Government/Policy

December 28, 2015

Corrosion Resistant AD & CVD Net Results

Written by John Packard

Last week the U.S. Department of Commerce announced the Preliminary Determination of the Antidumping (AD) portion of the CORE (corrosion resistant – galvanized, Galvalume, aluminized, etc.) trade suit.

We have received a number of questions/comments regarding the actual impact of the various rulings and what the ultimate cash deposits (not duties yet) will be.

Last week we heard from trade attorney Lewis Leibowitz that the US Department of Commerce has not changed the deposit rate to adjust for export subsidies for China. He told us this was because the countervailing duty (CVD) preliminary determination did not find any export subsidies for Yieh Phui (China) in the CVD preliminary determination. Yieh Phui was the only company that cooperated in the in the CVD investigation.

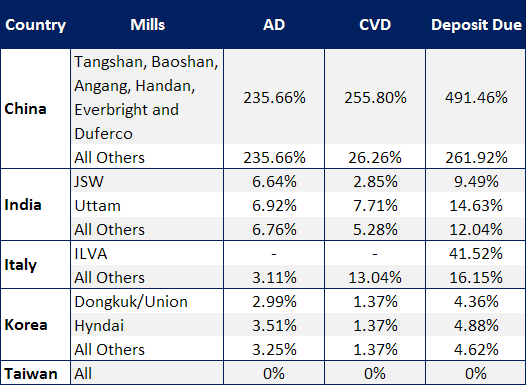

The CVD rate for Yieh Phui was 26.26 percent which also applies to all other Chinese exporting mills except for the mills that received Commerce questionnaires but did not cooperate with the investigation. Those companies, as cited in the CVD preliminary circumstances announcement, were: Tangshan, Baoshan, Angang, Handan, Everbright and Duferco. Each of these companies is subject to a 235.66 percent CVD deposit rate.

The deposit rates required for YP and all of the other Chinese steel mills (except those cited in the CVD announcement noted in the paragraph above) will be 235.66 + 26.26 = 261.92 percent.

For Tangshan, Baoshan, Angang, Handan, Everbright and Duferco their deposit rates would be 235.66 + 255.80 = 491.46 percent.

The deposit rates will need to be paid if they entered the US on or after the date the AD/CVD Preliminary Determinations were printed in the Federal Register. The countervailing duty determination was published November 6, 2015. The antidumping determinations have not been published as of December 28, 2015.

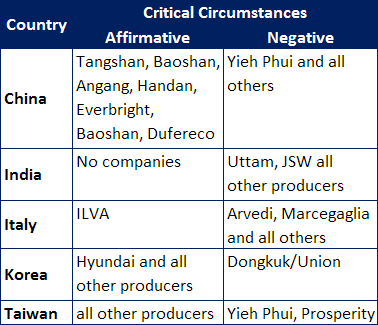

Those countries hit with critical circumstances could be asked to pay the deposit rate(s) back dated by 90 days from the date the appropriate notice was published in the Federal Register.

Here are the results for critical circumstances:

So, the interesting question is how competitive will India and Korea be against Taiwan and the other countries that do not have dumping deposits?

SMU spoke with a trading company which represents Taiwanese steel mills and his comment was their Indian competition should no longer be a problem for their mills due to the Indian mills having to pay 9.49 to 14.63 percent cash deposits.

Don’t forget currency values also become an important consideration when figuring out who will be competitive going forward and who will not…

We will continue to focus on this angle in the coming days.