Market Segment

March 18, 2016

Service Center Intake, Shipments and Inventory through February 2016

Written by Peter Wright

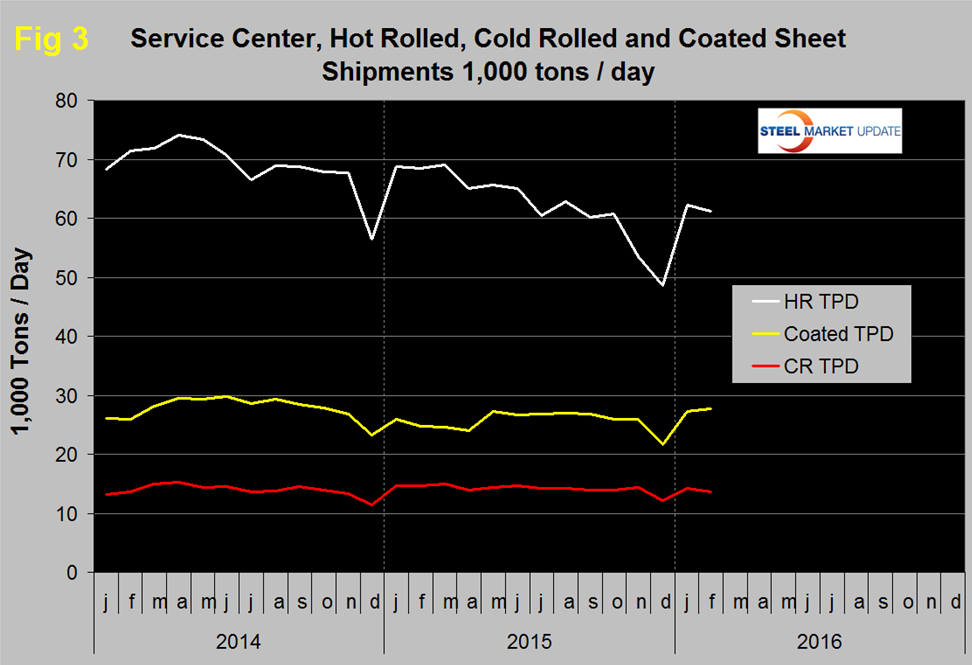

Based on Steel Market Update (SMU) analysis of the recently released MSCI service center inventory and shipment data, total service center carbon steel shipments increased by 125,500 tons in February to 3.034 million tons. Shipping days at 21, were up by one from January. On a tons per day basis (t/d) shipments decreased from 145,400 tons in January to 144,500 tons in February. In the eight years since and including 2009, February shipments on average on a t/d basis have been down by 0.8 percent from January, this year shipments were down by 0.6 percent.

![]()

