Market Data

February 18, 2016

SMU Steel Buyers Sentiment Index: Small Slip on Today's Number but 3MMA Moves Higher

Written by John Packard

Steel Market Update conducted our mid-February flat rolled steel market trends analysis over the past four days. The SMU Steel Sentiment Indices are one of a group of proprietary products which are derived from this particular analysis which we conduct twice per month.

When reviewing the data we found that our “Current” Sentiment Index dropped one point to +58 which is still well within the optimistic range of the index. Current Sentiment measures how buyers and sellers of steel feel about their company’s ability to be successful based on the existing market conditions. The +58 reading is up 2 points over one month ago and is 5 points higher than at this time last year.

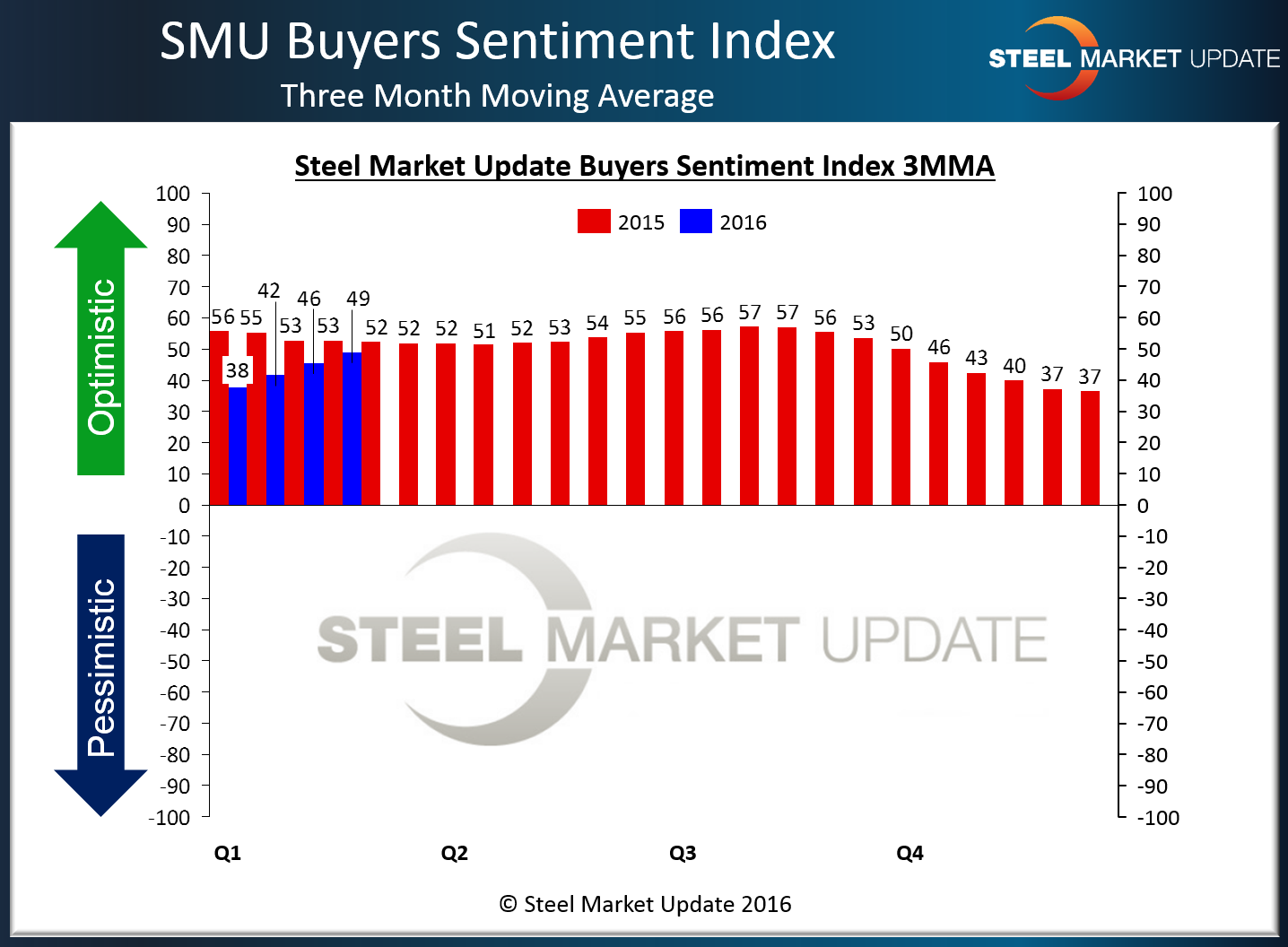

SMU prefers to look at the data based on a rolling three month moving average (3MMA). This takes any “bumps” out of the data and provides us a better look at the trend. The 3MMA is up +3.5 points to +49. Our 3MMA on Current Sentiment has been rising consistently since the middle of December or, essentially ever since the domestic steel mills began announcing (and actually collecting) higher prices on flat rolled steels.

