Prices

February 4, 2016

Futures Pricing Lower: Is the Rally Over Already?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer rotates weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

If you enjoy the articles that Spencer has been writing about the HRC Futures markets we recommend that you contact him and let him know you are paying attention. If you have an interest in learning more about the HRC Futures markets and other futures trading we encourage you to contact him and let you know your interest. He can be reached by email at spencer.johnson@intlfcstone.com or by phone at 212-379-5492. Spencer has advised SMU that due to the limited contact he will no longer write articles on the HRC Futures markets. Our gut feel is there are more people listening to Spencer out there than he realizes…

Futures Pricing Lower: Is the Rally Over Already?

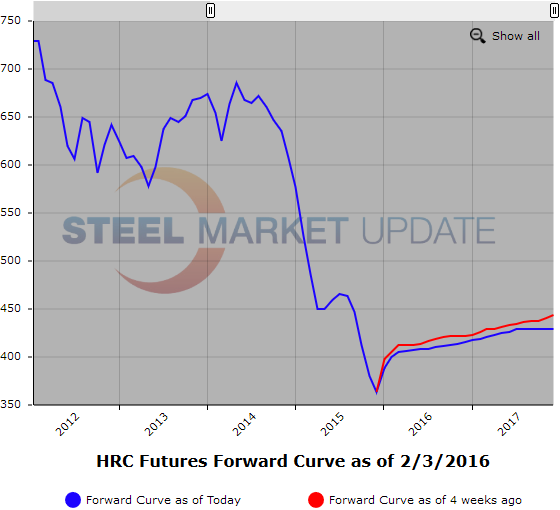

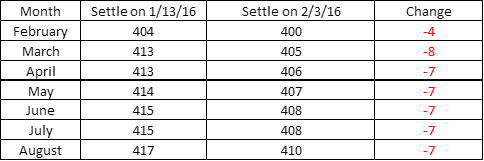

In our last comment here, we focused on how the rally had developed up to that point, and what obstacles remained to prices continuing their march higher. Since that comment, markets have fallen across the board by about $7-8/ton, with the exception of nearby February which was already valued at minimal contango. The timing on these forwards makes some sense; March has long been the month in which the markets have been anticipating the full impact of trade cases, which is why March continues to trade at such a premium to February. Here is how it looks as of last night’s (2/3/16) settlements:

At this point the HRC futures market has been unable to ignore the calamity that is almost every other commodity market currently being traded, and steel forwards have fallen slightly, in line with the broader trend of the commodity complex. Although we do not want to focus too much of this piece on outside markets, the outlook for oil seems especially relevant. Steel and oil are both classic macro play commodities with a very high correlation to big macro factors like GDP growth, so it makes sense to think about one commodity with the other in mind, and not just because of the obvious connections like OCTG demand.

As oil slumped below $30/barrel, a price that was once unthinkable, steel mills were pushing through a second price hike in as many months. So far, that seems to have been a bust, but we do continue to hear positive things such as lead times extending and a lack of willingness to cut deals on the part of producers. Those are positives. Another positive is that outlooks for oil in the remainder of the year seem to be brightening. Why? Here are a few thoughts:

1) Rig counts have plunged to unimaginable lows; with lots of hedges rolling off, producers are going to be seeing even more cuts to output as the year goes on. This is the simple and eternal adage: the cure for low prices is low prices.

2) Chinese demand is still significant and China has shown willingness to kick the can. In other words, China may not be growing like they have been, but they still suck up a huge amount of global oil production and the lack of demand seems overblown, especially given the likelihood that more stimulus measures seem to be preferred by the politburo over more long-term benefits of weaning the economy off of fixed asset investment driven growth.

3) Rumors continue apace that Russia and OPEC could reach an agreement on output cuts. Obviously a rumor, but there is always the chance that the more immediate benefits of cash-flow will be assessed against the real benefit of reduced supply.

Nothing is certain, and certainly nothing in commodity markets is certain, but a brighter outlook for oil would indeed mean a brighter outlook for steel. That is no doubt music to the ears of many stockholders who are now eyeing the recent lows in the $360’s and are looking to play cautiously in the year ahead.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Below is a graphic of the HRC Futures Forward Curve. The interactive capability of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.