Prices

April 7, 2016

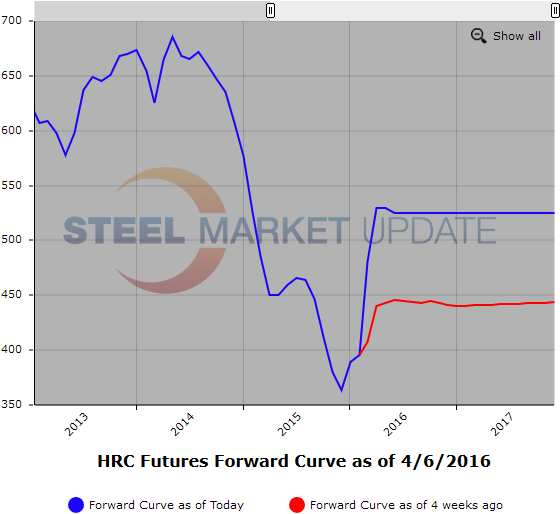

Hot Rolled Futures: Prices Gap Higher in Concert with Announced Mill Price Increases

Written by Jack Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how he saw trading over the past week:

HR futures activity, 11,900 ST traded this past week, had been relatively quiet until yesterday afternoon when prices “gapped” higher. This move could have been in response to announced mill price increase announcements and higher prices being paid for scrap. All week participants had been bid last value ($490 ST[$24.50cwt]) for May’16 through Dec’16. The futures curve May’16 out through Cal’17 was basically settled flat @ $490 ST. On Friday Jan’17 and Mar’17 both traded @ $490 ST[$24.50cwt] on 600 ST/mo.

With the exception of ’17 trades, nearby offers had been scarce so there was limited trading. However, yesterday morning Q3’16 traded @$494 ST[$24.70cwt] on 500 ST/mo. On the follow what looked like a far away $525 ST[$26.25cwt] offer was lifted for May’16, Jun’16, & Q3’16 on 500 ST/mo.This was immediately followed by additional trades in May’16 and Jun’16 @ $530 ST[$26.50cwt] on 500 ST/mo. Today May’16 and Jun’16 have again traded at $525 ST[$26.25cwt] down $5 from yesterday. On the follow May’16 traded @ $520 ST[$26.00cwt] on 900 St/mo. The $30/35 gap between the last prices traded for May’16 and Jun’16 surprised the market which has been lulled by the gradually rising HR prices.

Also of note today Cal’17 traded @ $514 ST[$25.70cwt] on 400 ST/mo which is significant because the most recent futures trades reflect a futures curve that has gone from contango to one that is in backwardation. However, market focus will probably return to the large contango between spot and the May’16 future. Even in the midst of another round of mill price increase announcements the above contango between spot and the nearby months appears to be a bit rich. (Last Steel Market Update HR spot range estimate of $440-$460 ST and last $525 ST trade price for the May’16 HR future.) Is HR supply constrained enough to warrant a $60/$65 premium over the next 7 weeks? With a lot of the mills closing their books for May and capacity utilization rates still running below 72% we expect good two way interest as participants look to answer this question following the sharp move higher in nearby futures prices.

Settlements as of Wednesday night:

Spot month $480

May’16 $530

Jun’16 $530

Q3’16 $525

Q4’16 $525

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Scrap

CFR Turkey scrap continues to grind higher. Last reported @ $245 MT but hearing cargoes moving in mid $250 range yesterday and possibly higher. Market chatter suggests supply tightness likely to run into May even as supplies improve. Expect further HR price increase announcements along with the addition of the Big River Mill will add additional price pressure in BUS.

BUS for April looks to be about $50 higher than last month. Hearing Detroit settling around $230 GT and everywhere else Midwest around $240 GT. We are still offering 2H’16 BUS @ $250 GT, 500 GT per month.

Indicative levels BUS

May’16 $240

Jun’16 $240

Q3’16 $250

Q4’16 $250