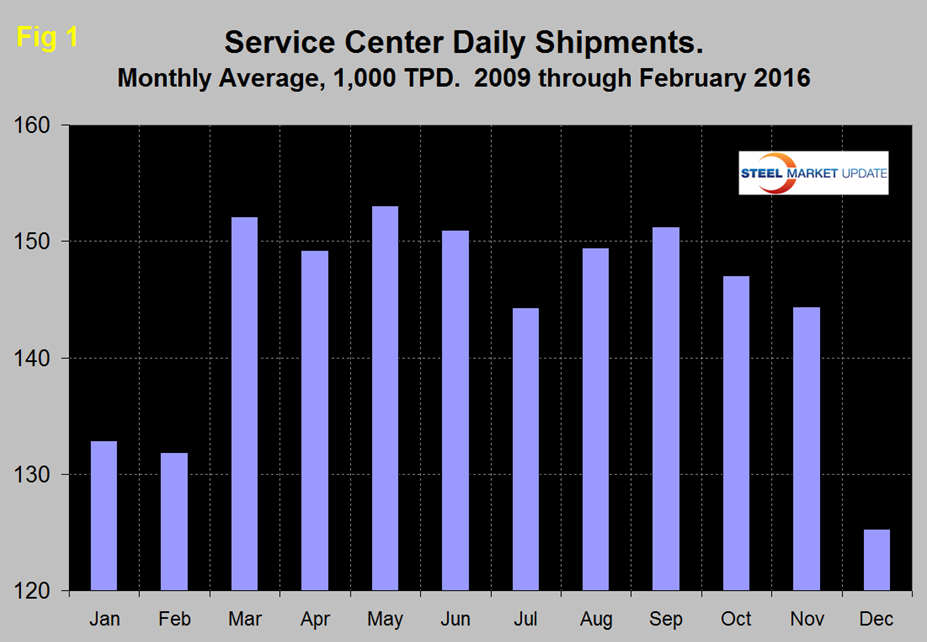

Therefore on a long term basis (8 years) the February performance compared to January was almost exactly normal. This observation is only intended to give a long term perspective because MSCI data is extremely seasonal and we need to get past that before commenting in detail on current results. Figure 1 demonstrates this seasonality and why comparing a month’s performance with the previous month is usually misleading.

Shipments in t/d decreased for three consecutive months in Q4 2015 and as is normal bounced back in January and were little changed in February. We can expect a surge in shipments this month. In the SMU analysis we always consider year over year changes to eliminate this seasonality. Table 1 shows the performance by product in February compared to the same month last year and also with the average t/d shipments for February in the last three years.

We then calculate the percent change between February 2016 and February 2015 and with the 3 year February average. Our intention is to provide an undistorted view of market direction. In February intake at 139,900 t/d was 4,600 tons less than shipments. This was the fifth month of deficit after three straight months of surplus. The intake deficit was evident for all flat rolled product groups except coated sheet and tubulars as long products had a small surplus. Compared to February 2015, intake was down by 9.9 percent overall.

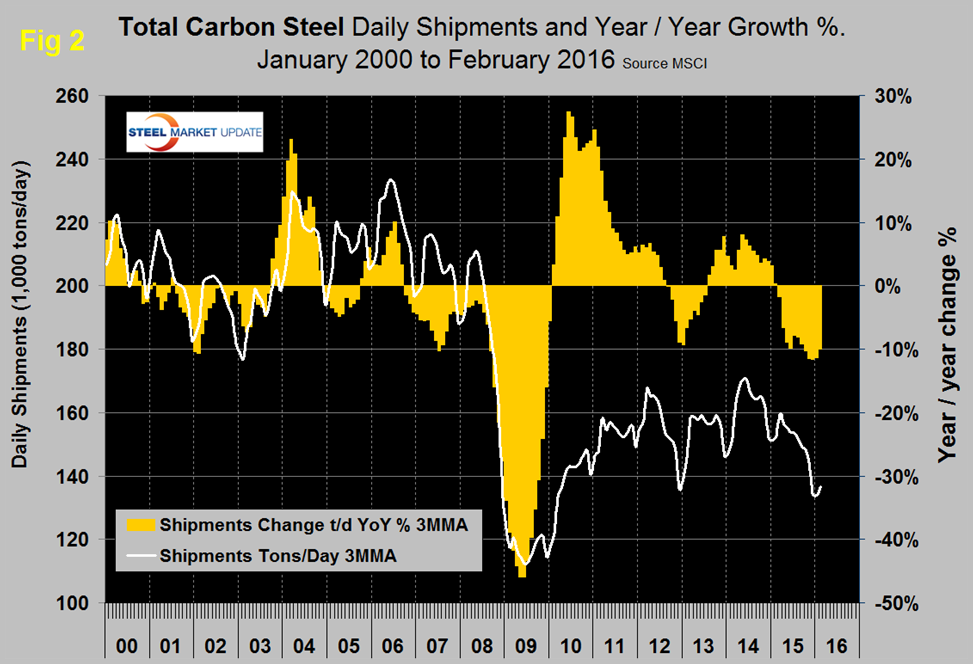

In December 2015 the MSCI expanded their data to include sub sets of the major product groups and provided two years of data covering all of 2014 and 2015. Table 1 shows the breakdown of sheet products into hot rolled, cold rolled and coated products. From an intake point of view, hot rolled and cold rolled were down by double digits but coated products had a huge (33.8 percent) y/y increase.

