Market Data

April 1, 2016

Gross Domestic Product Q4 2015 Third Estimate

Written by Peter Wright

The Bureau of Economic Analysis (BEA) released the third estimate of Q4 2015 Annual Revision of the National Income and Product Accounts on Friday.

![]()

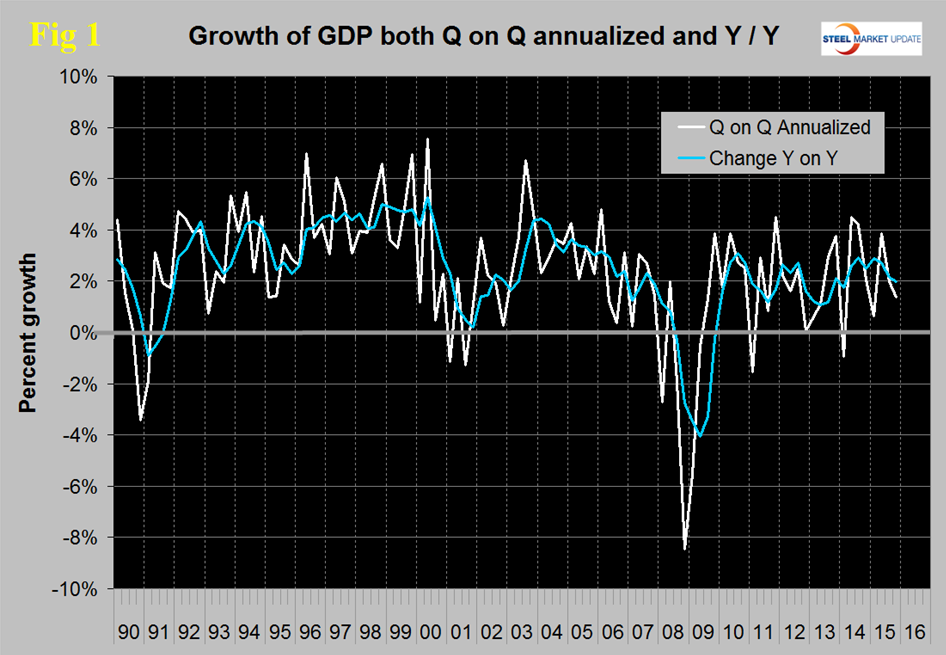

The annualized growth rate in the third estimate of the fourth quarter was 1.38 percent, down from 1.97 percent, in the third quarter and down from 3.86 percent in Q2. Normally there are two revisions of the first estimate and sometimes three. Revisions to the four quarters of 2015 were +0.4 percent, +1.59 percent, +0.5 percent and +0.69 percent respectively. GDP is measured and reported in chained 2009 dollars and in the third estimate of Q4 was $16.471 trillion. The growth calculation is misleading because it takes the quarter over quarter change and multiplies by 4 to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect.

The blue line is the trailing 12 months growth and the white line is the headline quarterly result. On a trailing 12 month basis year over year, GDP was 1.98 percent higher in the fourth quarter of 2015 than it was in Q4 2014. In the last five years, since Q1 2011 the trailing 12 month growth of GDP has ranged from a high of 2.88 percent to a low of 1.07 percent therefore the latest result is central within this variability.

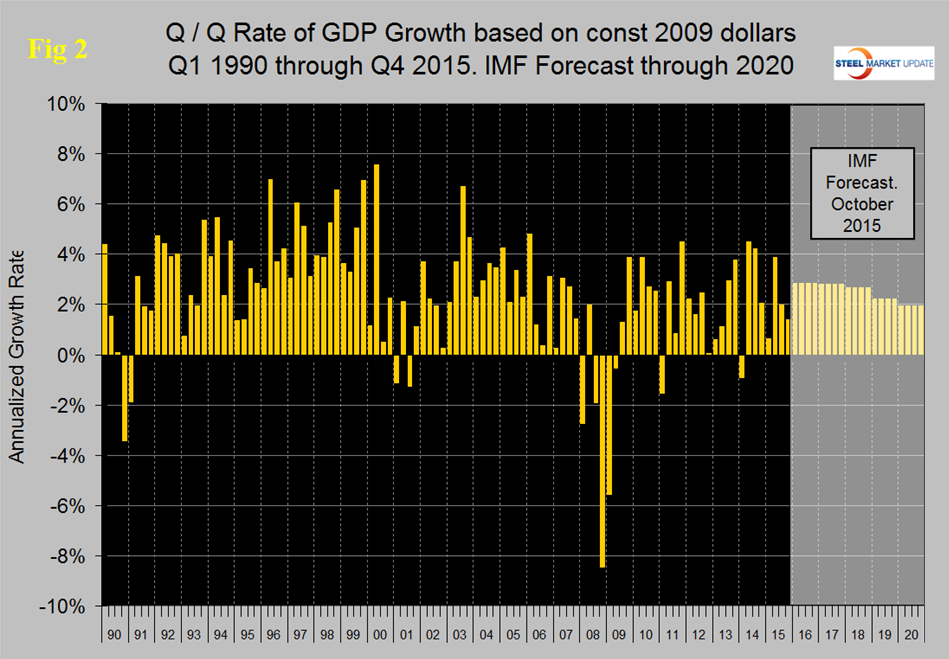

Figure 2 shows the headline quarterly results since 1990 and the latest IMF forecast through 2020.

