Prices

February 14, 2016

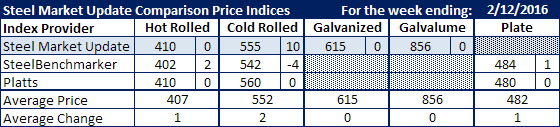

Comparison Price Indices: Prices Stabilizing

Written by John Packard

Flat rolled steel prices are beginning to stabilize according to the most recent revisions in the flat rolled steel indices followed by Steel Market Update.

Benchmark hot rolled remained stuck at $410 per ton ($20.50/cwt) at both SMU and Platts while SteelBenchmarker, which reports prices twice per month, published their new HRC number as being $402 per ton.

Cold rolled had a mixed performance this past week with SMU taking our average up $10 per ton to $555 per ton ($27.75/cwt) while Platts remained at $560 and SteelBenchmarker was down $4 and came in at $542 per ton.

Galvanized pricing on .060” G90 remained at $615 per ton and Galvalume .0142” AZ50, Grade 80 at $856 per ton.

Plate prices were also essentially unchanged with Platts coming in at $480 per ton and SteelBenchmarker at $484 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.