Market Data

April 7, 2016

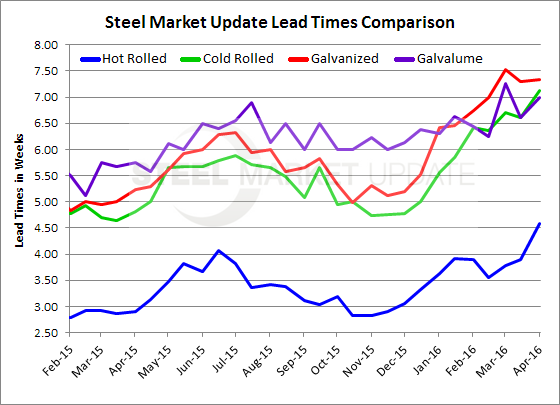

Steel Mill Lead Times Continue to Move Out

Written by John Packard

Steel mill lead times on all four flat rolled products have become more extended, according to those who responded to our most recent flat rolled steel market analysis. As lead times extend, steel buyers have to place more orders in order to protect their inventories. The more orders placed, the better chance for the domestic steel mills to collect higher flat rolled steel spot prices.

As our regular readers know, Steel Market Update writes articles about flat rolled steel mill lead times based on two sources: our twice monthly surveys and directly from steel buyers who receive lead time sheets from the mills (or receive them verbally). The following data is based on the lead times collected from our latest survey which concluded on Thursday (earlier today) of this week.

Hot rolled lead times averaged out to 4.59 weeks, 0.69 weeks higher than our last survey. This time last year they were 2.91 weeks.

The average lead time for cold rolled was 7.12 weeks, up from 6.60 in mid-March. One year ago lead times were 4.82 weeks.

Galvanized lead times were steady at 7.33 weeks. This time last year they were 5.24 weeks.

Galvalume lead times averaged 7.00 weeks, up 0.40 weeks from our last survey. One year ago they were 5.75 weeks.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.