Logistics

March 29, 2016

Logistics Report for Late March 2016

Written by Sandy Williams

Business conditions are still terrible in the ocean freight market as vessel operators cope with oversupply of ships and weak demand.

Wrote MID-SHIP in the March 24 MID-SHIP Report, “The freight markets are at levels not seen or experienced for 30-35 years and there is no silver bullet in sight, even though there is a general consensus developing that we have likely bottomed out but do not see a quick recovery for the market generally.”

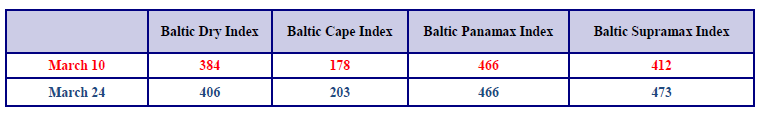

The Baltic Dry Index was at 406 on March 24, up from 332 on March 1. The average earnings for Cape size vessel was $2,005 on March 23. In an illustration of how bad conditions are in the cape size market, MID-SHIP noted that a charter hire rate in recent weeks for a transatlantic round trip voyage was $1000 per day, well below the operating expense of $7000 and $7500 per day for a cape size vessel.

Panamax, Supramax and Handysize market rates have been increasing in the past few weeks. The time charter route averages for the three markets as of March 24 were $3,650, $3,944 and $3,972, respectively.

Barge

River traffic has been slowed by high water conditions on several U.S. rivers. The barge market is seeing weak northbound demand as import volumes decrease across all commodity sectors including steel products and steel raw materials.

Great Lakes

The shipping season on the Great Lakes officially began March 25 with the passage of the Roger Blough through the Poe Lock at Sault Ste. Marie. The St. Lawrence Seaway opened a few days earlier on Monday, March 21.

Ice build-up was mild on the lakes this winter with the Coast Guard logging just 1,200 hours of ice breaking in Operation Taconite this past season.

Truck

The American Trucking Association reported that truck tonnage jumped 8.6 percent in February, setting an all-time record. Spot flatbed load volumes rose 11 percent and capacity declined 3 percent, which increased the load to truck ratio 14 percent up to 18.3 percent. National average diesel fuel price increased 2 percent to $2.119 per gallon. Fuel surcharges are expected in the range of $.24 to $.26 per one way mile.

Rail

U.S. rail traffic was down 14 percent year over year for the week ending March 19 according to data from the Association of American Railroads. Weekly volume included 235,390 carloads, down 17.2 percent y/y, while U.S. weekly intermodal volume dropped 190.7 percent to 248,073 containers and trailers. In the first 11 weeks of 2016 total rail traffic was 5,520,673 carloads and intermodal units, a decrease of 5.2 percent from a year ago.