Prices

February 28, 2016

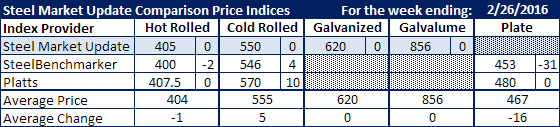

Comparison Price Indices: Little Movement

Written by John Packard

Flat rolled & Plate prices have been moving mostly sideways over the past few weeks as little has happened to propel prices higher (or lower) from here.

Hot rolled prices have been stuck in the $400-$410 per ton range with SteelBenchmarker at the lower end of the range while SMU ($405) and Platts ($407.50) rounding out this week’s HRC index numbers.

Cold rolled prices have a slightly wider spread with SteelBenchmarker at $546 per ton, SMU at $550 and Platts at $570 per ton.

SMU saw both galvanized and Galvalume prices as stable this week.

Plate prices dropped $31 per ton on SteelBenchmarker to $453 per ton (SteelBenchmarker reports steel prices twice per month) while Platts remained at $480 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.