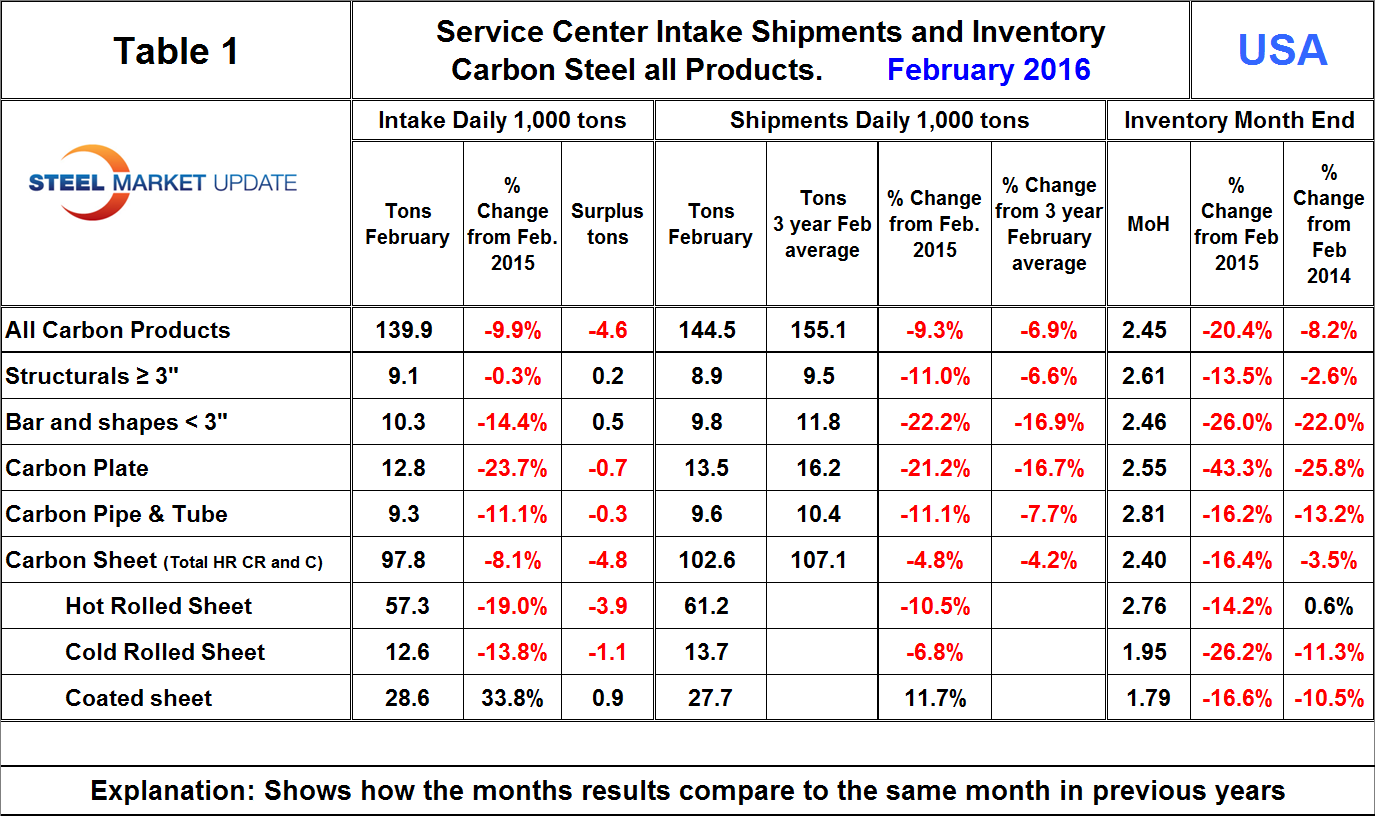

Shipments of all products on a t/d basis were down by 9.5 percent from February 2015 and were 6.9 percent less than the average February shipments for 2016, 2015 and 2014. The fact that the single month y/y growth comparison is worse than the three year comparison is an indication that momentum is negative and the contraction is accelerating. Figure 2 shows the long term trends of daily carbon steel shipments since 2000 as three month moving averages.

