Market Data

February 28, 2016

Durable Goods Jump 4.9% in January

Written by Sandy Williams

Durable goods in January rose 4.9 percent in January, reversing a December’s plunge of 4.6 and perhaps indicating stabilization for U.S. manufacturing. The January jump was the biggest monthly gain since March 2015.

Orders rose for all major categories of the industrial goods but especially for autos and aircraft.

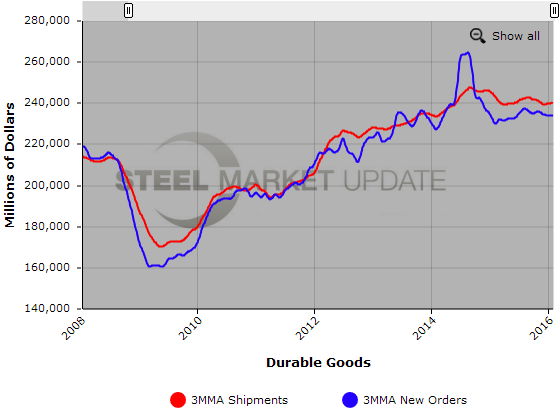

The chart below, depicting the three month moving average for shipments and orders, illustrates the relatively steady trend for durable orders since August 2015.

The Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders in January 2016 from the Department of Commerce reads as follows:

New Orders

New orders for manufactured durable goods in January increased $11.1 billion or 4.9 percent to $237.5 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 4.6 percent December decrease. Excluding transportation, new orders increased 1.8 percent. Excluding defense, new orders increased 4.5 percent. Transportation equipment, also up following two consecutive monthly decreases, led the increase, $8.2 billion or 11.5 percent to $79.7 billion.

Shipments

Shipments of manufactured durable goods in January, up two of the last three months, increased $4.6 billion, or 1.9 percent, to $241.9 billion. This followed a 1.6 percent December decrease. Transportation equipment, also up two of the last three months, led the increase, $4.3 billion or 5.7 percent to $80.0 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in January, up three of the last four months, increased $0.6 billion or 0.1 percent to $1,187.7 billion. This followed a 0.5 percent December decrease. Computers and electronic products, up twenty-five consecutive months, drove the increase, $0.7 billion or 0.5 percent to $137.2 billion.

Inventories

Inventories of manufactured durable goods in January, down six of the last seven months, decreased $0.4 billion, or 0.1 percent, to $396.3 billion. This followed a 0.2 percent December increase. Primary metals, down twelve consecutive months drove the decrease, $0.7 billion or 2.0 percent to $33.8 billion.

Capital Goods

Nondefense new orders for capital goods in January increased $14.0 billion or 21.6 percent to $79.2 billion. Shipments increased $2.9 billion or 3.9 percent to $78.3 billion. Unfilled orders increased $0.9 billion or 0.1 percent to $743.9 billion. Inventories decreased $0.1 billion or 0.1 percent to $175.4 billion. Defense new orders for capital goods in January increased $1.1 billion or 11.9 percent to $10.2 billion. Shipments decreased $0.5 billion or 4.8 percent to $9.6 billion. Unfilled orders increased $0.7 billion or 0.4 percent to $151.1 billion. Inventories increased $1.0 billion or 4.6 percent to $22.3 billion.

Revised December Data

Revised seasonally adjusted December figures for all manufacturing industries were: new orders, $457.3 billion (revised from $456.5 billion); shipments, $468.3 billion (revised from $467.0 billion); unfilled orders, $1,187.1 billion (revised from $1,187.4 billion); and total inventories, $641.5 billion (revised from $642.3 billion).