Market Data

January 21, 2016

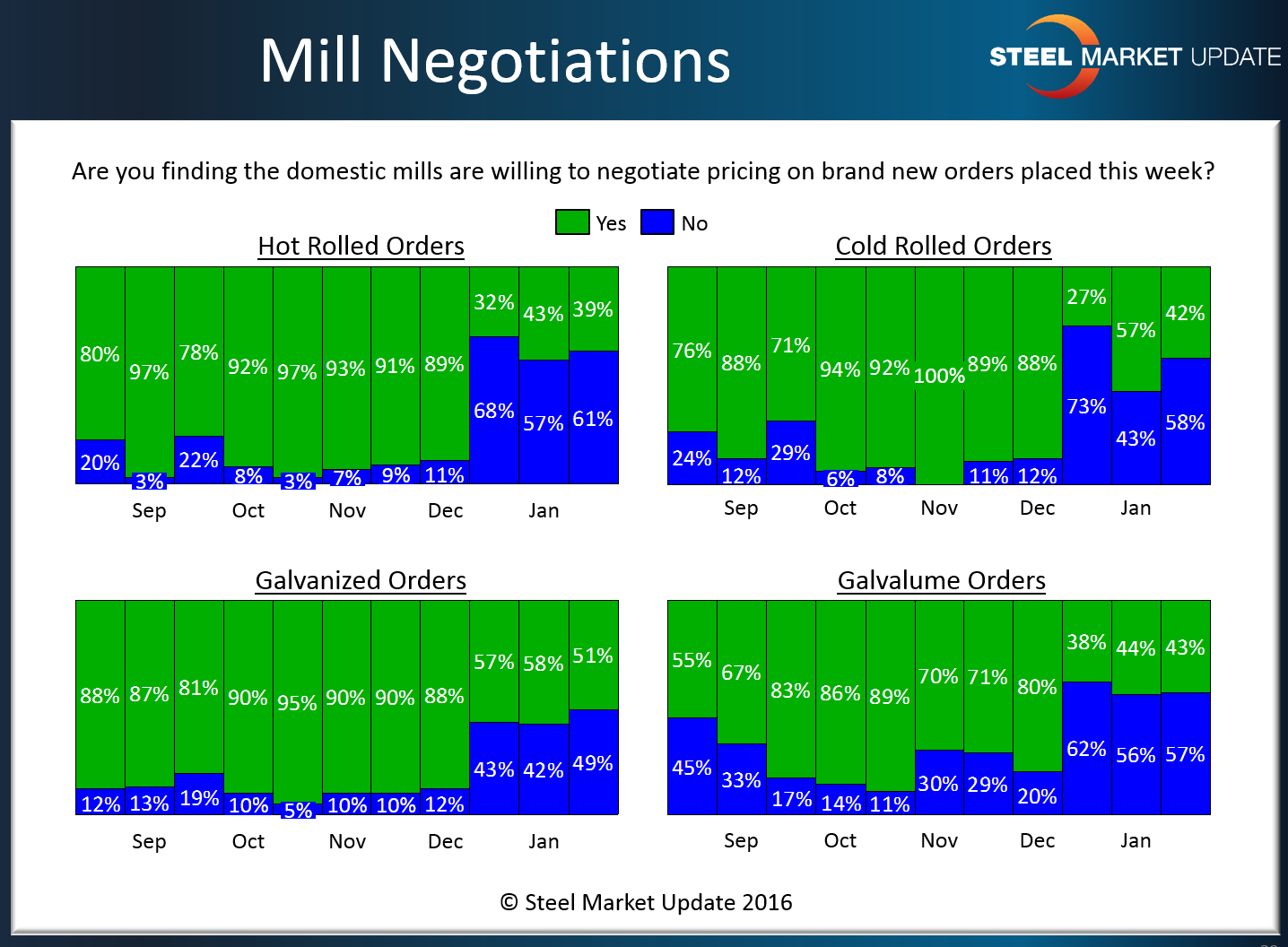

Steel Mills Less Willing to Negotiate Flat Rolled Pricing

Written by John Packard

As lead times move out (see article above) we traditionally find the mills less willing to negotiate flat rolled steel prices. We asked those taking our mid-January flat rolled steel market survey to provide us information regarding the willingness of the U.S. steel mills to discount or negotiate steel prices.

Hot rolled, which has been the weakest of the flat rolled steel products, found 39 percent of those responding to our questionnaire as indicating the mills as willing to negotiate HRC pricing. This is down from the high 80-97 percent range we had been collecting from our surveys in September, October, November and December 2015.

Cold rolled results were similar at 42 percent reporting the mills as willing to negotiate.

Slightly more than half (51 percent) of the respondents reported the mills as willing to negotiate galvanized pricing while 43 percent reported the mills as willing to negotiate Galvalume pricing.

As you can see from the graphic below, the negotiation trend was broken right after the domestic mills began announcing price increases at the beginning of December 2015.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.