Prices

January 12, 2016

SMU Price Ranges & Indices: New Increases Should Push Prices Higher

Written by John Packard

The prices we have referenced in tonight’s issue do not reflect the new price increase announcements. We understand that there are new prices floating in the marketplace that has galvanized and Galvalume base prices at $28.50/cwt and hot rolled well over $400 per ton. However, the numbers we have been collecting since Monday are showing prices as being up by $10 per ton compared to what we were gathering last week.

Our SMU Price Momentum Indicator continues to point toward higher prices in the coming weeks. This has been reinforced by the announcements out of Nucor, California Steel and NLMK USA earlier today.

A service center executive forwarded SMU an email where one of their mill suppliers told them they had until the end of the day to get their orders in or risk new prices tomorrow (not one of the mills who made public announcements today).

Prior to the announcements being made we held conversations with a number of very large service centers who discussed with us their desire to have the mills move cautiously higher and not try to bit off more than the market can bear. We will all be watching lead times as well as foreign offerings (which have been running $20-$30 per ton higher than late December offers according to the sources we spoke to today) for signs of strength and weakness.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $370-$410 per ton ($18.50/cwt- $20.50/cwt) with an average of $390 per ton ($19.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end remained the same. Our overall average $10 higher over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 3-7 weeks.

Cold Rolled Coil: SMU Range is $520-$540 per ton ($26.00/cwt- $27.00/cwt) with an average of $530 per ton ($26.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week while the upper end remained the same. Our overall average is $10 per ton higher than it was one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $26.00/cwt-$27.00/cwt ($520-$540 per ton) with an average of $26.50/cwt ($530 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end remained the same. Our overall average $10 higher over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $580-$600 per net ton with an average of $590 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks.

Galvalume Coil: SMU Base Price Range is $26.00/cwt-$27.00/cwt ($520-$540 per ton) with an average of $26.50/cwt ($530 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week while the upper end remained the same. Our overall average is $10 per ton higher than it was one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $811-$831 per net ton with an average of $821 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

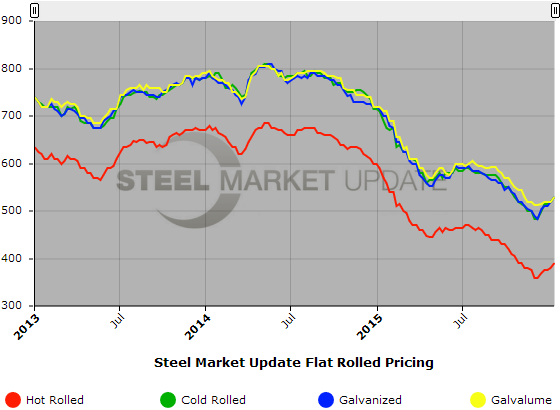

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.