Market Data

March 11, 2016

Net Job Creation by Industry through February 2015

Written by Peter Wright

The Bureau of Labor Statistics (BLS) reported on Friday in their analysis of non-farm employment that 242,000 jobs were added in February, up from 172,000 in January, December and January were revised up by a total of 30,000. More detail on this report is included at the end of this piece.

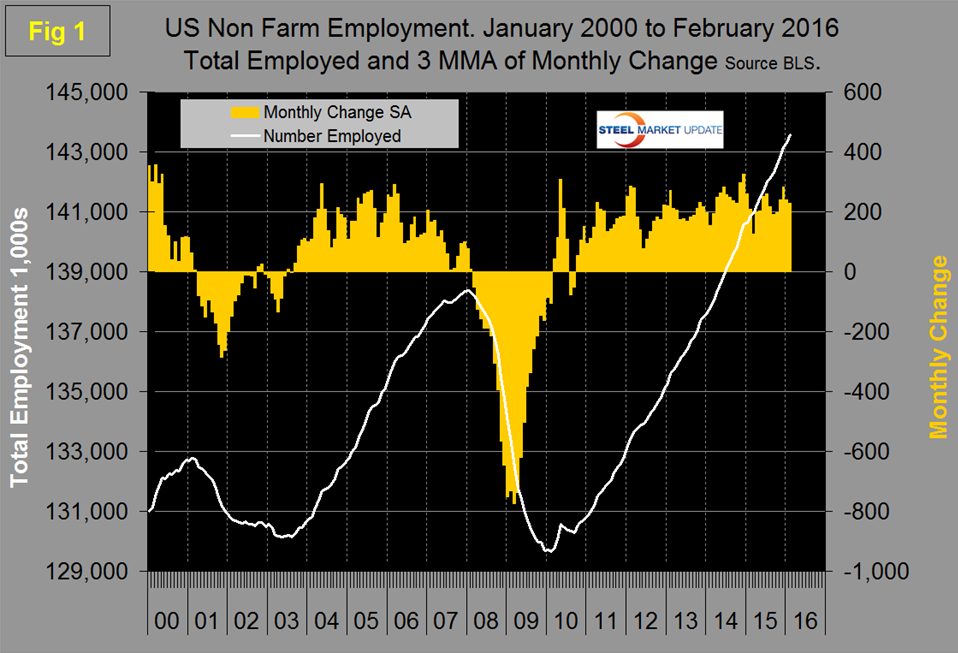

![]() The three month moving (3MMA) of gains through February was 228,000. The unemployment rate, U3, calculated from a different survey, remained unchanged in February at 4.9 percent, down from 5.0 percent in December. Monthly job gains have averaged 212,000 per month in the fourteen months since and including January 2015 (Figure 1).

The three month moving (3MMA) of gains through February was 228,000. The unemployment rate, U3, calculated from a different survey, remained unchanged in February at 4.9 percent, down from 5.0 percent in December. Monthly job gains have averaged 212,000 per month in the fourteen months since and including January 2015 (Figure 1).

