Prices

April 17, 2016

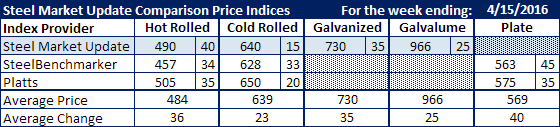

Comparison Price Indices: Big Price Moves

Written by John Packard

All of the steel indexes we follow reported flat rolled steel prices this past week with each showing major double digit gains for the domestic steel mills hot rolled, cold rolled, galvanized, Galvalume and plate.

Hot rolled prices surged with each index reporting at least a $34 per ton increase (+$35 for Platts and +$40 for SMU). There is a significant difference between the various indexes with SteelBenchmarker having the lowest number on HRC. SMU and Platts collection techniques are more closely aligned resulting in HRC averages closer to $500 per ton (SMU $490 and Platts $505). We expect the HRC numbers to continue to rise in the coming days with the new price announcements out of virtually all of the domestic steel mills.

Cold rolled prices also rose this past week and, like hot rolled, there is a spread between the low end of the range (SteelBenchmarker) and the high end (Platts).

.060″ G90 galvanized numbers also rose by large double digit numbers as did Galvalume (.0142″ AZ50, Grade 80).

Plate pricing surged an average of $40 per ton with Platts up $35 to $575 per ton and SteelBenchmarker up $45 to $563 per ton.

It is important to point out that SteelBenchmarker only reports pricing twice per month while SMU is weekly and Platts is daily.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.