Analysis

February 18, 2016

Housing Data Falters Slightly In January Suggesting Slower Momentum

Written by Sandy Williams

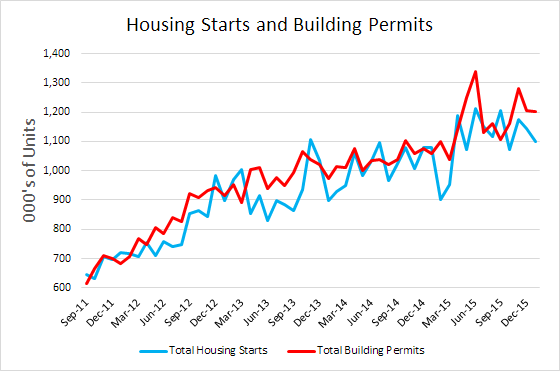

Residential construction is beginning the new year with slower momentum. A blast of winter weather in the Northeast slowed construction starts in January after a warmer than usual December.

The Commerce Department reports U.S. housing starts fell 3.8 percent from December to a seasonally adjusted annual rate of 1.099 million in January, the lowest rate since October. On a year over year basis total starts were up 1.8 percent. Single family starts fell 3.9 percent to 731,000 and multi-family starts dropped 2.5 percent to 354,000.

“January’s production numbers are in line with our recent HMI reading and show that builders are being cautious as they face some market uncertainties and supply side constraints,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill.

“Despite the modest dip in starts this month, we expect to see ongoing, gradual growth in housing production in 2016,” said NAHB Chief Economist David Crowe. “An improving economy, solid job creation and pent-up demand for housing should keep the market moving forward.”

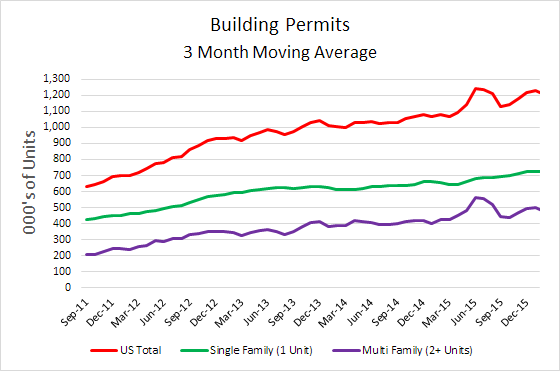

In January the three month moving average for housing starts was 1,139 million up from December’s 3MMA of 1,130 million but slipping from November’s average of 1,151 million. Starts have been on a generally upward trend since the recession, peaking in summer 2015 and moderating later in the year. The chart below smooths out the peaks and valleys of the month to month figures and shows housing starts from a three month moving average perspective.

Permit authorization, an indicator of future construction, dropped a slight 0.2 percent month over month in January. Permits were at a SAAR of 1,202 million, 13.5 percent higher than January 2015. The three month moving average shows building permits at 1,229 million, since dipping in September to 1,132 million.

Single-family permit authorizations in January were at a rate of 720,000, 1.6 percent below the revised December figure of 732,000. Authorizations of units in buildings with five units or more were at a rate of 442,000 in January, up 1.1 percent from December.

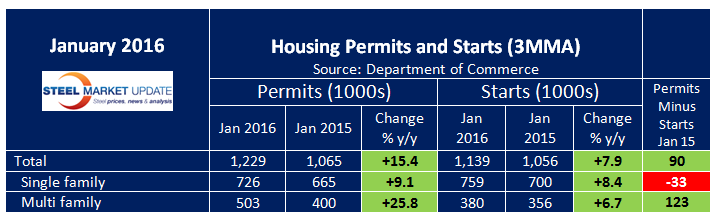

The table below shows the three month moving average for housing permits and starts in January has improved year over year. At the national level the differential between permits and starts for single and multi-family units is suggesting that consumers are continuing to favor apartments over single family housing. In January on a 3MMA basis, permits for multi-family exceeded starts by 123,000. In contrast, permit issuance for single family units was 33,000 lower than single family housing starts in January.

Looking ahead towards new construction, only the Northeast showed a decline in permit authorizations. Regional SAAR totals for permit authorizations in January were as follows:

Northeast: 90,000, -55.4 percent m/m, -25.6 percent y/y

Midwest: 205,000, +26.5 percent m/m, +38.5 percent y/y

South: 577,000, +0.3 percent m/m, +11.0 percent y/y

West: 330,000, +24.5 percent m/m, +22.2 percent y/y

Economists suggest low mortgage rates, higher wages and pent-up demand will continue to motivate consumers to purchase homes and lease new apartments.

Builder Confidence

Builder confidence dropped three points in the latest survey by the National Association of Home Builders. The press release regarding the NAHB/Wells Fargo Housing Market Index follows:

Builder confidence in the market for newly-built single-family homes fell three points to 58 in February from an upwardly revised January reading of 61 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Though builders report the dip in confidence this month is partly attributable to the high cost and lack of availability of lots and labor, they are still positive about the housing market,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill. “Of note, they expressed optimism that sales will pick up in the coming months.”

“Builders are reflecting consumers’ concerns about recent negative economic trends,” said NAHB Chief Economist David Crowe. “However, the fundamentals are in place for continued growth of the housing market. Historically low mortgage rates, steady job gains, improved household formations and significant pent up demand all point to a gradual upward trend for housing in the year ahead.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI component measuring sales expectations in the next six months rose one point to 65 in February. The index measuring current sales condition fell three points to 65 and the component charting buyer traffic dropped five points to 39.

Looking at the three-month moving averages for regional HMI scores, all four regions registered slight declines. The Midwest fell one point to 57, the West registered a three-point drop to 72 and the Northeast and South each posted a two-point decline to 47 and 59, respectively.