Analysis

January 9, 2016

Dodge Momentum Index Bounces Back in December

Written by Sandy Williams

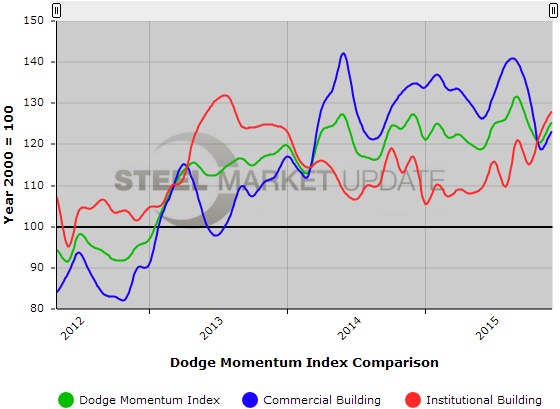

The Dodge Momentum Index bounced back in December after a 3.6 percent decline the previous month. The Momentum Index, a measure of the initial report for nonresidential building projects in planning, rose 4.1 percent to post 125.2 in December. The increase was spread between commercial and institutional planning which rose by 3.6 percent and 4.7 percent, respectively. The index reading for commercial building in December was 123.1 and posted 127.9 for institutional building.

On a year over year basis, the index finished 2.4 percent higher than its previous December reading. Commercial projects declined 6.7 percent after surging 26.4 percent during 2014 and then settling into a more sustainable pace in 2015.

Dodge Data & Analytics expects renewed growth in planning activity for the commercial sector in 2016, supported by strong industry fundamentals such as vacancy rates and employment.

Compared to December 2014, institutional project planning was 15.8 percent higher due to passage of construction bond measures and improved financial conditions for state and local governments.

Ten projects exceeding a value of $100 million entered the planning stage in December.

The Dodge Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.