Market Data

March 24, 2016

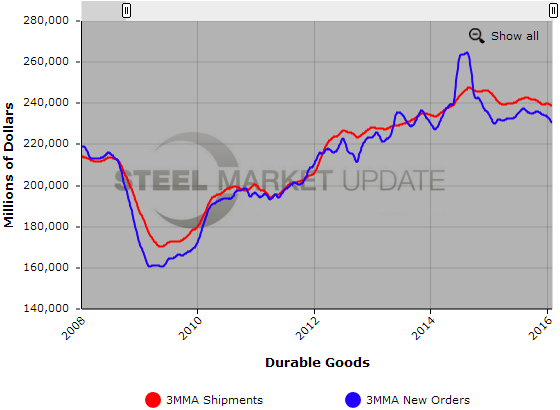

Durable Goods Orders Fall 2.8% in February

Written by Sandy Williams

Orders for durable goods fell 2.8 percent in February for the third decline in four months. The latest report from the Commerce Department shows transportation equipment leading the decrease, down 1.2 percent last month. Civilian aircraft orders plunged 27.1 percent leading the transportation equipment descent.

Inventories continued to decrease as manufacturers struggle to bring inventories in line with demand. Primary metals inventories decreased 1.2 percent to $33.2 billion, continuing 13 months of inventory realignment.

Shipments of manufactured durable goods, led by a decrease in transportation equipment, fell 0.4 percent after a 1.5 percent gain in January.

The 1.8 decline in orders non-defense capital goods excluding aircraft, considered core capital goods, reflects a continued softening in investment. Shipments of core goods are used in calculating gross domestic product and could result in a downward revision.

In contrast to the broad slow down reflected in the February report, recent manufacturing surveys point to strengthening of the sector for March, providing optimism for improved manufacturing orders in the coming months.

The text of the Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders February 2016 from the Department of Commerce follows:

New Orders. New orders for manufactured durable goods in February decreased $6.6 billion or 2.8 percent to $229.4 billion, the U.S. Census Bureau announced today. This decrease, down three of the last four months, followed a 4.2 percent January increase. Excluding transportation, new orders decreased 1.0 percent. Excluding defense, new orders decreased 1.9 percent. Transportation equipment, also down three of the last four months, led the decrease, $4.9 billion or 6.2 percent to $74.2 billion.

Shipments. Shipments of manufactured durable goods in February, down two of the last three months, decreased $2.1 billion or 0.9 percent to $238.3 billion. This followed a 1.5 percent January increase. Transportation equipment, also down two of the last three months, led the decrease, $1.0 billion or 1.2 percent to $79.0 billion.

Unfilled orders. Unfilled orders for manufactured durable goods in February, down two of the last three months, decreased $4.2 billion or 0.4 percent to $1,183.7 billion. This followed a virtually unchanged January increase. Transportation equipment down three consecutive months, drove the decrease, $4.8 billion or 0.6 percent to $789.1 billion.

Inventories. Inventories of manufactured durable goods in February, down seven of the last eight months, decreased $1.1 billion or 0.3 percent to $394.3 billion. This followed a 0.2 percent January decrease. Primary metals, down thirteen consecutive months led the decrease, $0.4 billion or 1.2 percent to $33.2 billion.

Capital Goods. Nondefense new orders for capital goods in February decreased $5.9 billion or 7.5 percent to $72.7 billion. Shipments decreased $1.9 billion or 2.5 percent to $75.4 billion. Unfilled orders decreased $2.7 billion or 0.4 percent to $742.0 billion. Inventories decreased $0.2 billion or 0.1 percent to $174.7 billion.

Defense new orders for capital goods in February decreased $2.6 billion or 25.6 percent to $7.5 billion. Shipments decreased less than $0.1 billion or 0.2 percent to $9.7 billion. Unfilled orders decreased $2.2 billion or 1.5 percent to $148.6 billion. Inventories decreased $0.5 billion or 2.4 percent to $21.7 billion.

Revised January Data. Revised seasonally adjusted January figures for all manufacturing industries were: new orders, $462.5 billion (revised from $463.9 billion); shipments, $467.0 billion (revised from $468.4 billion); unfilled orders, $1,187.9 billion (revised from $1,188.1 billion); and total inventories, $637.2 billion (revised from $637.5 billion).