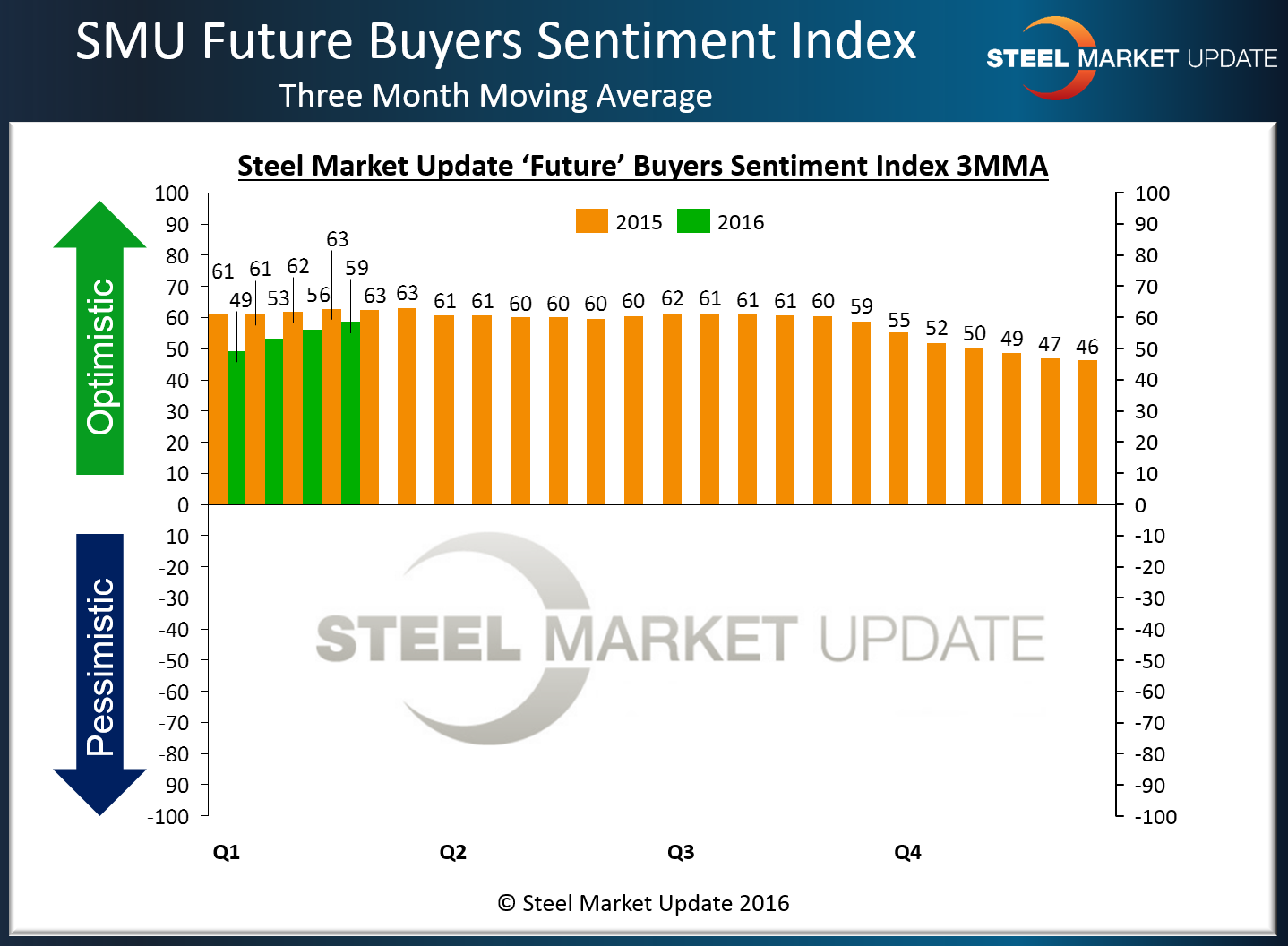

Our “Future” Sentiment Index dropped -9 points and is being reported today at +61. The +61 is again well within the optimistic range of our index (we explain our point system at the end of this article and it can also be found online). Even with a 9 point drop our three month moving average improved by +2.33 points and is now +58.67. One year ago our Futures Sentiment Index was reported as being +62.83.

What Our Respondents Are Saying

SMU found that many of the respondents are taking a cautiously optimistic approach to their business, especially regarding flat rolled steel prices. The following comments were left behind during the survey process regarding the direction expected for flat rolled prices going forward:

A manufacturing company told us, “I think they [steel prices] will keep moving up until foreign again possibly takes over. China is still supplying substrate to other countries who are not listed in the suits.”

Another manufacturing company added, “I think the rise in price was a bubble. Buyers came off the sidelines in Dec to take advantage of the bottom, this in addition to the AD and reduced capacity helped push lead times out. I think lead times will come back in line early 2Q. It just doesn’t feel like anything is happening out there right now!”

A third manufacturing company told us, “Prices will move higher but with a cautious approach by the domestics.”

A service center told us, “With current input cost and the opportunity for foreign coupled with moderate demand it is hard to see prices moving much higher.”

A fourth manufacturing company said, “[Prices will stabilize and move sideways] For at least a couple of months.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 46 percent were manufacturing and 40 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.