Market Data

March 17, 2016

Auto Loan Defaults Causing Concern

Written by Sandy Williams

Record auto sales may be less about a stronger economy and more about auto lending practices, according to recent data by Fitch Ratings.

Auto loans given to borrowers with lower credit scores, called subprime loans, have resulted in an alarming rate of auto loan defaults. Seriously delinquent subprime car loans rose above five percent in February, said Fitch, the highest level in 20 years.

Bloomberg Business writes: “What’s drawn particular attention: auto loans to people with credit scores below 620—borrowers with the poorest credit—have increased more than 150 percent from the market bottom six years ago, compared with a 98 percent rise in overall auto lending in that period. Loans made to those borrowers still comprised a relatively small share of all originations last quarter at about 22 percent, up from 17 percent in 2009.”

Last year auto loans were above the $1 trillion mark for the first time ever with about a fifth of that made to subprime borrowers, according to Equifax. Easy credit with low down payments and extended payment terms combined with low fuel prices had consumers lining up for new autos. Fitch says subprime loan losses rose by 34 percent in February but are still below recession levels.

Subprime auto loans are not the same as the subprime mortgage loans that promise an investment for your money. Autos quickly depreciate and borrowers usually can manage car payments more easily than larger mortgage payments.

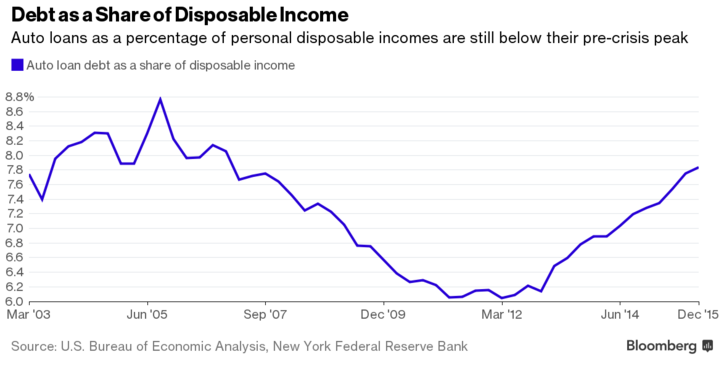

Andrew Hunter at Capital Economics says growth of auto loan debt is “fairly meaningless.” What matters, he says, is the whether households have the disposable income to service that debt.

In the Bloomberg chart above, auto debt is still below the pre-recession peak in 2005. And, while not booming, employment levels have been growing and with it wages which should keep most auto loan borrowers from delinquency.

Low interest rates were around 4 percent on 48 month loans in fourth quarter 2015 and higher rates, said Hunter, are unlikely to be a major threat since most auto loans are fixed rate.

So bottom line is don’t take a loan you can’t afford, and don’t worry so too much about those who do—car loans are not likely to crash the economy.