Prices

January 14, 2016

Keeping an Eye on Demand

Written by John Packard

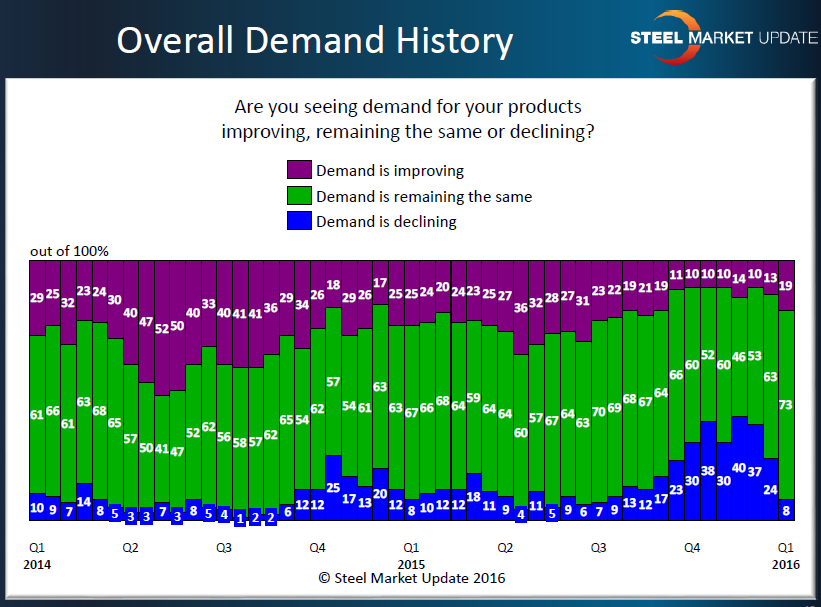

Over the last two flat rolled steel market analysis performed by Steel Market Update (the last concluding this past Thursday, January 7th) we have seen a dramatic break in the overall (all participants included) demand trend. As you can see by the graphic provided, over the past two quarters we saw the rise and peak of those reporting that demand is declining. During the past six weeks we saw the percentage of respondents reporting declining demand move from 37 percent to 24 percent and this past week that number dropped to just 8 percent.

At the same time we are seeing an early move for those respondents who are reporting demand as improving which went from 10 percent to 13 percent and last week finished at 19 percent.

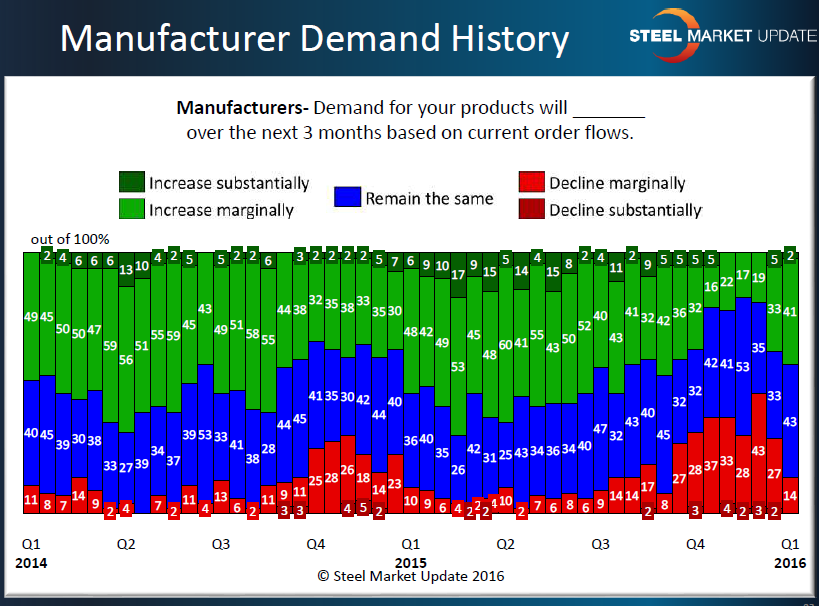

The majority of the change appears to be coming from the end user segment of our survey. We saw a strong move over the past four weeks by the manufacturing sector. Forty-three percent of the manufacturing respondents said that demand for their products was either increasing substantially (2 percent) or marginally (41 percent).

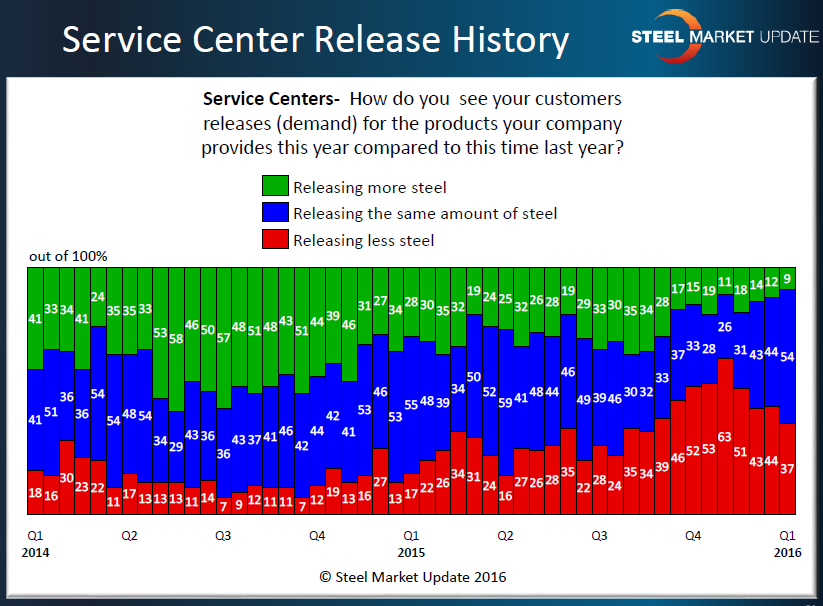

From the service center perspective we are seeing a small change but a large percentage of the service center respondents continue to report their customers as releasing less steel than at this time last year. Based on the manufacturers responses we think the red bars on the below graphic will continue to recede as business slowly improves.