Prices

December 15, 2015

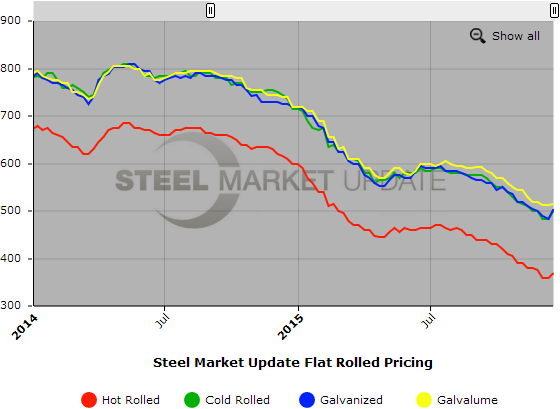

SMU Price Ranges & Indices: Heading on Up

Written by John Packard

When Steel Market Update (SMU) reviews pricing we take a number of items into account. We look at the transaction prices that buyers report to us as having been made within the past few days. We look at the offers to sell being made by the mills as well as the offers to buy being made by buyers (ask/bids) to see if the momentum has changed. We also take into consideration information that we glean from domestic mills regarding the transaction prices they report to us. The fact that we actively consider asking prices (or bids when prices are moving lower) keeps us on the cutting edge of where we believe actual prices to be as well as the direction they are heading.

The domestic steel mills began raising spot prices last week. We are seeing the results of those increases being reflected in the upper end of our range. On average we are reporting the upper end as being at least $20 per ton higher than one week ago (exception Galvalume which tended to already reflect higher spread than galvanized). Hot rolled continues to be the weakest product and we will watch it carefully as we go through the next few weeks as we expect the bottom end to move higher from here.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $340-$400 per ton ($17.00/cwt- $20.00/cwt) with an average of $370 per ton ($18.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end increased $20 per ton. Our overall average is $10 per ton higher than last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 3-4 weeks.

Cold Rolled Coil: SMU Range is $480-$520 per ton ($24.00/cwt- $26.00/cwt) with an average of $500 per ton ($25.00/cwt) FOB mill, east of the Rockies. The lower end of our range rose $15 per ton compared to last week while the upper end increased $20 per ton. Our overall average is up $17.50 per ton over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $24.00/cwt-$26.50/cwt ($480-$530 per ton) with an average of $25.25/cwt ($505 per ton) FOB mill, east of the Rockies. The lower end of our range increased $15 per ton compared to one week ago while the upper end rose $30 per ton. Our overall average is up $22.50 per ton from last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $540-$590 per net ton with an average of $565 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $24.50/cwt-$27.00/cwt ($490-$540 per ton) with an average of $25.75/cwt ($515 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $5 per ton compared to last week while the upper end increased $10 per ton. Our overall average is up $2.50 per ton over one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $781-$831 per net ton with an average of $806 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.