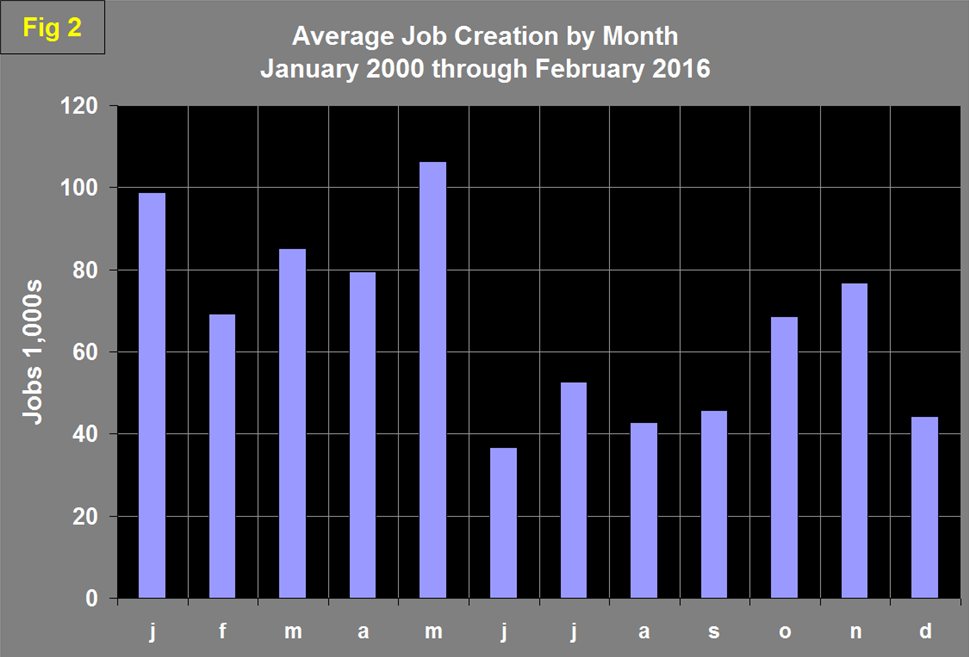

These numbers are seasonally adjusted by the BLS so to examine if any seasonality is left in the data after adjustment we have developed Figure 2 which suggests that the adjustment is far from perfect.

Normally February’s number of jobs created decrease on a seasonally adjusted basis, this year there was a 41 percent increase therefore we conclude that this was an excellent result. Total nonfarm payrolls are now 5,195,000 more than they were at the pre-recession high of February 2008.

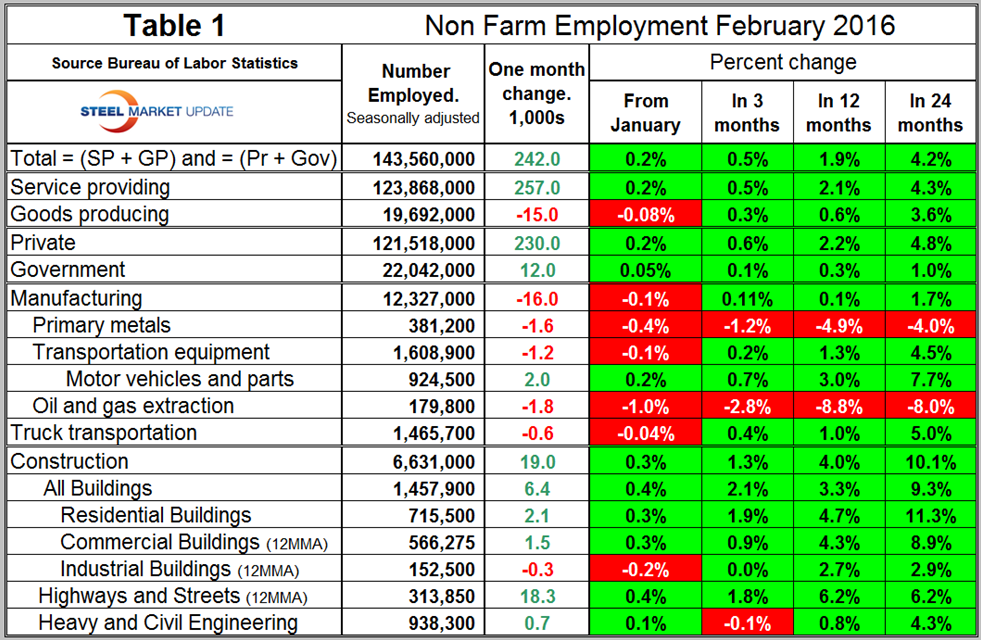

Table 1 slices total employment into service and goods producing industries and then into private and government employees.

Total employment equals the sum of private and government employees. It also equals the sum of goods producing and service employees. Most of the goods producing employees work in manufacturing and construction and the major components of these two sectors are also shown in Table 1. In February, 230,000 jobs were created in the private sector and 12,000 in government. The Federal government gained 5,000 as state governments lost 5,000 and local governments gained 12,000. Since February 2010, the employment low point, private employers have added 14,261,000 jobs as government has shed 434,000. In February service industries expanded by 257,000 as goods producing industries lost 15,000 people. Therefore from the steel industry point of view this was not an excellent report. Since February 2010, service industries have added 11,672,000 and goods producing 2,065,000 positions. The big surprise in January was that manufacturing gained 23,000 jobs but gave back 16,000 in February. Note the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those that have most relevance to the steel industry.

