Market Data

February 4, 2016

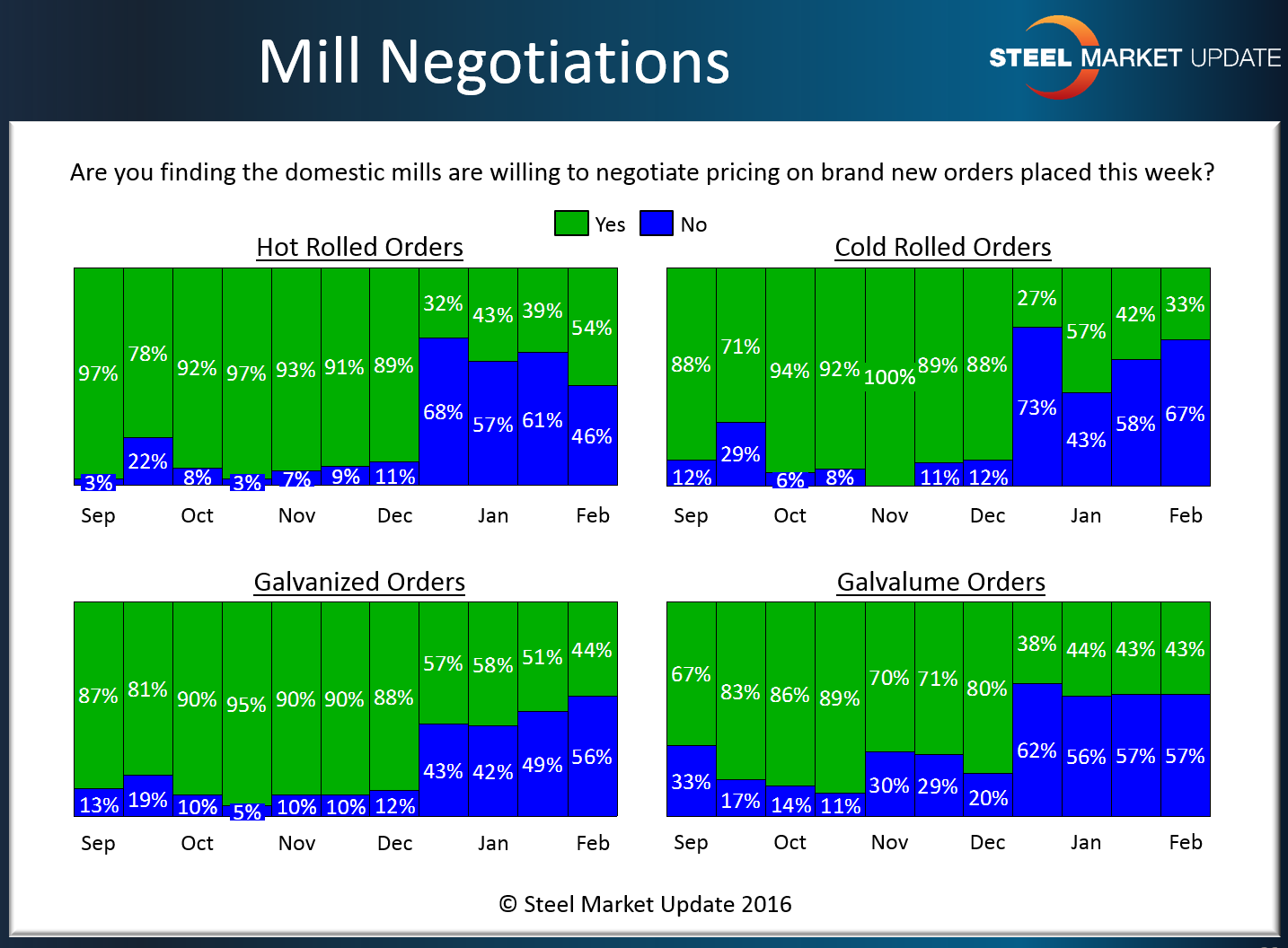

Steel Mills Resisting Negotiating Flat Rolled Steel Prices

Written by John Packard

As we mentioned in our previous article, flat rolled steel mill lead times have moved out by a week on hot rolled and as much as two weeks on cold rolled and galvanized. Galvalume lead times have remained decent but have not extended at this time but, that is to be expected for seasonal reasons.

When it comes to steel mills’ willingness to negotiate steel pricing with their customers we are finding that less than half of our respondents to our flat rolled market trends questionnaire conducted this week are reporting mills as willing to negotiate cold rolled (33 percent), galvanized (44 percent) and Galvalume products (43 percent). The only product suggested as having prices as more negotiable than what we were measuring over the past couple of months is hot rolled (54 percent). But, even HR at 54 percent is much better than what was being reported to us in September, October, November and December 2015 (see graphic below).

One mill executive told SMU earlier this week that they were willing to sacrifice lead times in order to collect a minimum base price of $28.00/cwt on galvanized steel.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.