Market Data

February 9, 2016

Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices

Written by Peter Wright

The following article is normally reserved for our Premium members only, but we felt it would be a good one to share with all of our readers. If you are interested in upgrading to a Premium membership or would like to trial it, contact our office at (800) 432 3475 or info@SteelMarketUpdate.com.

The Q1 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices was released on February 1st. This survey addresses changes in the standards and terms on, and demand for, bank loans to businesses and households on a quarterly basis and is based on the responses from 73 domestic banks and 24 U.S. branches and agencies of foreign banks. The Federal Reserve generally times the quarterly survey so that results are available for the January/February, April/May, August, and October/November meetings of the Federal Open Market Committee. The following is an abridged version of the Federal Reserve report followed by SMU comments and graphs.

![]()

Regarding loans to businesses, the January survey results indicated that, on balance, banks tightened their standards on commercial and industrial (C&I) and commercial real estate (CRE) loans in the fourth quarter of 2015. The survey results indicated that demand for C&I loans had weakened somewhat and demand for CRE loans strengthened somewhat during the fourth quarter on net. In response to the special questions, banks, on net, indicated that they expected standards on C&I and CRE loans to tighten over 2016 and loan performance of C&I loans and loans secured by multifamily residential properties (MF loans) to deteriorate over that same period.

Regarding loans to households, on balance, the survey found a moderate easing of standards on some categories of residential mortgage loans as well as on auto loans, while banks reported having left standards on credit card loans basically unchanged. Moderate net fractions of banks reported weaker demand across most categories of residential real estate loans, while demand for auto loans and credit card loans remained basically unchanged on net. In response to the special questions, banks, on net, indicated that they expected to ease standards on some categories of residential mortgage loans over 2016 and that delinquency and charge-off rates on subprime auto loans would increase.

There is a huge amount of valuable data in this report which can be accessed here by those readers who wish to dig deeper.

