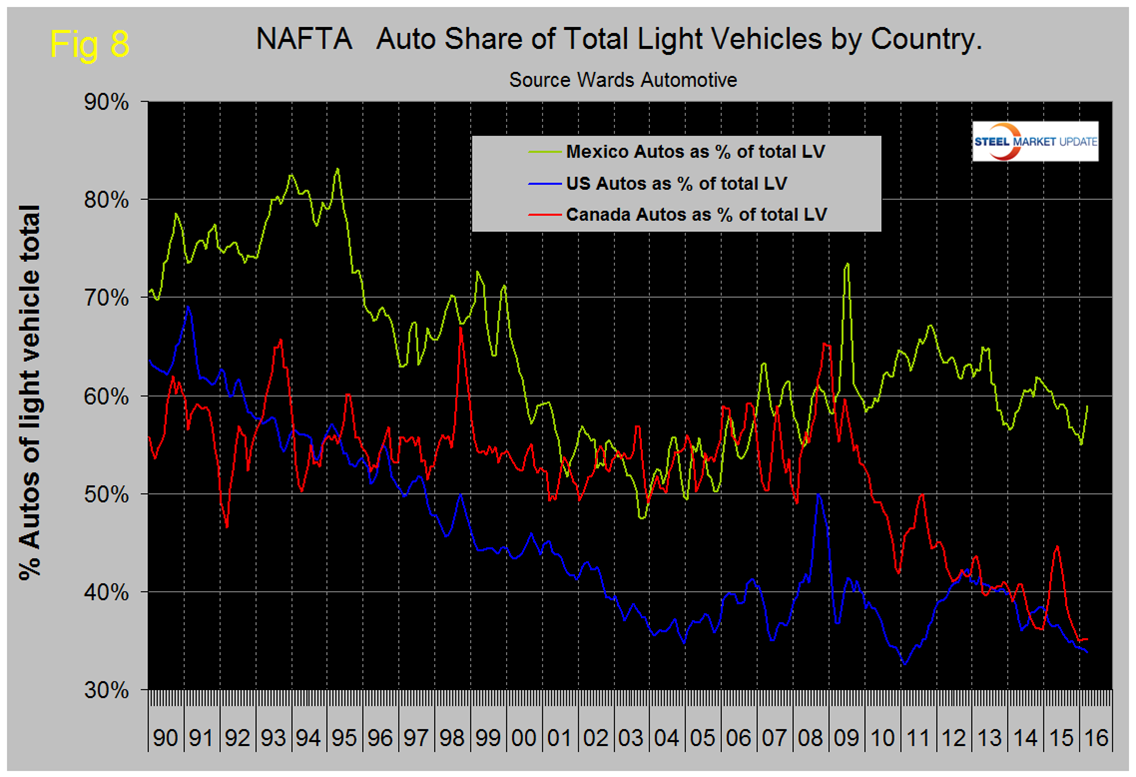

The percentage of light trucks in the production mix of all three countries has been increasing, driven by consumer buying preferences as described above. However in February and March the share of autos in Mexico’s product mix increased by 2.0 percent in February and another 2 percent in March. The change in preference for light trucks tends to favor the US and Canada over Mexico because the mix of light vehicles is very different by country, (Figure 8). The percentage of autos in the Mexican mix in the last three months was 58.9 percent but only 33.7 in the US and 35.1 percent in Canada. This means that Mexico has staked out a higher relative capacity in autos which will serve it well when gas prices eventually rebound.

Ward’s Automotive reported this week that total light vehicle inventories in the US decreased by 4 days of sales in March to 65 days which was 7 days more than March last year. Month over month FCA (Fiat Chrysler Automotive) was down by 7 days to 82, Ford was down by 4 to 80 and GM up by 4 to 71 days.

The SMU data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production and growth rate and production share by country.