Prices

March 24, 2016

Hot Rolled Futures: Difference a Week Makes

Written by Jack Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Andre Marshall and Jack Marshall of Crunch Risk LLC. Here is how they saw trading over the past week:

Financial Markets:

Wow what a difference a week makes! Like a lot of you, I was on vacation last week and was surprised when I picked up a paper at the airport after a week off the grid to find out the world had turned bullish all of a sudden. I’m pretty sure it wasn’t that many writings ago that I warned our market that the world had gotten too bearish and that it couldn’t sustain, but I was shocked at the speed at which the media had all of a sudden decided that things looked rosier, much rosier.

The stock market reflected this enthusiasm with a big move up in that week. When I checked out on the 10th of March the S+P low was 1963 and when I read about last Friday’s market I saw an S+P 500 level of 2043 or a 4% move up in the week. This all but erased the markets year losses and put the S+P back to, and slightly above, where we were end year last year, with the May future last @ 2030 level. Support lies below around 2000 and the market looks poised to move higher to test the olds highs around 2137, but not likely before a retracement first in the interim. Two concerns still loom, crude’s direction and the U.S Presidential election, which continues to look like a circus, but now apparently with violence.

In Crude, we have bounced up against that $42/bbl. and so far failed with the crude May future now $39.60/bbl.. This is important for if it can’t get through this resistance then it will go back down to test/set the next low in the chart. Some think we test the $27/bbl. low again. Hard to predict, but we do know that when crude is depressed the markets overall get depressed so it’s something to keep an eye on.

Like Crude, Copper has also come of its highs earlier this week @ $2.30/lb zone with last market today $2.235/lb.. So again the concern is the rally was all “short-cover” driven and now the prices suffer due to continued challenging fundamentals, i.e. precarious China future and concerns over tepid world growth. For now however, prices remain healthy enough off the lows that buyers should still beware of upside risk.

HRC Steel

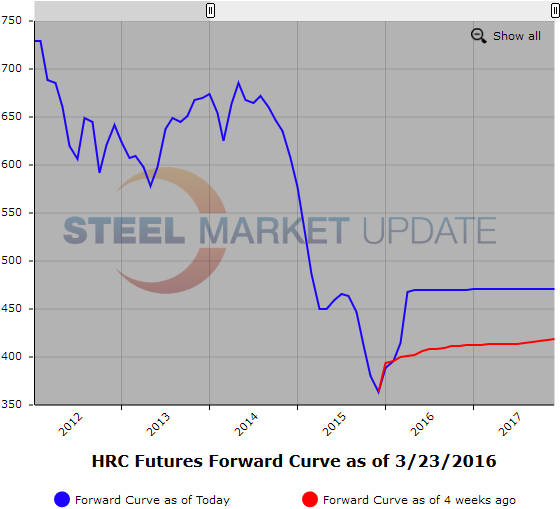

This past week HR futures prices continued to move higher, however transaction volumes were light as participants showed caution and were possibly frozen by the fast rising futures prices as the market experienced a small short squeeze. Last night the curve was basically flat @ $470 ST[$23.50cwt] Q2’16 out through Cal’17 with a large price gap between the spot futures month and the Q2’16 HR future. The CME HR spot month future (Mar’16) which last traded on Tuesday at $415 ST[$20.75cwt]is about $25 ST below SMU’s latest spot physical HR consensus estimate ($440ST). The $30/$35 price gap between physical spot and the Q2’16 and Q3’16 future has caught people by surprise, and appears to reflect some near term expectations of tighter available supply and thus higher prices. Import order cancellations due to anti-dumping duties appear to have added to the price pressure as near term domestic demand rises for nearby periods as some customers scramble.

We have had a slight uptick in futures buying inquiries which suggests that there may be more upside, at least near term, however volumes have been light and not focused on any particular period. Q2’16 HR futures price rose $14 from last week. It traded @ $456 ST[$22.80cwt] last Friday and @ $470 ST[$23.50cwt] yesterday and today. Q3’16 HR traded @ $470 ST[$23.50cwt] and $475 ST[$23.75cwt] yesterday and today, which is up from trades last week @ $460 ST[$23.0cwt]. Q4’16 HR traded @ $457 ST[$22.85cwt] last week and @ $470 ST[$23.50cwt] this Wednesday. In short the front end of the curve has moved up about $15 and the rest of the futures curve has moved up about $10 from last week and reflects a pretty healthy premium over the steadily rising physical spot price.($470-$440=$30).

Spot month $415

Q2’16 $470

Q3’16 $470

Q4’16 $470

Q1’17 $470

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Scrap

CFR Turkey scrap prices appear to have leveled off around $229 MT. They have been unchanged at $229 MT since dropping from $230 on Monday. Additional cargoes leaving the East Coast continue to put pressure on scrap supplies in North East which appears to be spilling over into Midwest markets. Markets expect continued scrap pressure as Chinese billet prices remain buoyed.

Chatter has April BUS prices rising around $30/$40 GT pushing the level up to roughly $225 GT. Shortage of pig iron and a pick up in mill activity is creating some tightness in supply as mills are not getting enough tons. We are currently seeing buying interest in Q2’16 BUS at $210 GT and selling interest in Q2’16 through Q4’16 at $240 GT.