Market Data

December 17, 2015

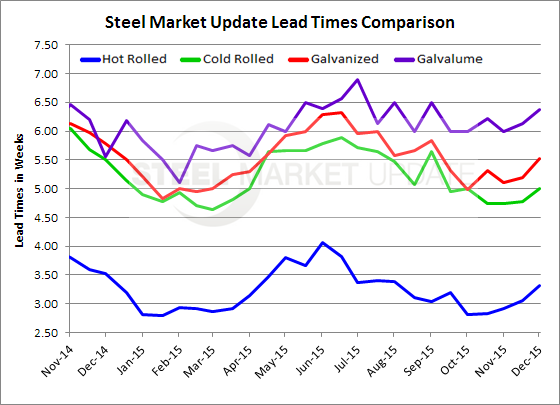

Steel Mill Lead Times Beginning to Move but Still Below Year Ago Levels

Written by John Packard

Flat rolled steel lead times, according to those responding to this week’s market analysis questionnaire, have begun to move. The question now becomes will they continue to move and will they move out far enough to force buyers back into the market?

Our respondents reported hot rolled lead times as having extended slightly from the 3.05 weeks reported at the beginning of December to 3.32 weeks this week. Over the past 3 months lead times have been averaging less than 3.0 weeks. One year ago HRC lead times were reported to be averaging 3.53 weeks.

Cold rolled lead times also move out slightly and are now reported to be averaging 5.0 weeks. One year ago CRC was averaging 5.5 weeks.

Galvanized lead times also moved out a tick to 5.52 weeks from the 5.20 weeks reported two weeks ago. Last year at this time GI lead times averaged 5.78 weeks.

Galvalume lead times are now being reported as averaging 6.38 weeks slightly longer than the 6.13 weeks reported two weeks ago and above the 5.55 weeks reported at this point in time last year.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.