Market Data

April 7, 2016

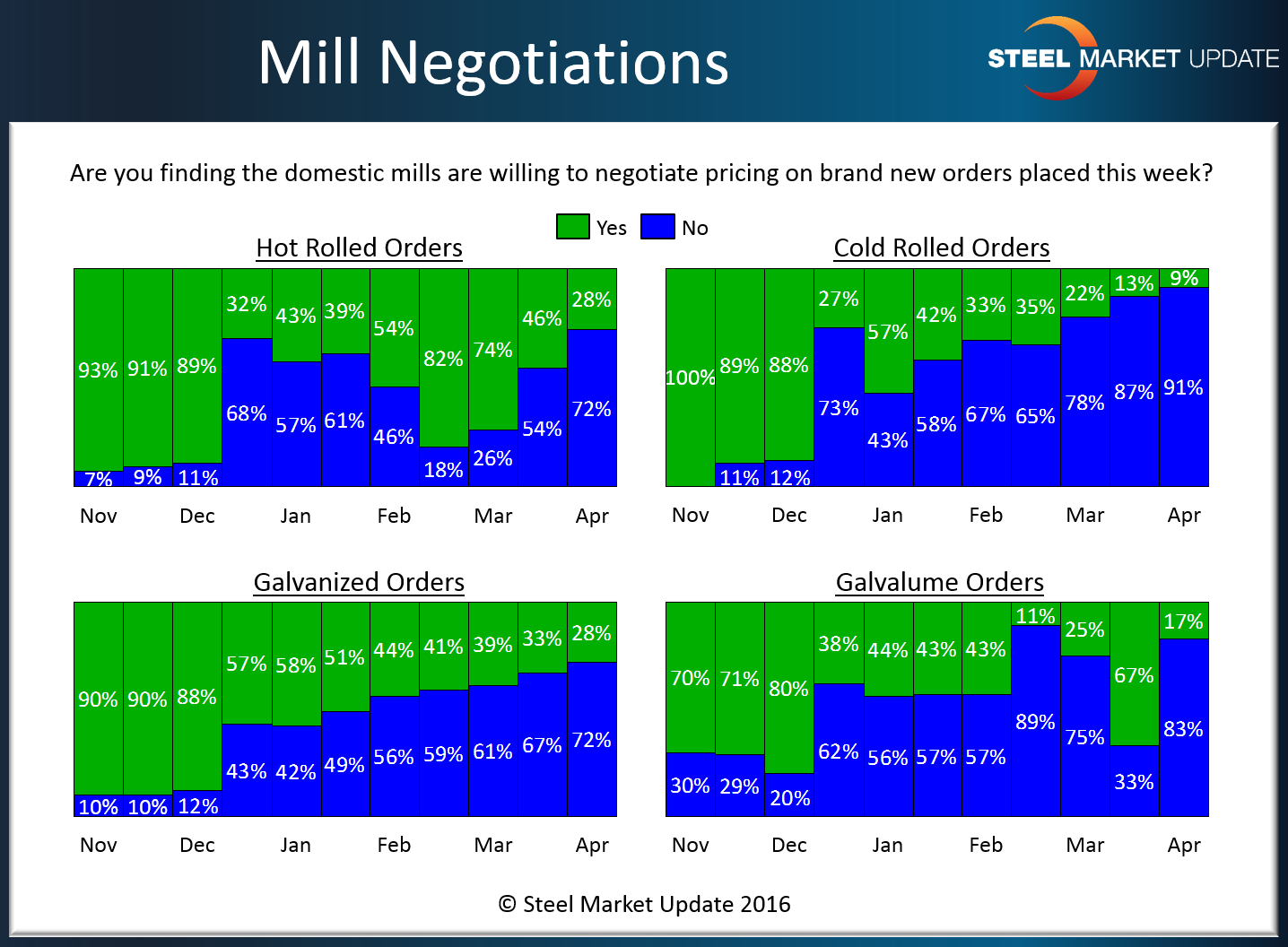

Steel Mill Negotiations: All the Chips are on the Mill Side

Written by John Packard

Buyers and sellers of flat rolled steel reported to Steel Market Update this past week that the domestic steel mills are less willing to negotiate steel prices. We believe this is due to strengthening order books, extending lead times, positive Sentiment and improving demand.

In fact, we were learning throughout the day today that many mills are either not in the spot market at all, or their order books are currently closed pending settlement of scrap pricing and having a couple of the larger mills (such as SDI) open their books.

We have had two price increase announcements so far this week: NLMK USA at +$40 per ton ($2.00/cwt) and SSAB at +$60 per ton ($3.00/cwt).

You can clearly see the trend for negotiations between the domestic steel mills and their customers based on the results of this weeks flat rolled steel market trends analysis.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.