Prices

February 4, 2016

Crude Steel Production in 2015

Written by Peter Wright

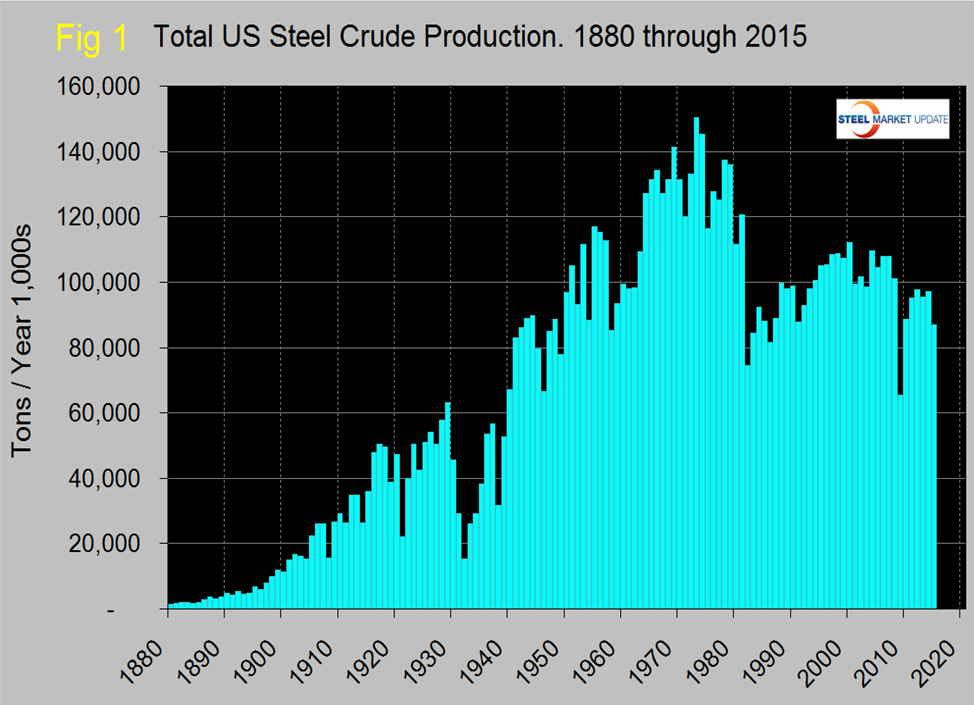

According to the AISI A7 report, total crude steel production in 2015 was 86,912,000 tons, down by 10.6 percent from 2014. Figure 1 puts this into a historical context with 130 years of data.

Peak production was 150,483,000 in 1973 and in that year 26 percent was produced in open hearth furnaces, 18.4 percent in EAFs and the balance in BOFs.