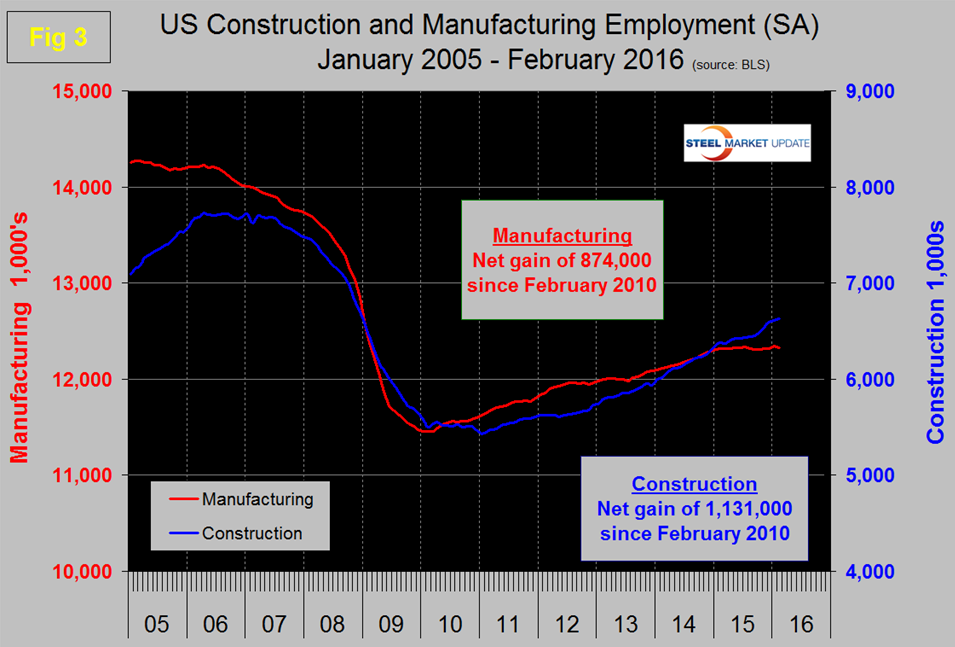

Primary metals lost 1,600 jobs in February and that sector is down by 4.9 percent in 12 months. Motor vehicles and parts gained 2,000 jobs in February, oil and gas extraction has had negative job creation in all four time periods examined in Table 1. Truck transportation lost 6,000 jobs in February after three straight months of gains. Construction added 19,000 jobs in February for a total of 330,000 in the 14 months since and including January 2015. Some of the major construction sub categories are routinely reported one month in arrears which distorts the data in Table 1. These include, industrial buildings, commercial buildings and highways and streets. Construction has moved ahead of manufacturing as a job creator but it must be recognized that productivity increases in manufacturing are very much greater than they are in construction. Construction has added 1,131,000 jobs and manufacturing 874,000 since the recessionary employment low point in February 2010 (Figure 3). Based on the total construction analysis that we report in our CPIP update, we assume that construction jobs will continue to expand vigorously.

The Associated General Contractors of America had this to say about the February result; the overall picture for construction employment is very positive with robust job growth and very little unemployment,” said Ken Simonson, the association’s chief economist. “Yet it appears that many nonresidential construction firms have run out of people to hire to keep pace with demand for new projects.”