Daily shipments had a post recessionary high of 173,300 in April 2014 and as shown by the brown bars in Figure 2 have had 12 consecutive months of negative growth. In February shipments of all major product groups except sheet were down by double digits year over year. Within the sheet group, coated products had positive growth, the only bright spot in this whole report. Figure 3 shows the historical shipping rate of sheet products since January 2014.

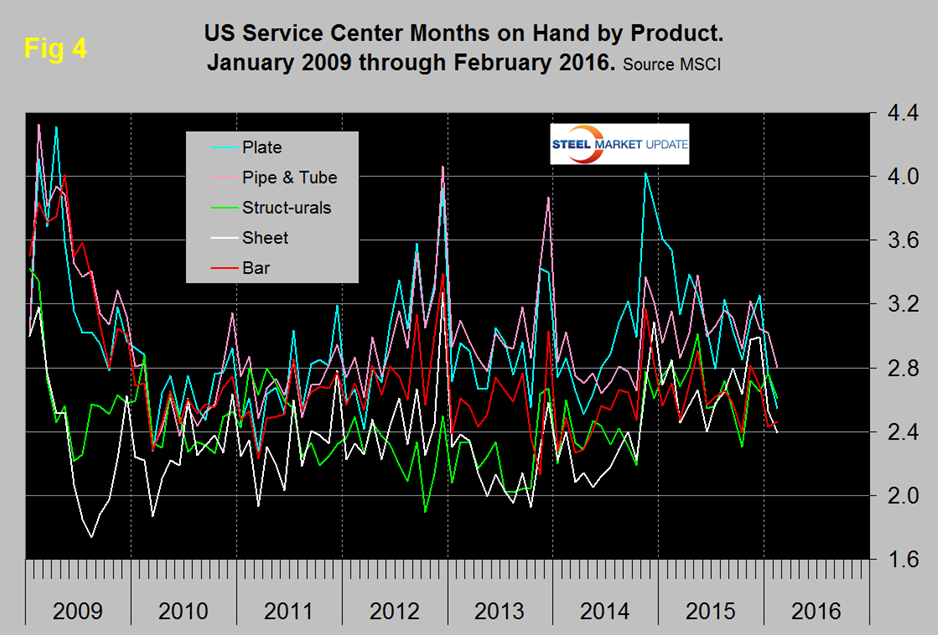

February closed with months on hand (MoH) of 2.45, down from 2.59 at the end of January. All products had a double digit y/y decrease in MoH and plate was down by 43.3 percent. Figure 4 shows the MoH by product monthly since January 2009. Pipe and tube currently has the highest months on hand.