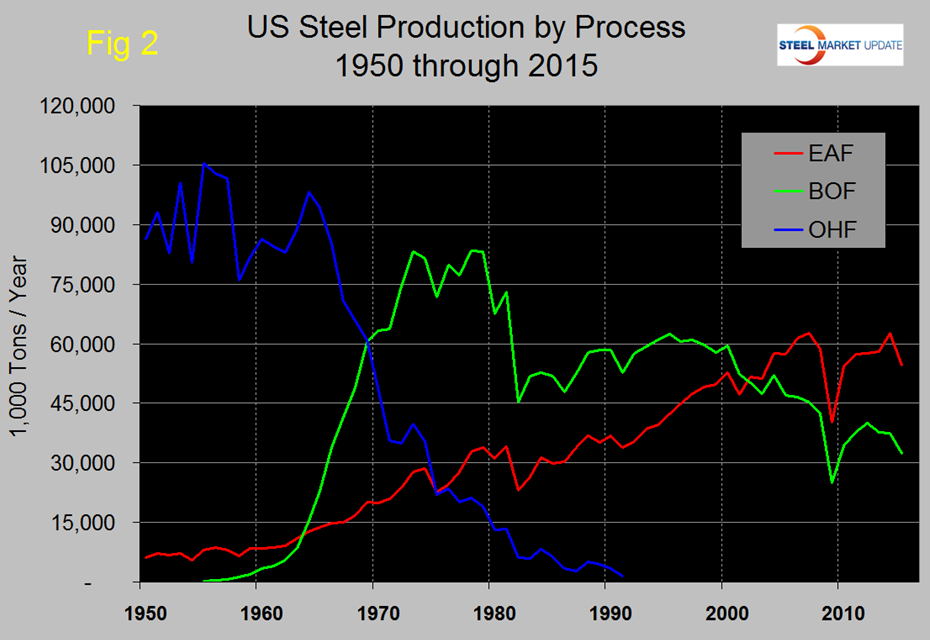

Figure 2 shows the historical mix by process since 1950.

In 2002 the EAF overtook the BOF as the primary production process in the US. In 2015 the mix was 62.7 percent EAF and 37.3 percent BOF.

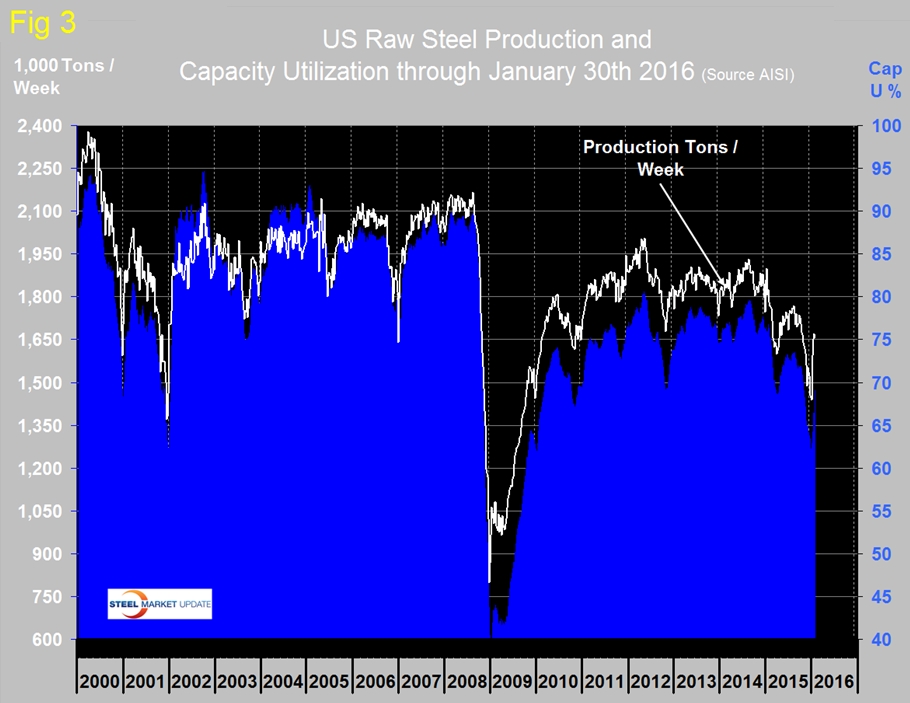

Figure 3 shows weekly production and capacity utilization from January 2000 through January 30th this year.

In the week ending January 30th capacity utilization was 69.1 percent on a 4 week moving average basis. For 2015 as a whole capacity utilization was 70.1 percent. Capacity utilization bottomed out in w/e January 2nd at 62.3 (4WMA), recovered to 66.5 in w/e January 23rd then jumped to 69.1 in w/e January 30th. The latter change was driven entirely by an apparent write down of 2.5 million tons of capacity by the AISI though we have seen nothing in writing to explain that. It is our opinion that the change in total capacity is due to US Steel permanently shuttering the blast furnace and hot end at their Fairfield, Alabama steel mill. By our calculations the impact was about 2.4 million net tons of production.

The temporarily idling of the Granite City hot end would not be reflected as a reduction in capacity because hypothetically the capacity could be returned to the market relatively quickly.

Pig iron production in 2015 was 28,038,000 tons down from 32,380,000 in 2014.