Analysis

March 1, 2016

Automakers Deliver Strong February Sales

Written by Sandy Williams

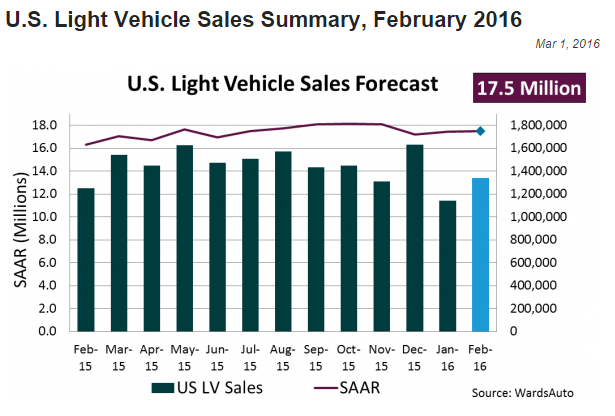

Automotive sales for February are expected to increase as much as 8 percent year over year for the highest February volume in 15 years. GM estimates the seasonally adjusted annual rate will be 17.7 million units while WardsAuto predicts 17.5 million.

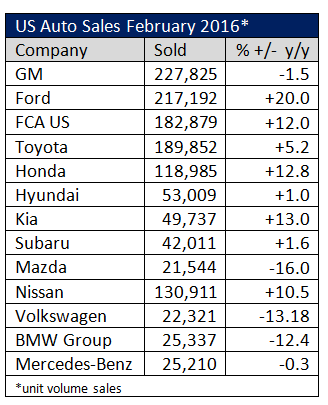

Most automakers are posting positive gains for February sales. GM sales slipped 1.5 percent last month due to a planned reduction in rental deliveries, but GM is confident about the 2016 market. The company is counting on growing sales from Millennials (under age 34) who account for 20 percent of GM sales.

“We continue to be optimistic about the continued strength of the U.S. economy,” says GM Chief Economist Mustafa Mohatarem. “Employment remains strong, interest rates remain at historically low levels and gas prices are stable, so we expect auto sales to remain strong for the foreseeable future.”

Volkswagen sales continue to lag, down 13.18 percent year over year. Individual records were set, however, for some models such as the crossover Tiguan and e-Golf.