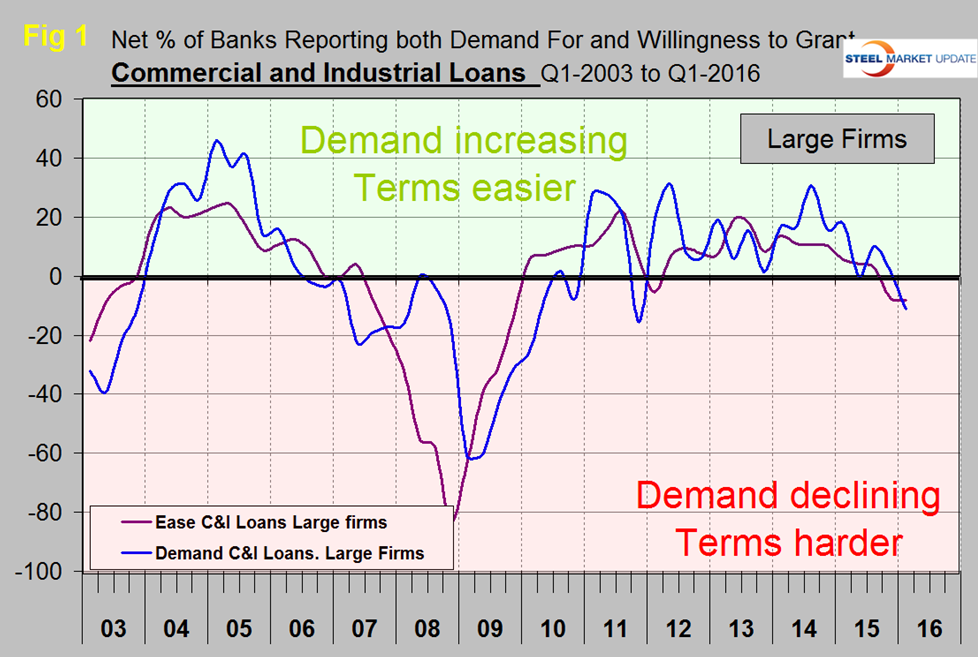

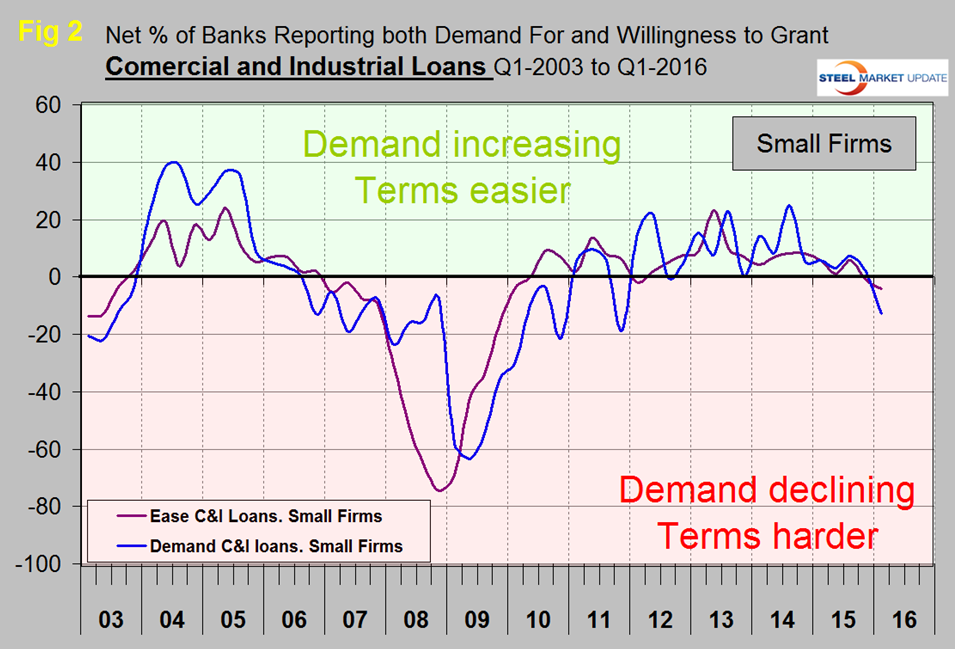

At SMU we extract and graph the major elements in the survey. Regarding loans to businesses, the February survey indicated that there was a net decrease in demand for commercial and industrial (C&I) loans from both large (>$50MM revenue) firms and small firms (<$50MM revenue) (Figure 1 and Figure 2).

Terms were unchanged for large firms and tightened slightly for small firms. What this means for example is that the number of banks reporting a tightening of standards to small firms was 4.2 percent higher than the proportion reporting an easing of standards to those same firms. A net proportion of banks reported a reduction in demand from both categories of firms for the first time since Q4 2011.

