Analysis

April 2, 2016

U.S. Auto Sales Grow but SAAR Dips Below 17 Million

Written by Sandy Williams

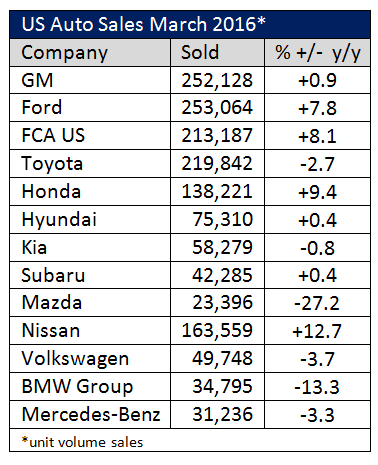

March U.S. automotive sales exceeded expectations on a year over year basis with total raw volume sales growing 3 percent due to higher volume of premium brands.

The seasonally adjusted annual rate of 16.5 million units, however, fell below 17 million for the first time since April 2015. WardsAuto expects a major spike in SAAR in April because of extra selling days during the month.

Wards Auto is currently forecasting a SAAR of 17.8 million units for 2016.

Toyota sales slowed in March, slipping 2.5 percent in unit sales. Bill Fay, Group Vice President and General Manager of the Toyota Division, commented:

“While 2016 has had a healthy start and while January and February are keeping pace from 2015, March has shown some softening, due to consumers being more cautious about spending – but they are still spending. The economy still feels stable, and fundamentals for consumer spending remain strong. The unemployment rate is expected to continue to decline, and, given the state of the economy, the Fed chose not to raise rates again in the first quarter. So we remain optimistic about the industry in 2016, as we prepare to head into the spring and summer selling season.”

A strong automotive market is critical to the success of the flat rolled steel industry which has been riding on the back of automotive ever since the Great Recession. Most forecasters have automotive remaining at the 17 million level through 2016 and into 2017. But, automotive is a cyclical business and we need to watch production and inventory numbers carefully.