Market Data

March 6, 2016

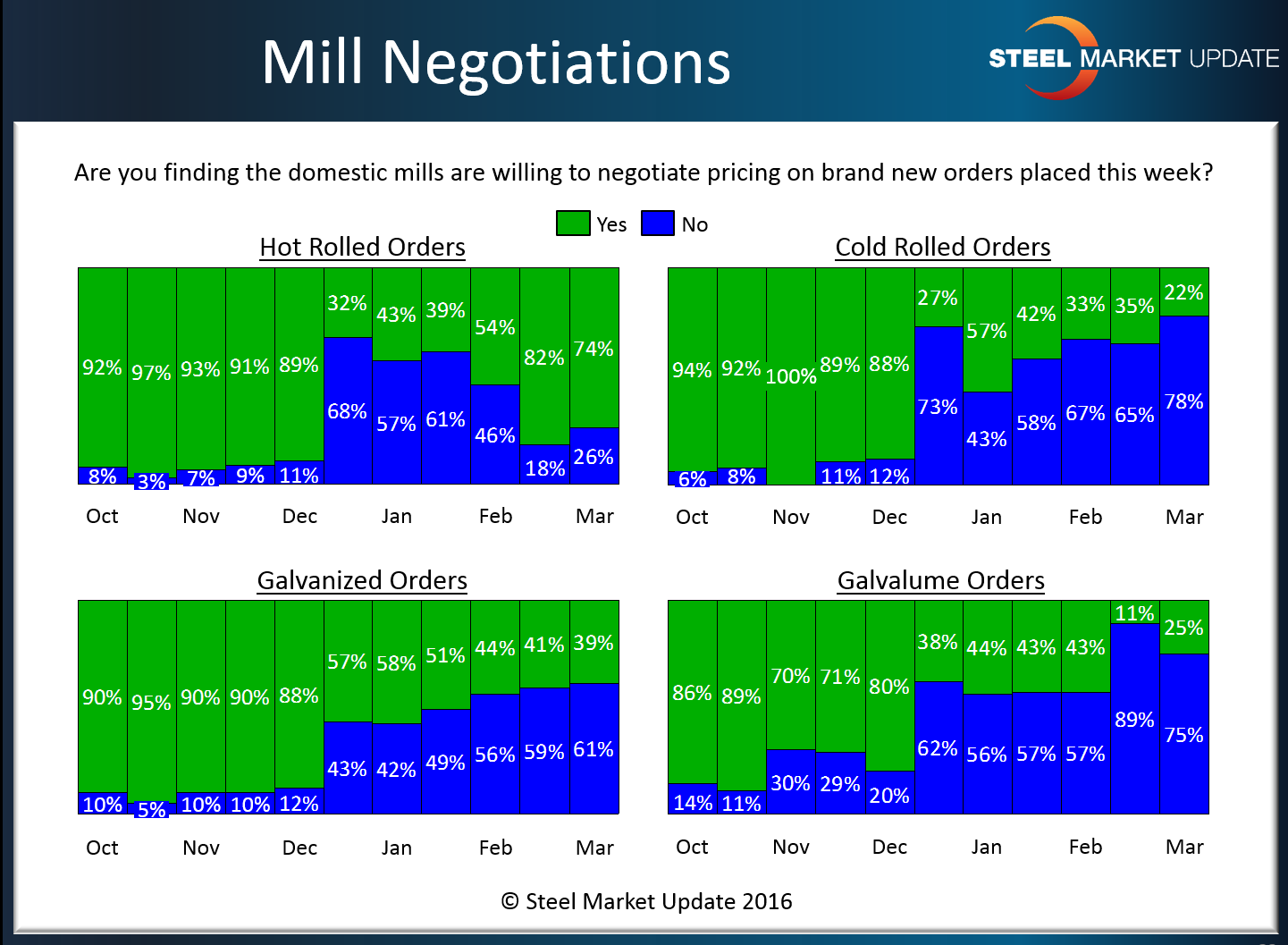

Steel Buyers Report Steel Mills as Less Willing to Negotiate Pricing

Written by John Packard

Buyers and sellers of flat rolled steel reported to Steel Market Update this past week that the domestic steel mills are less willing to negotiate steel prices. We believe this is due to strengthening order books, extending lead times, positive Sentiment and improving demand.

The only product not following the rest of the market is hot rolled steel which 74 percent of our respondents reported as the one product being considered negotiable when dealing with the steel mills. When looking back to the first week of January we had 43 percent of our respondents reporting HRC pricing as negotiable.

Cold rolled saw 22 percent of our respondents reporting the mills as willing to negotiate pricing. At the beginning of January, 57 percent reported the mills as willing to negotiate CRC pricing.

Galvanized dropped from 58% during the first week of January to 39 percent this past week.

Galvalume also dropped compared to the beginning of the New Year when we had 44 percent of our respondents reporting prices as negotiable. This past week that percentage dropped to 25 percent.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.