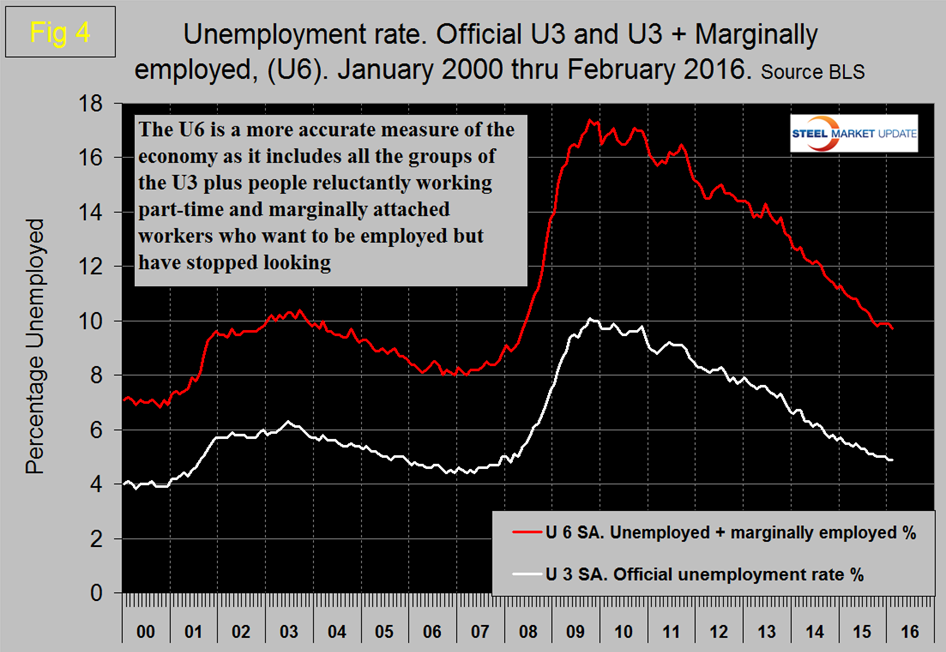

The official unemployment rate known as U3, has decreased from 5.5 percent in May to 5.0 percent in October and to 4.9 percent in January and February. This number doesn’t take into consideration those who have stopped looking. The more comprehensive U6 unemployment rate decreased from 11.3 percent in February 2015 to 9.7 percent in February 2016 (Figure 4).

U6 includes workers working part time who desire full time work and people who want to work but are so discouraged that they have stopped looking. The differential between these rates was usually less than 4 percent before the recession but is still 4.8 percent. The good news is that the gap is slowly closing.

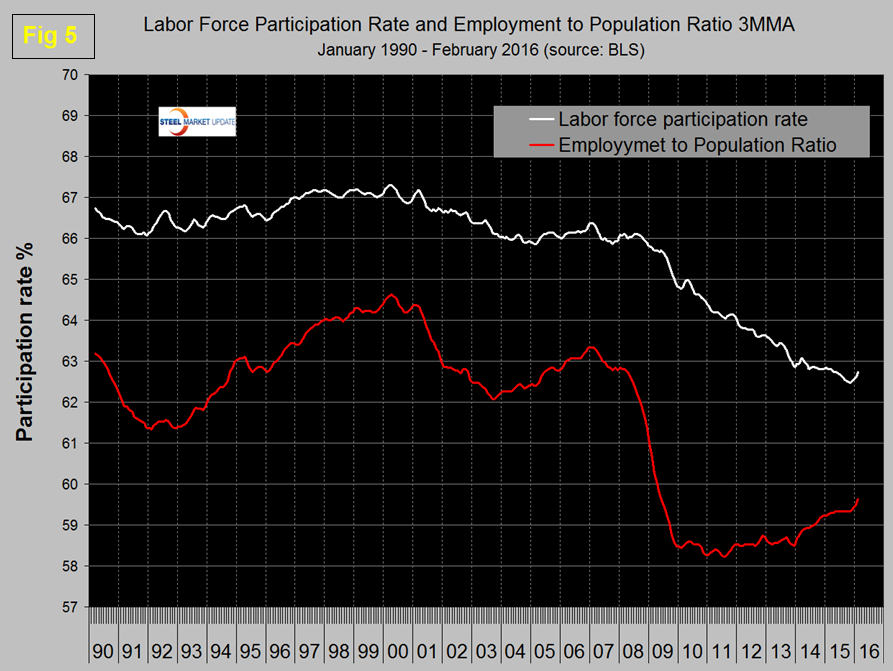

The employment participation rate is widely quoted in the press as going nowhere. In February 2016 the rate was 62.9 percent which was the same as January last year. We’re not sure that we understand what this is a percentage “of” because of the multiple descriptions of the labor pool. Another measure is the number employed as a percentage of the population which we think is much more definitive. In February this measure stood at 59.8 percent which was up from 59.3 percent in January last year. Figure 5 shows both measures on one graph.

