Prices

January 28, 2016

Hot Rolled Futures: Trades Focused Around June-August This Week

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Assisting Andre with tonight’s article is Jack Marshall also associated with CrunchRisk. Here is how Andre and Jack saw trading over the past week:

Financial Markets

Last week we talked about the big decline in the stock market, having broken the August 2015 lows at 1830 on the S&P 500 and having reached almost exactly the October 2014 low of 1813 only to rebound and rally to 1885 before settling into the 1860-1870 zone. We are last 1880 on the March future with a recent range either side of that. Resistance sits above at 1905-1918 and it is looking moew likely that unless we can break this resistance in the next week or so that we are headed lower. Lower likely means closer to a 20 percent correction than a 10 percent correction. Closer to 20 percent would take us into the 1700-1750 region.

In copper, we’ve rallied about 10 cents per pound since the January 15th lows with last price around $2.04-$2.05/lb. on the March future.

Meanwhile in crude oil it is a similar story of bouncing and settling sideways off the lows with March futures last $33.36 per barrel. If we breach this level we are probably headed quickly to the next resistance level at $42.50/bbl.

Steel (HRC)

Focus on lead times has been validated here this week as HR index rose steeply from last week posting at $397 up $14 from last week. January Index average will settle @ $398/ST. As the market digests the news that almost all of the first mill price increase announcements have been met there has been very little futures activity around the more positive news for HR spot. Surprisingly we have had more selling inquiries in 2016 futures months and there has been a noticeable lack of bids. Futures trades this week focused around the June through August period. HR Jul’16 traded @ $414 & $415/ST[$20.70/cwt & $20.75cwt] and HR Aug’16 traded @ $414 & $416/ST [$20.70/cwt & $20.80cwt]. Another light volume week for exchange futures trading in HR as only 7,020ST traded. Open interest for HR is currently 24,650 contracts or 493,000ST.

spot $397/ST

Feb/Mar’16 $407/ST

2H’16 $417/ST

Busheling Scrap (BUS)

The early chatter in the markets is that BUS will be sideways to up a few dollars. Excess global scrap capacity will continue to be the main focus. While the latest HR CRU price increase points to improved sentiment in the domestic flat rolled business as evidenced by some tightness in certain scrap regions, continued slack export demand from Turkey and Asia due to cheaper alternatives continues to indirectly impact domestic pricing. Latest CFR Turkey prices are below $180 which is a slight decrease from last week. Futures interests have shifted to the 1H’16.

Current CME BUS interests we have seen are , Feb/Jun’16 $180/GT bid – offered @ $190/GT.

LME steel scrap interests :Feb’16 offered @ $186/MT, Mar’16 offered @ $188/MT and last Feb’16 trades @ $183/MT.

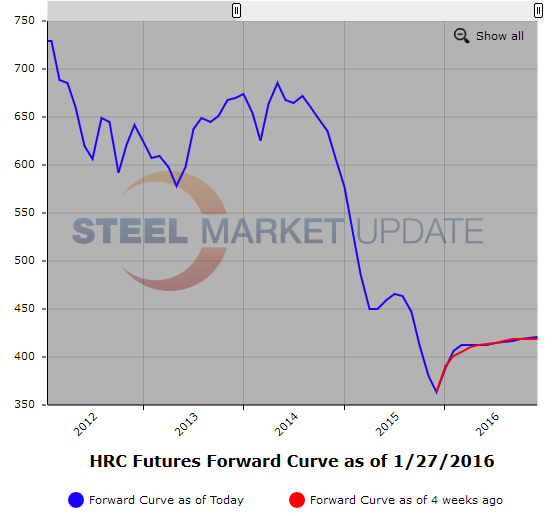

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.