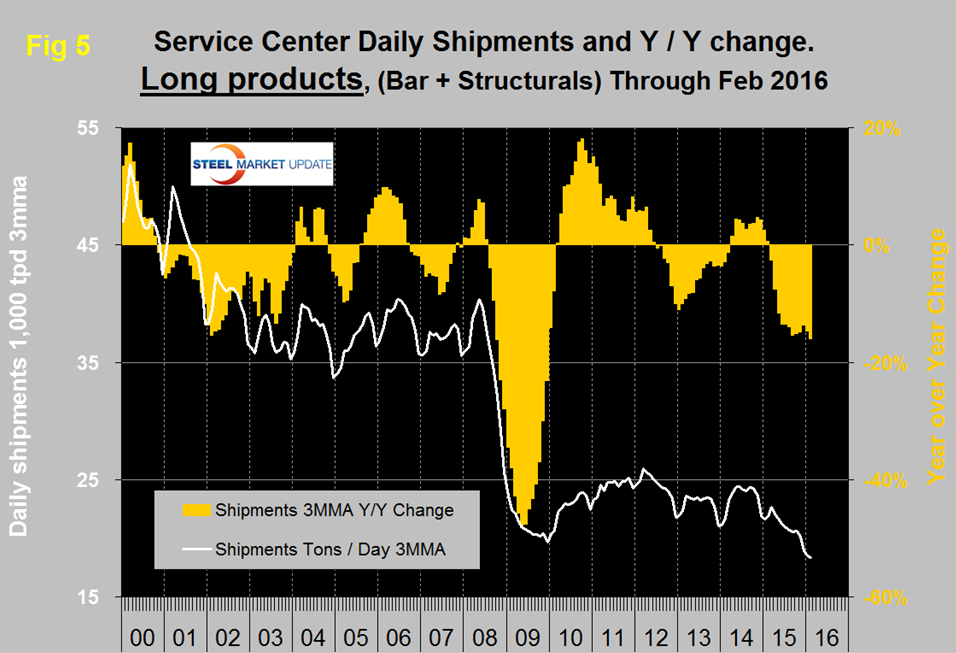

There continues to be a wide difference between the performances of flat rolled (sheet + plate) and long products (structurals + bar) at the service center level. Long products have had a very poor recovery from the recession. On a 3MMA basis y/y, the growth of long product shipments was negative for 21 straight months until April 2014 which was the first of eleven months of growth. However in March 2015 on a y/y basis shipment growth returned to negative territory and has stayed there ever since with double digit contraction for each of the last ten months (Figure 5).

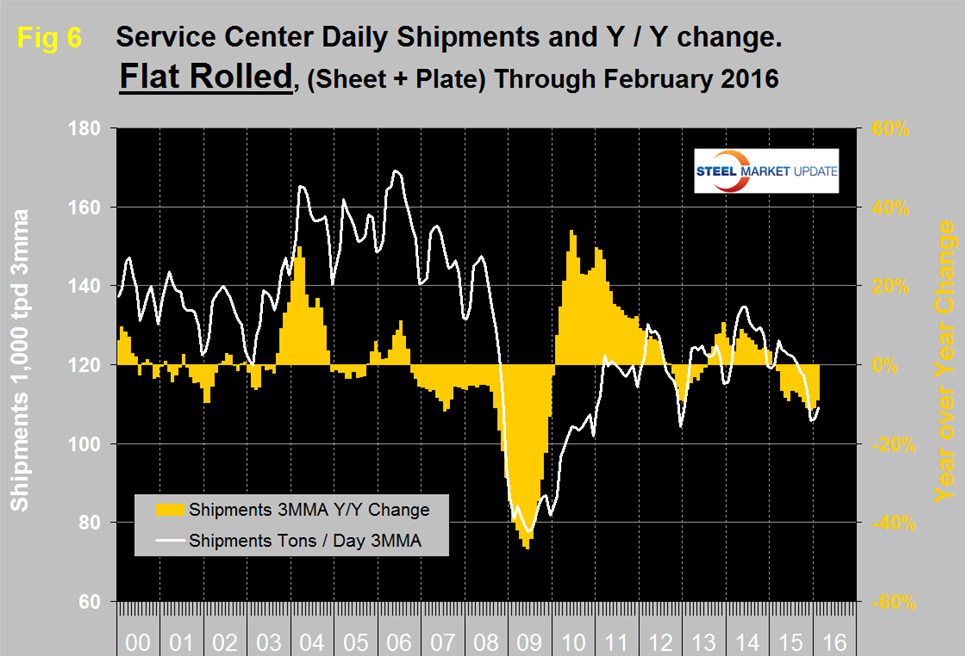

Considering the improving construction statistics, we have no explanation for this dismal and deteriorating long product performance other than that possibly more customers are bypassing service centers and buying direct from mill inventories or alternatively the numbers are just wrong because of gaps in company participation. Flat rolled has had a much better recovery since mid-2009 and had positive y/y growth for 18 straight months through January 2015. In February 2015 growth slowed to zero, in March came in at negative 1.6 percent and has been negative ever since (Figure 6).

