Market Data

February 18, 2016

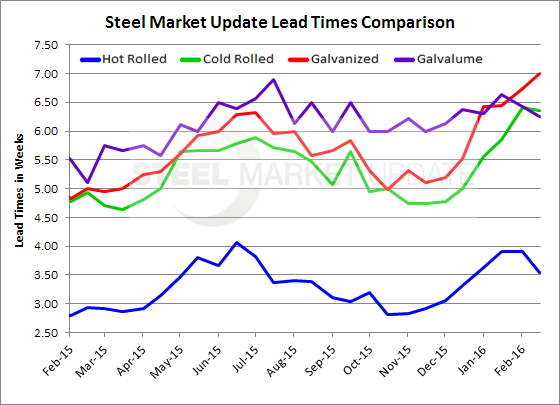

Steel Mill Lead Times: Essentially Unchanged from Early February

Written by John Packard

Steel Market Update conducted our flat rolled steel market trends analysis this week, a portion of which is dedicated to understanding domestic mill lead times from a group perspective. These lead times shown in the graphic below have nothing to do with the mill lead time sheets produced by the domestic mills. The data shown is the result of all respondents (manufacturing and service centers). Based on those averages lead times declined on three of our four flat rolled products followed by Steel Market Update.

Hot rolled lead times declined from 3.90 weeks in our last survey to 3.55 weeks this week. Although shorter than what we have measured over our last three surveys, this figure is still extended in comparison to what we were seeing during the later part of 2015.

Lead times for cold rolled products continued to be longer than 6 weeks.

Galvanized lead times increased in duration from 6.74 to 7.00 weeks.

Lead times for Galvalume remained essentially unchanged at about 6 and 1/2 weeks.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.