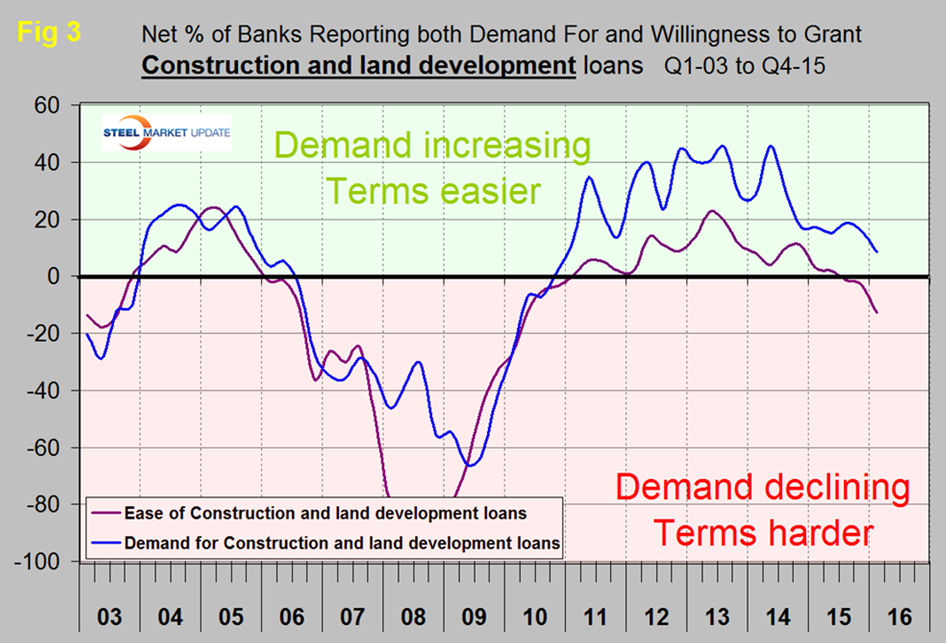

There has been an increase in the number of banks reporting declining demand for construction and land development loans in the last two quarters, however more banks are still reporting demand increase than decrease. The net percentage of banks reporting a tightening of lending standards for construction loans increased from 3.0 percent in Q4 2015 to 12.7 percent in Q1 2016 (Figure 3).

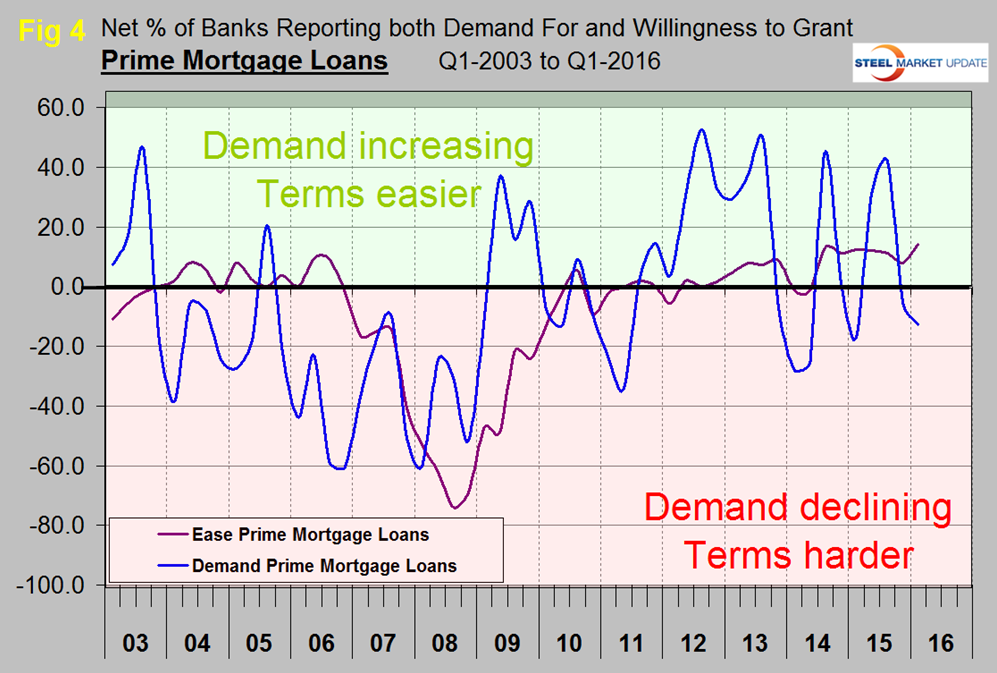

Demand for prime real-estate mortgages has been extremely erratic and seasonal for four years. In Q1 2016, demand was better than in the first quarter of both 2014 and 2015 (Figure 4). Terms on these PRE mortgages were easier in Q1 than for any time since our data begins in Q1 2003.

The implications of this report are more or less neutral for the steel market. Loan demand is down for commercial and industrial loans but not drastically so and terms are still reasonable. Demand for construction and land development loans is still good though terms have tightened somewhat. Banks are still relaxing terms for prime home mortgages and demand is better than in the first quarter of the last two years. The survey found a moderate easing of standards on auto loans, while banks reported having left standards on credit card loans basically unchanged. Demand for auto loans and credit card loans remained basically unchanged on net.