Prices

February 18, 2016

Hot Rolled Futures: Mixed Signals

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Assisting Andre with tonight’s article is Jack Marshall also associated with CrunchRisk. Here is how Andre and Jack saw trading over the past week:

Financial Markets

As mentioned the S+P 500 has bounced back up to the 1900 zone, I think the high was 1927 yesterday. We have since settled sideways around the 1917 mark. The market has to decide whether it can muster further optimism from a market of mixed signals, i.e. jobs added in January only up 150K, but trend positive and unemployment now 4.9%, and wages increasing a bit, hope that inflation will find its way to us eventually. We likely retest lows and move closer to a 20% retracement at some point, but resilience in the market on this last dip suggests the market may be comfortable in this zone for a bit before picking its next real direction.

Crude is a similar story of a mixed bag, i.e. the Saudis and Russians have agreed to halt increases in production, but they are at max capacity so… This does however give a hope that the OPEC countries will start to coordinate further, but hard to see Saudis communicating with the Iranians about anything. Next step is for Iran to ramp back closer to 1mllion barrels per day (bbls/day) and then they see where they are on communication. The crude price has traded either side of $30/bbl on this latest news, last trading $30.64/bbl on the March future. Despite the hopefulness crude still probably has some volatility ahead in both directions.

Not much to report in Copper which is last $2.07/lb on the March future, which is within a penny of where it was when I last reported and it hasn’t really moved in either direction.

Steel (HRC)

Recent choppy price movements in HR physical market prices, as reflected in the front month of CME HR futures, and in futures sellers actively pushing down the back end of the HR forward curve suggest that some participants in the market believe that physical sales may have topped out for the immediate term.

We had a pretty active day last Friday in HR futures as 850 lots or 17,000 ST of HR futures traded. The main focus was Q2’16 which traded heavily at $400 ST[$20cwt]. and was very close to converging with the CME front month futures settlement- Feb’16 @ $397 ST[$19.85cwt]. 61,700 ST of HR futures traded last week of which 34,700 ST traded below $410 ST.

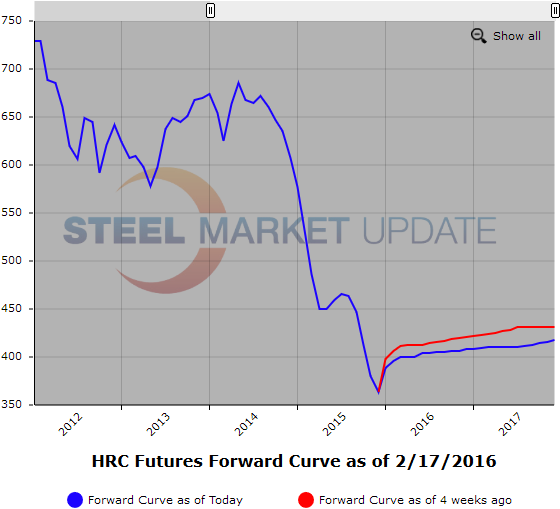

This week by comparison has been very quiet with just a few trades in the front end of the curve. On Monday Mar’16 traded @ $402 ST[$20.10cwt] on 1,000 ST and this was followed by a Mar/Apr’16 and Mar’16 trades @ $400 ST[$20cwt] on 1,000 ST per month today. The current slope of the CME HR curve settlement values is very gradual with Feb/Jun’16 @$400 ST, 2H’16 @ $405.5, 1H’17 @ $410, and 2H’17 @ $414. With all this compression of the curve we are starting to see some bids finally come into the market.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

BUS (Busheling Scrap):

Little has changed since last week as markets continue to move sideways. CFR Turkish scrap prices have remained fairly anchored around the mid 170 mark as excess global supply continues to indirectly impact flows leaving domestic markets little changed. Incremental increases in capacity utilization rates at mills do not appear to have improved demand enough to push BUS prices higher from the low 180 price point.