In their October revision, the IMF downgraded their forecast of US growth in 2015 from their April estimate of 3.14 percent to 2.57 percent and downgraded 2016 from 3.06 percent to 2.84 percent. This April the IMF will release its next report on global and national GDP with forecast through 2020. We anticipate that the forecast for both global and US GDP will be reduced for at least 2016.

Historically it has been necessary to have about a 2.5 percent growth in GDP to get any growth in steel demand so this latest estimate of GDP doesn’t suggest any significant change in steel demand in the immediate future. This relationship is a long term average and in reality steel is extremely more volatile than GDP. If GDP takes a dive then steel demand craters and if GDP takes a sudden upturn steel soars. Neither of these extremes is evident at present.

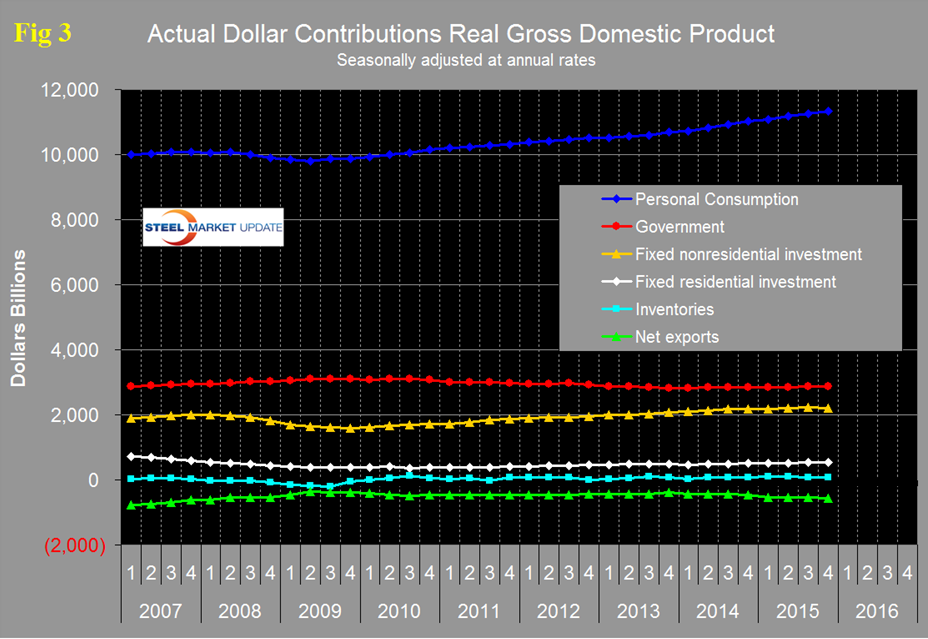

There are six major subcomponents of the GDP calculation and the magnitude of these is shown in Figure 3.

