Government/Policy

April 19, 2016

Status of Flat Rolled Trade Cases

Written by John Packard

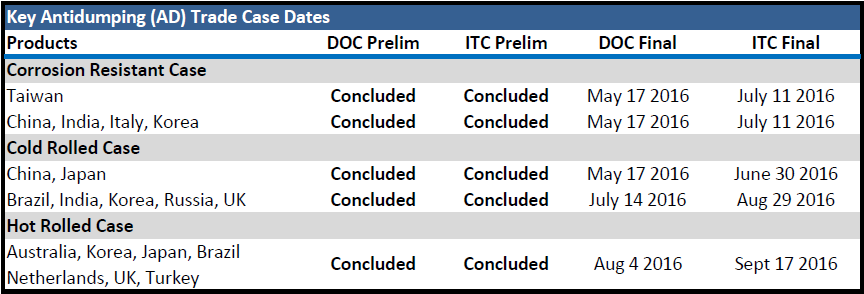

The following is a quick update on the status of the flat rolled trade cases (hot rolled, cold rolled and corrosion resistant) and what are the next important dates to remember. The corrosion resistant, which covers galvanized, Galvalume and related products such as galvanneal and aluminized, are scheduled to have the Final Determination by the US Department of Commerce voted on May 16 with the release to the public the following day, May 17th.

In each of the trade suits, the Preliminary Determinations from both the US Department of Commerce and the International Trade Commission are done. We are now entering the “Final” phase with the US DOC ruling first and then the ITC.