Market Data

March 17, 2016

SMU Steel Buyers Sentiment Index Close to Record High

Written by John Packard

Buyers and sellers of flat rolled steel continue to smile when asked about their company’s ability to be successful both in the current market environment as well as looking out into the future three to six months. The result has taken the SMU Steel Buyers Sentiment Index higher and we are approaching record levels in many of our proprietary indices. The bottom line is the flat rolled steel marketplace is optimistic and moving higher.

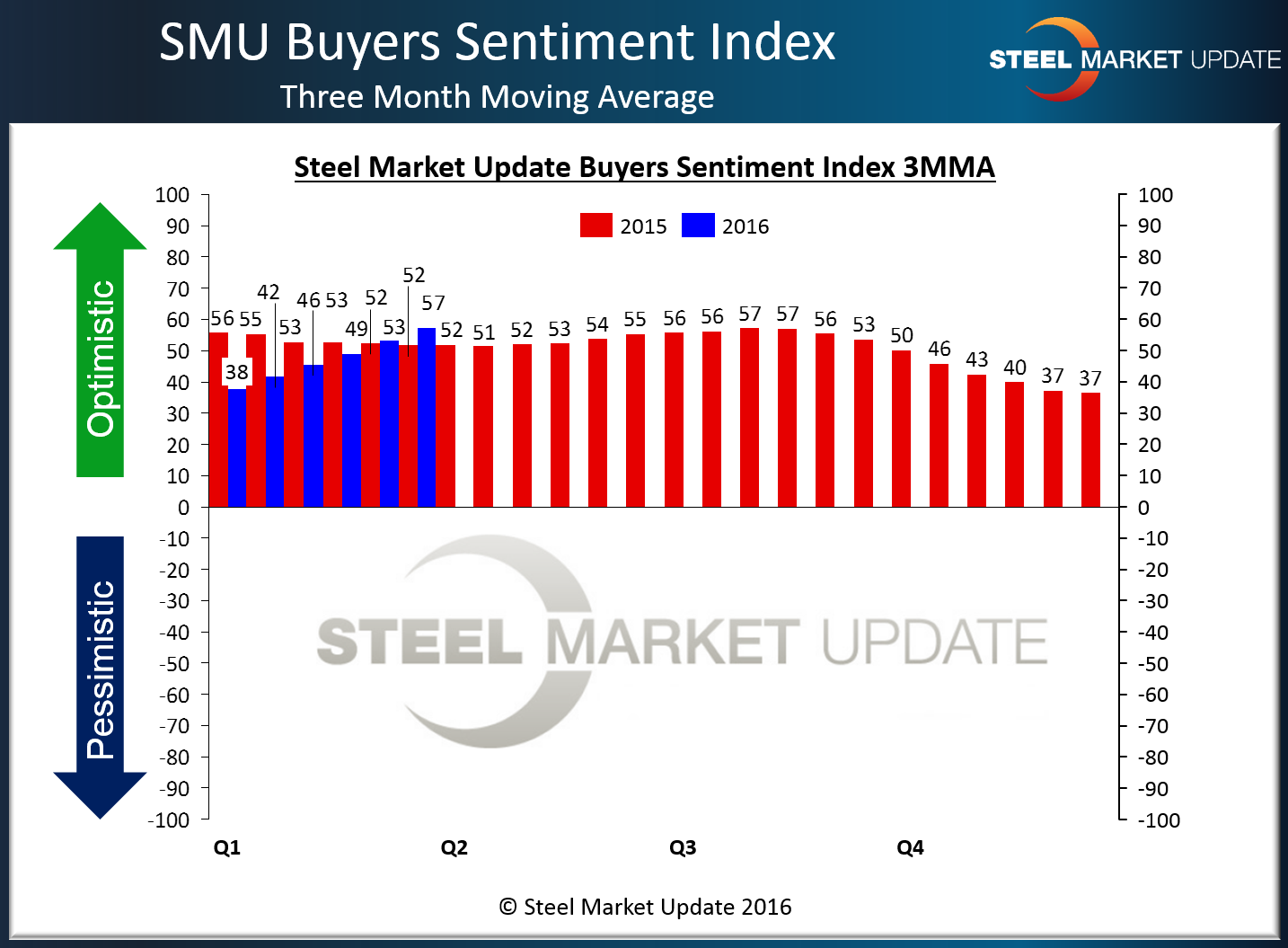

Current Sentiment was measured this week as being +67. This is +8 points higher than what we saw at the beginning of the month and is an outstanding +23 points more optimistic than what we reported at the beginning of the New Year. The highest level we have seen for Current Sentiment is +68 which was reported in August 2014.

On a three month moving average basis (3MMA) Current Sentiment rose +4 points to +57.17 which is the highest we have seen on our 3MMA since August 2015. The record for our 3MMA was the +61.83 reported during the middle of September 2014.