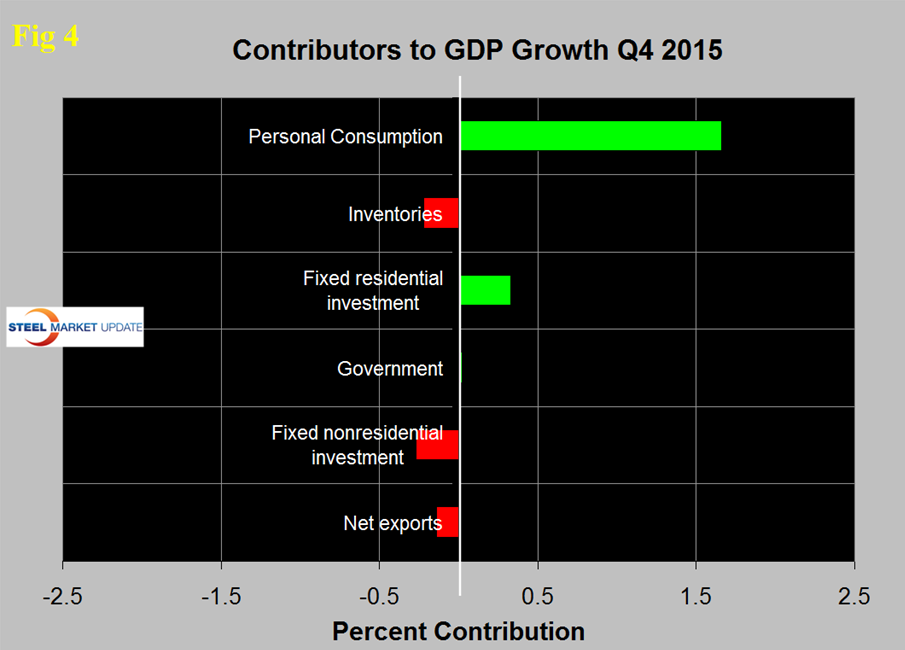

Personal consumption accounted for 68.79 percent of the total in the latest data. Figure 4 shows the change in the major subcomponents of GDP in Q4 2015 and the dominance of personal consumption as a growth driver.

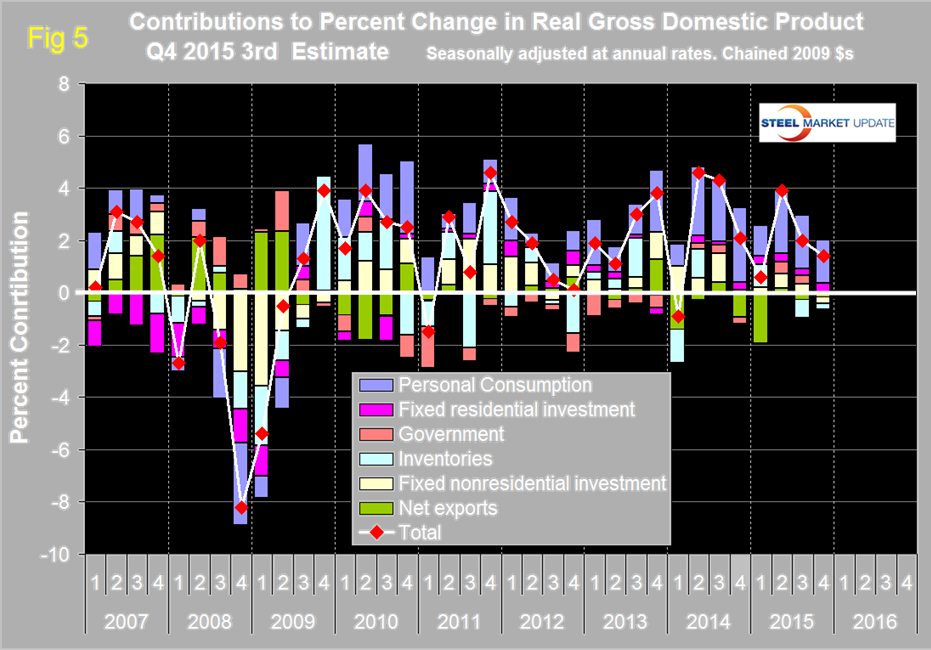

The change in fixed nonresidential construction was the greatest detractor, this includes nonresidential buildings and infrastructure which in the Commerce Department’s construction report did quite well in the fourth quarter. The BEA data for GDP is seasonally adjusted therefore we have a discrepancy in government data from different departments. Declining inventories have a negative effect on the overall GDP calculation and this was the case in the fourth quarter. Over the long run inventory changes are a wash and simply move growth from one period to another. Net exports also reduced the overall result by 0.14 percent. The effect of net exports has been very erratic. In Q1 they contributed negative 1.92 percent and in Q2 positive 0.18 percent. Figure 5 shows the same data as Figure 4 extended back through Q1 2007 and describes the quarterly change in the six major subcomponents of GDP.

Prior to the latest two quarters of data, the last time that inventories made a major negative contribution was Q1 2014. The contribution of personal consumption at 1.66 percent was down from 2.04 percent in the third quarter. Personal consumption includes goods and services, the goods portion of which includes both durable and non-durables. Government expenditures contributed 0.02 percent to growth in Q4 down from 0.32 percent in Q3. The contribution of fixed residential investment at 0.33 percent in Q4 was up from 0.27 percent in Q3 and has been fairly consistent and positive for the last seven quarters. The contribution of fixed nonresidential investment has been more variable and declined from positive 0.33 percent in Q3 to negative 0.27 percent in Q4. Inventories which had contributed negative 0.71 percent in Q3 contributed negative 0.27 percent in Q4. Figure 6 shows the breakdown of the $16 trillion economy.

SMU Comment: We have observed frequently in our SMU reports that steel demand has not been where it should be based on several previously indicative benchmark indicators and that a decline in inventories throughout the supply chain was likely a major contributing factor. This GDP data would seem to be supportive of that view as an inventory reduction has detracted from GDP for the last half of 2015.