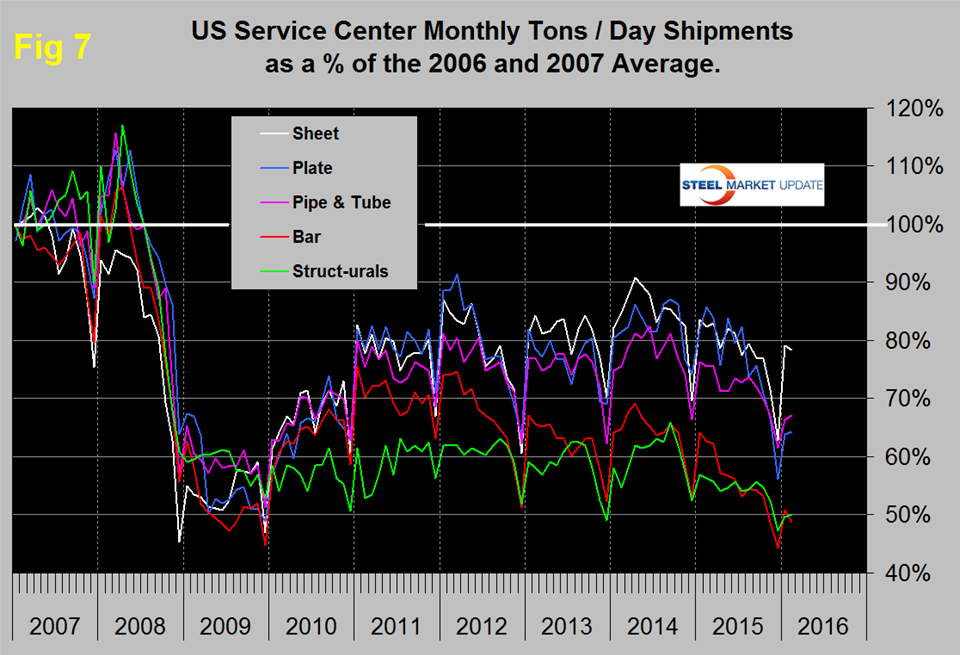

In 2006 and 2007, the mills and service centers were operating at maximum capacity. Figure 7 takes the shipments by product since that time frame and indexes them to the average for 2006 and 2007 in order to measure the extent to which service center shipments of each product have recovered.

All products experienced the normal January pick up and as described above bars and structurals have the worst record of recovery. Sheet had a strong upward kick in January with a small give back in February. The total of carbon steel products is now at 68.1 percent of the shipping rate that existed in 2006 and 2007, with structurals and bar at 50.1 percent and 48.8 percent respectively. Sheet is at 78.4 percent, plate at 64.3 percent and tubulars at 67.1 percent.