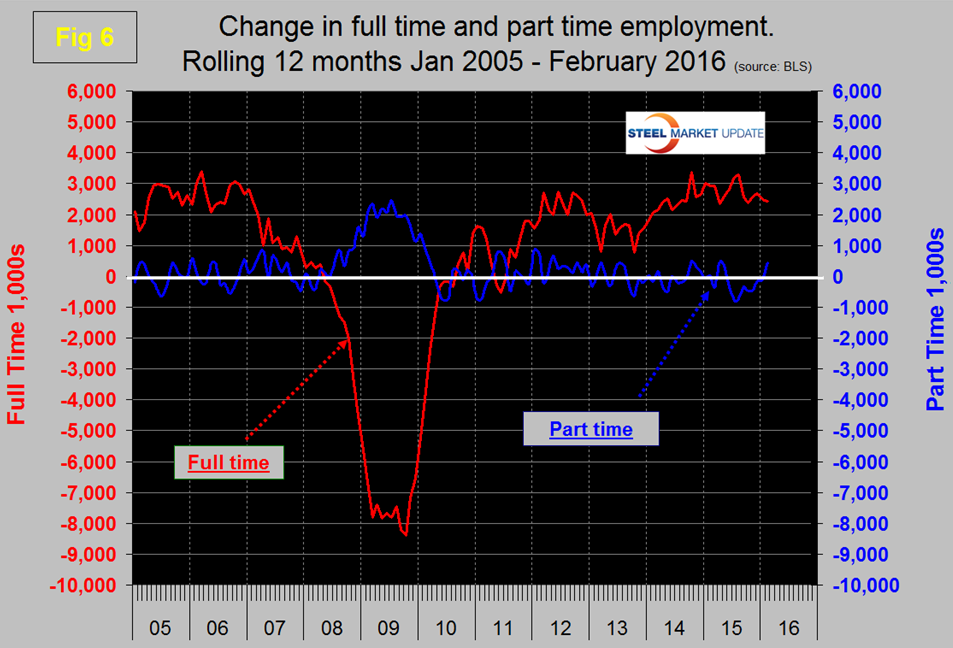

Since and including January 2015 there has been an increase of 3,272,000 full time and of 347,000 part time jobs. Figure 6 shows the rolling 12 month total change in both part time and full time employment. Frequently in the press we read that a large part of job creation is in part time employment. This is not the case but because the part-time numbers are extremely volatile we have to look at longer time periods than a month or even a quarter to get the picture.

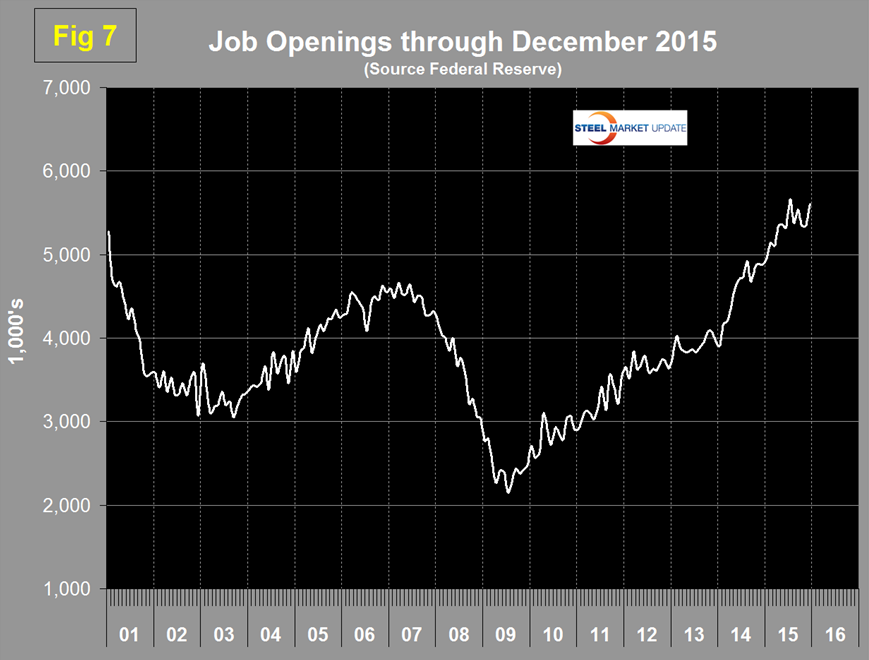

The job openings report known as JOLTS is reported on about the 10th of the month by the Federal Reserve and is over a month in arrears. Figure 7 shows the history of unfilled job openings which have skyrocketed in the last two years to levels not seen since the data series was initiated in 2000. The previous high was 5.25 million at the end of 2000; in the last two years we have seen a surge from 3.906 million in January 2014 to 5.607 million in the latest report for December 2015.

Explanation: On the first Friday of each month the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. At SMU we track the job creation numbers by many different categories. The BLS data base is an excellent reality check for other economic data streams such as manufacturing and construction and we include the net job creation figures for those two sectors in our “Key Indicators” report. It is easy to drill down into the BLS data base to obtain employment data for many sub sectors of the economy. For example, among hundreds of sub-indexes are truck transportation, auto production and primary metals production. The important point about each of these hundreds of data streams is in which direction they are headed. Whenever possible we at SMU try to track three separate data sources for a given steel related sector of the economy. We believe this gives a reasonable picture of market direction. The BLS data is one of the most important sources of fine grained economic data that we use in our analyses. The States also collect their own employment numbers independently of the BLS. The compiled state data compares well with the federal data. Every three months SMU examines the state data and provides a regional report which indicates strength of weakness on a geographic basis. Reports by individual state can be produced on request.