Market Segment

December 15, 2015

Service Center Flat Rolled Shipments & Inventories Fall

Written by John Packard

The Metal Service Center Institute (MSCI) released shipment and inventory data for U.S. steel distributors. The headline for total steel products is shipments fell during the month of November both on a month over month basis (143,100 tons per day in November vs. 152,900 tons during October) as well as on a year-over-year basis (-8.1%).

U.S. steel service centers shipped a total of 2,862,700 tons during the 20 shipping days in November.

Inventories (all products) ended the month at 8,547,800 tons and, based on the daily shipment rate the month ended with 3.0 months worth of inventories on the floors of the service centers. The 3.0 month figure is up from the 2.7 months reported at the end of October. However, the 8.5 million tons is much lower than the 8.9 million tons reported at the end of October and well below the 9.2 million tons held at the end of November 2014.

Flat Rolled

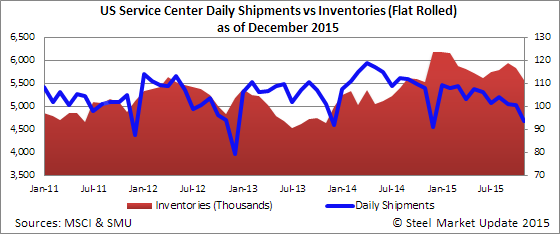

U.S. flat rolled distributors shipped 1,873,800 tons of sheet and coil products or an average of 93,700 tons per day. The 93,700 daily shipment rate is the worst seen since December 2014 when service centers shipped 91,200 tons per day of carbon flat rolled. Shipments were down 8.7 percent on a year-over-year basis.

Flat rolled inventories stood at 5,574,600 tons as of the end of November. Inventories dropped by 256,100 tons during the month but, because of the slowing shipment rate the number of months on hand increased from 2.6 to 3.0 months.

SMU Premium Forecast Results for November

![]() Every month SMU produces a shipment forecast for our Premium level subscribers. Last month we forecast flat rolled shipments would be 1,944,000 tons. Our forecast called for shipments to be 10 percent lower than the previous year (YOY). The actual reduction was 13.2 percent which is the second largest reduction year-over-year since April’s 13.3 percent miss. With actual shipments being 1,873,800 tons we missed our shipment forecast by only 70,200 tons.

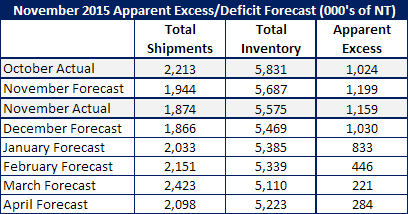

Every month SMU produces a shipment forecast for our Premium level subscribers. Last month we forecast flat rolled shipments would be 1,944,000 tons. Our forecast called for shipments to be 10 percent lower than the previous year (YOY). The actual reduction was 13.2 percent which is the second largest reduction year-over-year since April’s 13.3 percent miss. With actual shipments being 1,873,800 tons we missed our shipment forecast by only 70,200 tons.

When it came to inventories of flat rolled products we originally forecast total inventories would drop to 5,687,000 tons by the end of November. The actual reduction was larger than we forecast as daily receipts dropped to 80,885 tons per day. This was dramatically better (from an inventory reduction standpoint) as we had forecast receipts would drop to 90,000 tons per day (October was 96,000 tons/day and the 3-year average for the month of November 95,500 tons per day).

SMU Apparent Excess Inventories at Distributors and Premium Forecast

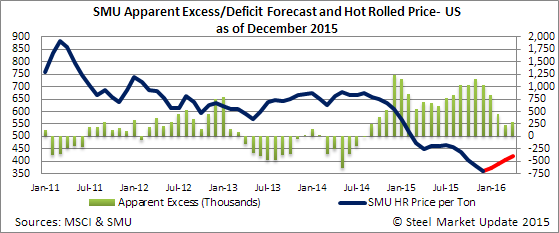

Based on our proprietary model we have the U.S. flat rolled steel distributors continuing to operate with inventory levels in excess by over 1 million tons. Our original forecast from last month had the excess growing slightly from the end of October’s 1,024,000 tons to 1,199,000 tons by the end of November. Based on the actual shipment and inventory data the Apparent Excess is now 1,159,000 tons.

Steel Market Update is of the opinion that shipments will be strained to keep pace in January and February (by historical standards). We believe the distributors will continue to reduce inventories through March 2016.

Our forecast calls for December receipts will be similar to November at 80,000 tons per day. Then in January we believe receipts will be down 15 percent below the 3-year average, by February that number drops to 7.5 percent below the 3-year average and then March and April are both expected to be down 5 percent below the 3-year average. If our forecast is correct our Apparent Excess model looks like this:

In our opinion once we get into March lead times we should begin to see a spurt in buying as the service centers will need to begin to restock. . With the latest price announcements coupled with shrinking inventories at the distributors we see prices as firming over the next couple of months. We do not see prices moving too far too fast as demand continues to be a question as well as the spread between domestic and foreign price offers.

Carbon Plate

U.S. service centers shipped 280,900 tons of plate during the month of November. This is 46,000 tons behind the prior month and 8 percent below November 2014.

Plate inventories stood at 869,600 tons which is 29.2 percent lower than one year ago levels. Based on the current shipping rate of 14,000 tons per day the distributors have 3.1 months of supply on hand.

Pipe & Tube

Distributors shipped 192,500 tons of carbon pipe & tube during the month. The 9,600 ton per day shipping rate is the lowest since December 2014 (9,500/tons per day).

Inventories of pipe & tube stood at 619,900 tons and the months on hand rose from 2.9 to 3.2 months based on the current shipping rate.