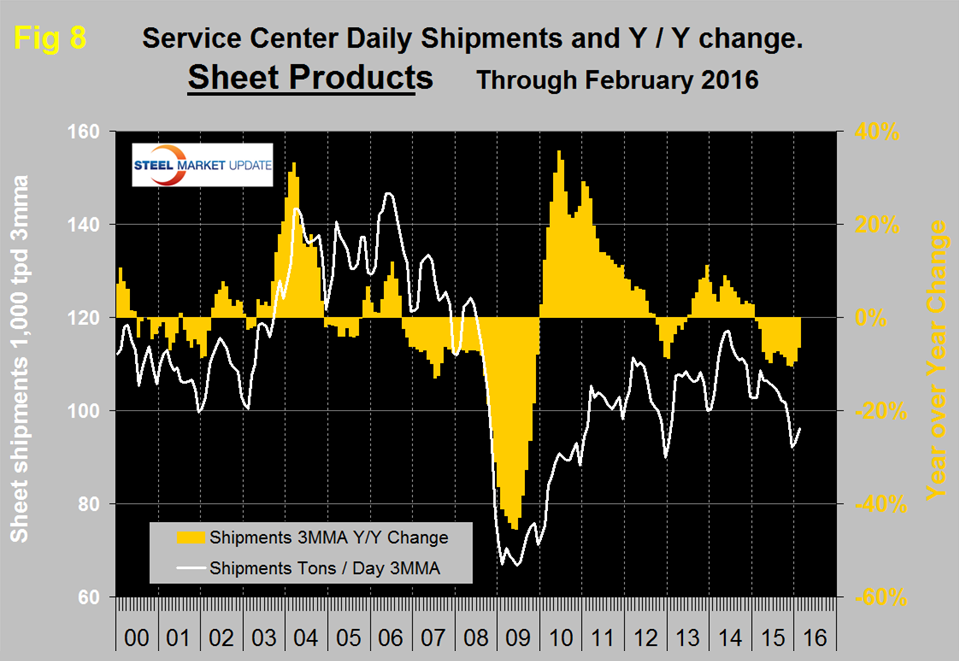

MSCI uses product nomenclature flat and plate. In this analysis at SMU we replace the term flat with sheet. MSCI’s definition of “flat” is all hot rolled, cold rolled and coated sheet products. Since most of our readers are sheet oriented we have removed plate from Figure 6 to highlight the history of sheet products which are shown in (Figure 8).

Following the strong post-recession recovery, sheet products experienced 9 months of decline from October 2012 through June 2013. This was followed by 19 months of growth through December 2015 but January 2015 slipped back into negative territory at -0.7 percent year over year and has been negative ever since with a 6.4 percent contraction in February 2016.

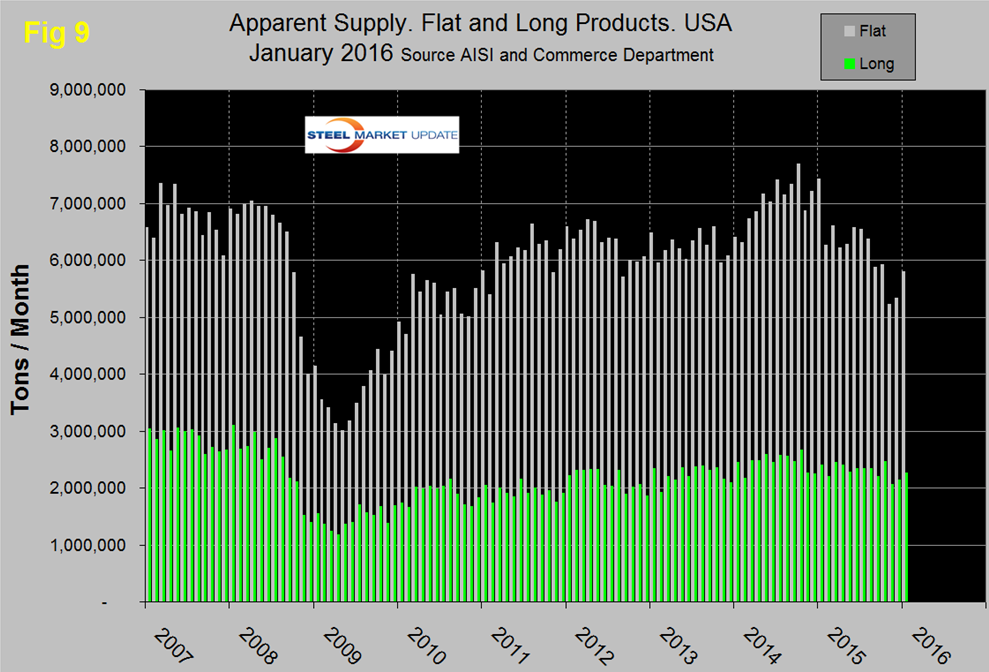

SMU Comment: In Figures 2, 5, 6 and 8, the white lines show t/d shipments. There was a distinct decline in shipments for all products throughout the second half of 2015 with a hesitation in February but on a y/y basis there is no light at the end of this tunnel. The MSCI data is looking like our report of total supply to the market which is based on AISI shipment and import data. Total supply of flat rolled products peaked in October 2014, dropped sharply in February then through August didn’t change much. However in November supply was the lowest since March 2010 as shown in Figure 9 (Note: this supply data is one month behind the MSCI information).

The SMU data base contains many more product specific charts than can be shown in this brief review. For each product we have ten year charts for shipments, intake, inventory tonnage and months on hand. Some readers have requested these extra charts for a particular product and others are welcome to do so.