Prices

January 21, 2016

Hot Rolled Futures: Conflicting News Affecting HRC Futures

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Assisting Andre with tonight’s article is Jack Marshall also associated with CrunchRisk. Here is how Andre and Jack saw trading over the past week:

Financial Markets

As I may have previously mentioned, the S&P 500 is in the midst of testing its support levels, i.e. the August 2015 low of 1830 and the October 2014 low of 1813. Yesterday morning we hit 1813 exactly and then bounced to today’s high around 1887 only to then retrace back to the 1860 level. Because the market broke the 1830 level it looks much more likely that we are now heading lower still to the 1750 zone or another 200 points down on the S&P or approximately 1800 on the DOW.

Crude oil is one component that has everyone frightened and our lows so far have been around $26 per barrel. We recovered slightly to just under $30 before retracing again. We are last $29.75 zone and probably heading lower still to $18-$20 per barrel area before the sellers finally run out of steam and then short covering ensues. Crude oil in many respects is stopping many from doing anything on the buy side in any commodity or equities markets. If crude were to recover quickly at some point, I would expect forward buying to come into all commodity markets.

Steel

Conflicting news continues to affect HR futures market sentiment. Another round of price increase announcements and longer mill lead times have not helped spot HR as HRC settlement index reported @ $383 down $7 from the previous week. This leaves the current month to date average for January HR CRU @ $386/ST[$19.30cwt] well short of the 1st round of mill price increase announcements and no where near the 2nd round. Anticipated steel demand due to expected inventory replenishment does not seem to have materialized for the mills to offset current available capacity.

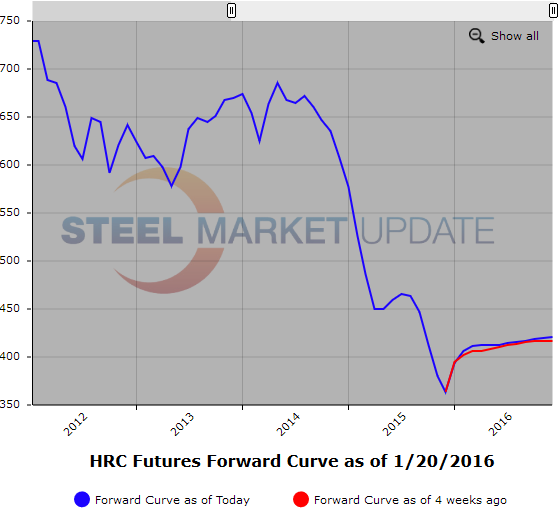

HR futures trading has been fairly active with 1,000 plus contracts [20,040 ST] trading this week. Of note is that upward price pressure that was building last week abated yesterday following the CRU release. Futures selling interests which had been absent most of last week resurfaced. Tuesday Mar,Apr and May’16 traded @ $418/ST[$20.90cwt], in contrast yesterday values dropped as Q1’16 traded @ $403/ST[$20.15cwt] and Q2’16 traded @$413/ST[$20.65cwt] and Mar/Jun’16 traded @ $412/ST[$20.60cwt] and Apr’16 traded @ $409/ST[$20.45cwt]. HR futures prices held steady in 2017 as futures selling interests in the back end of the curve resurfaced looking for bid levels at value. HR Q3’17 traded at $436/ST[$21.80cwt] and 2H’16 traded @ $434/ST[$21.70cwt]. Open Interest for HR is currently 24,034 contracts or 480,680ST.

Spot $383/ST

Q1’16 $403/ST

2H’16 $418/ST

Busheling Scrap (BUS)

Weak demand for East Coast shipments of scrap to Turkey have seen CFR Turkey price indications slide from the low $190’s/GT last week to sub $180/GT here this morning. Strong USD and lower priced alternatives continue to pressure prices. With prices recovering off lows, BUS appears sideways as weak demand reflected in softer HR CRU data will limit near term price pressure. Focus will be on any movement in capacity utilization rates and any possible winter weather for possible changes in BUS value.

Current CME BUS interests we have seen are: Feb/Jun’16 $180/GT bid – offered @ $190/GT. We continue to get inquiries for Cal’16.

LME steel scrap interests: Jan’16 offered @ $189/MT, Feb’16 offered @ $190/MT.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.