Market Data

December 17, 2015

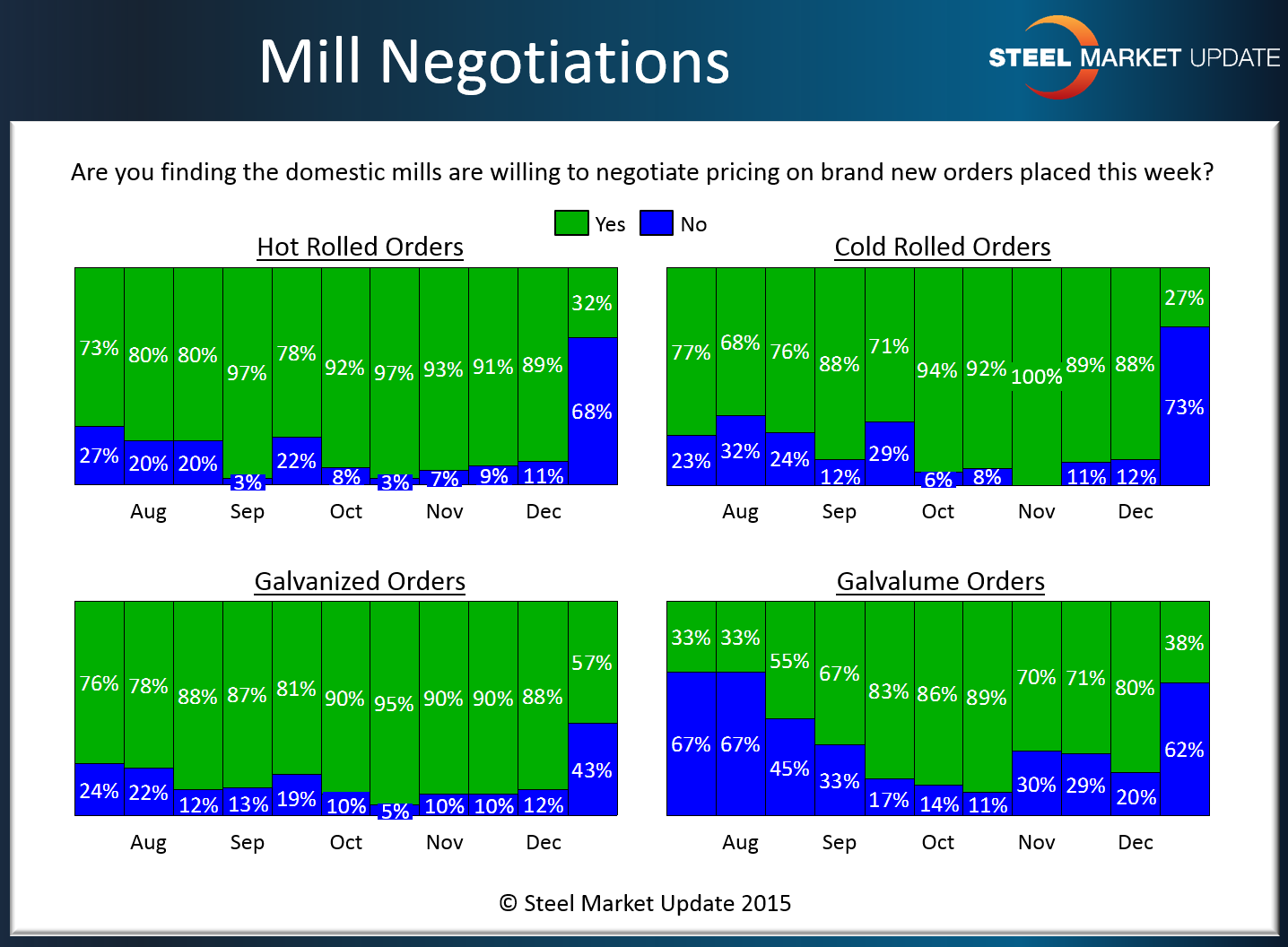

Steel Mills Standing Behind Announcements Less Willing to Negotiate Pricing

Written by John Packard

There was a significant change in the willingness of the domestic steel mills to negotiate pricing with their customers after the price announcements were made. According to the results of this week’s flat rolled market analysis conducted by Steel Market Update all products saw the percentage of those reporting the mills as willing to negotiate as dropping.

Our market analysis, which only two weeks earlier saw 89 percent of those responding to our questionnaire reporting the mills as willing to negotiate hot rolled pricing, this week only 32 percent saw the market the same way.

Cold rolled dropped from 88 percent two weeks ago to 27 percent this week.

Galvanized went from 88 percent to 57 percent.

Galvalume went from 80 percent to 38 percent.

So, we have seen the first couple steps in the process. The domestic mills have made price announcements (step 1) and now we are seeing, at least for now, that they are trying to collect a good portion of the announced increases (step 2).

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.