Future Steel Buyers Sentiment Index

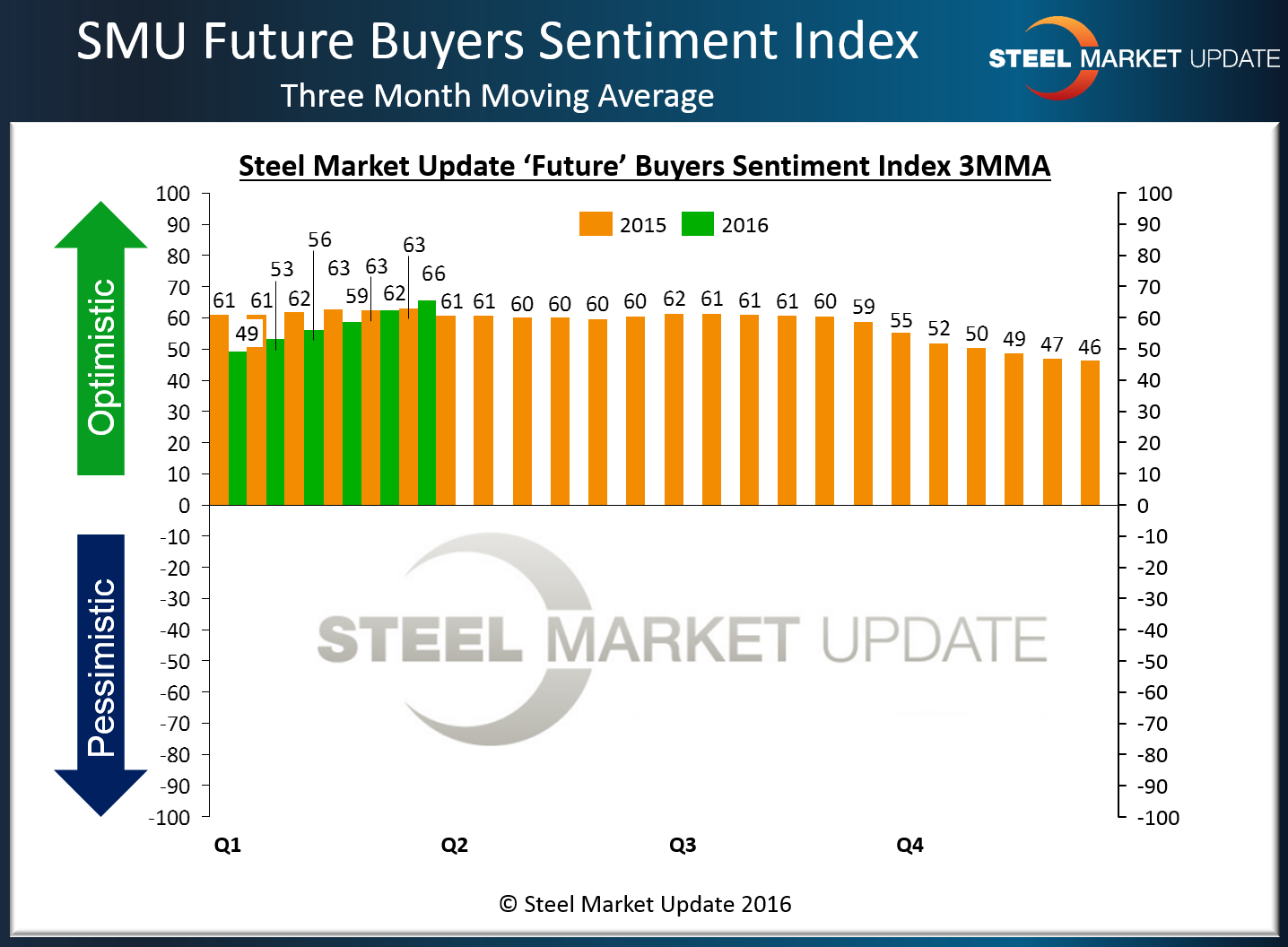

Buyers and sellers of flat rolled steel reported a more optimistic view of their company’s ability to be successful three to six months into the future. Our Future Sentiment Index rose three points to +71 which is the second highest reading we have seen since our Index began in late 2008. The highest mark reported was the +74 reported in mid-July 2014.

On a 3MMA basis Future Sentiment came in at +65.67, a +3.34 improvement over our beginning of March measurement and well above the +49.33 reported during the first week of January 2016.

Many steel buyers are of the opinion there will be further price increase announcements out of the domestic steel mills. Mill price increase announcements, assuming they can be collected, make inventories more valuable at both distributors as well as end users. The result should be widening margins in the spot markets where competition is working under the same business assumptions and play book. That is not always the case and SMU has heard from buyers in various regions around the country frustrated with those companies who are using their indexed based inventories, which trail the spot markets at lower than normal margins, for replacement cost.

Demand appears to be holding its own with energy, agriculture and large equipment weaker due to the high U.S. dollar and slowing business conditions in Asia and elsewhere.

Most steel buyers are somewhat insulated from the international markets unless their company is heavily involved in exports of OEM equipment. The automotive industry continues to chug along at a record pace (17 million+ units) and construction is bouncing higher as we move out of the winter doldrums and into what appears to be an early spring in most areas of the country.

We heard from both buyers and steel mills that order input has improved, including on hot rolled products as the removal of supply (integrated mill shutdowns coupled with smaller import tonnage) and confidence in the market has extended lead times and tightened prices.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 44 percent were manufacturing and 39 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.