Prices

January 26, 2016

SMU Price Ranges & Indices:Value Added Products Move Higher

Written by John Packard

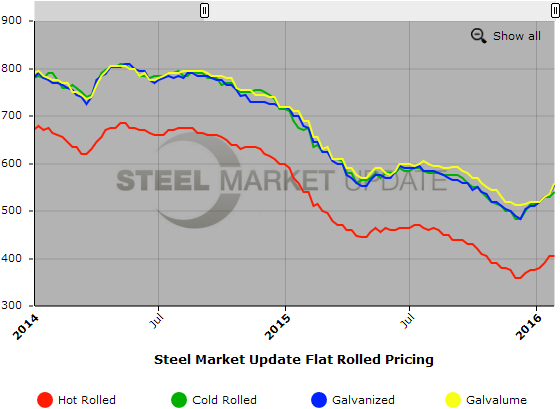

Hot rolled prices, which have moved $45 per ton (higher) since early December, did not move this past week. Hot rolled has been the weakest of products which both SDI and AK Steel alluded to in their earnings conference calls earlier today. However, we have seen lead times improve on cold rolled and coated steels which has helped move their prices higher. The net result is we are seeing a wider than normal spread in the base price of hot rolled vs. that of the other value added products. The historical norm is $100 to $120 per ton spread between hot rolled and galvanized base prices. So, when hot rolled is at $400 per ton the expectation is for galvanized to be $500-$520 per ton ($25.00/cwt-$26.00/cwt).

Our average for galvanized base prices this week is $555 per ton ($27.75/cwt). This represents a $150 per ton spread and that is worrying some buyers. “Hot rolled is the weak sister. That has me a little concerned right now,” is what one service center executive told us earlier today. He went on to explain that with the weak hot rolled markets this forces the mills to move more tons into the value added products which hypothetically could put pressure on those prices in the future.

Foreign steel is a concern in some markets and less so in others. We heard from a Texas company that they were buying material out of Mexico, Taiwan and elsewhere at very competitive numbers. Even so, they admitted that those numbers were beginning to rise.

A large service center told us this evening about foreign steel prices, “The spreads I’m seeing are about $45-70/ton, which is not attractive enough to generate orders. I think if CR and Galv continue to rise and we get to $80, that would do it. Also, Integrated lead-times on coated are getting out to the point where the foreign lead-time becomes less of a risk vs. extended domestic.”

Another large service center told us, “Domestic Mills are holding firm. All first increase plus part of second are sticking. Their order books appear strong. Off-shore looking for +$2.00 from last sale Q4. Those who did not already place may be surprised by Late May quoted arrival. Spot market is picking up. We anticipate this to improve through Q1…with higher prices and less inventory. Commodity implosion is having a psychological impact with buyers. Attitude today is buy only what you need. Too late to hedge.”

With that said, here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $380-$430 per ton ($19.00/cwt- $21.50/cwt) with an average of $405 per ton ($20.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average unchanged over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks.

Cold Rolled Coil: SMU Range is $530-$550 per ton ($26.50/cwt- $27.50/cwt) with an average of $540 per ton ($27.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week while the upper end remained the same. Our overall average is up $10 per ton compared to one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $27.00/cwt-$28.50/cwt ($540-$570 per ton) with an average of $27.75/cwt ($555 per ton) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average $20 higher over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $600-$630 per net ton with an average of $615 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks.

Galvalume Coil: SMU Base Price Range is $27.50/cwt-$28.50/cwt ($550-$570 per ton) with an average of $28.00/cwt ($560 per ton) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week while the upper end increased $10 per ton. Our overall average is $25 per ton higher than it was one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $841-$861 per net ton with an average of $851 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.