Prices

January 31, 2016

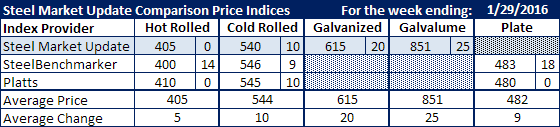

Comparison Price Indices: Prices Continue to Move

Written by John Packard

Flat rolled steel prices continue to move higher this past week, based on what we saw in the indices we follow on a regular basis (SteelBenchmarker reported prices this past week).

The weakest product continues to be hot rolled which has broken above the $400 level as the mills are pushing for $400-$420 per ton. The average of the three indexes referenced below is $405 per ton.

Cold rolled prices moved to an average of $544 per ton up $10 per ton over the prior week.

Galvanized and Galvalume prices both saw strong gains with galvanized being up $20 per ton (.060” G90 is the benchmark item for GI) and $25 per ton for Galvalume (.0142” AZ50 Grade 80 is benchmark used for AZ).

Plate prices rose on the SteelBenchmarker index (SteelBenchmarker reports twice per month) while they remain the same on Platts.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.