Market Data

April 7, 2016

SMU Steel Buyers Sentiment Index Jumps to Record High

Written by John Packard

Based on our analysis of the most recent flat rolled steel market trends survey conducted by Steel Market Update this week, we continue to find buyers and sellers of steel being very optimistic. The current market index improved to +70 which is the highest (most optimistic) number ever recorded by our Sentiment Index going back to its beginning in late 2008. We believe buyers and sellers are responding to improving pricing fundamentals increasing the value of inventories and making it easier to be successful in the spot markets.

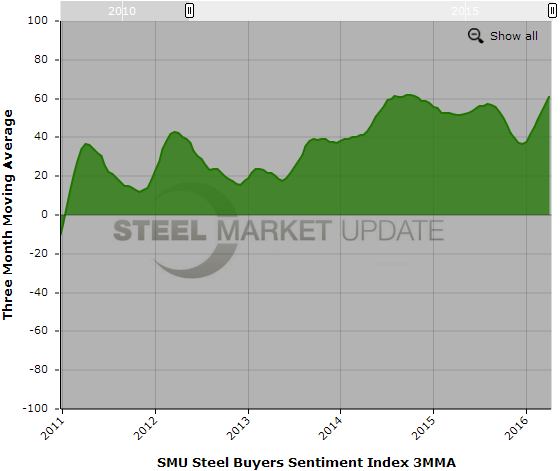

The +70 index reading is for how buyers and sellers feel about their company’s ability to be successful in the current market conditions (today). SMU likes to look at the same data over a three month period (rolling three month moving average) in order to gather a better sense of the underlying trend which has been gaining optimism since the first week of January 2016.

The new three month moving average of our Current Situation is +61.50, an increase of +4.33 over mid-March which averaged +57.17. In this current up cycle we have seen our 3MMA bottom out at +46.33 during the middle of December (the week after the first price increase announcements were made) and improve over each and every SMU reporting period since.

Future Sentiment 3MMA Close to Record High

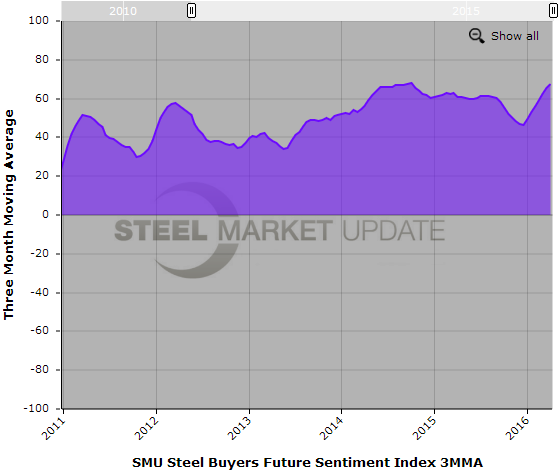

We asked buyers to look into their crystal ball and tell us if their company will be successful in the market three to six months into the future. Our “Future” Sentiment Index came in this week at +71 which is the same as mid March and 20 points more optimistic than the middle of December 2015.

Looking at Future Sentiment from the perspective of a 3 month moving average we found our growth trend firmly in place with a +67.33, the most optimistic reading we have had since the first week of October 2014.

What Our Respondents Are Saying

A manufacturing company told us, “We just need our competitors to show some spine and announce a price increase.”

Another manufacturing company put their spin to it with, “Some product lines are performing very well, but any products related to the energy industry are very depressed. If that picked up, we would be successful.”

A service center reported, “Now that the market has reversed, FIFO losses will turn into FIFO gains next fiscal qtr.”

A plate service center told us, “Plate market is coming around, finally…”

A combination service center and manufacturing company reported, “Orders are up for our Steel Service center portion of business; beat record month of previous month for March. Farm and Ranch equipment still down due to wet spring primarily.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 46 percent were manufacturing and 40 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.