Market Data

December 10, 2015

HARDI Economist Forecasting "Good" 2016 and Better 2017

Written by John Packard

Earlier this week Steel Market Update (SMU) attended the annual HARDI conference in Orlando, Florida. The well attended conference focused on a number of areas affecting the HVAC Wholesalers including presentations on the economy by Alan Beaulieu of the Institute for Trend Research (ITR) and Steel Market Update regarding the status of the galvanized sheet industry.

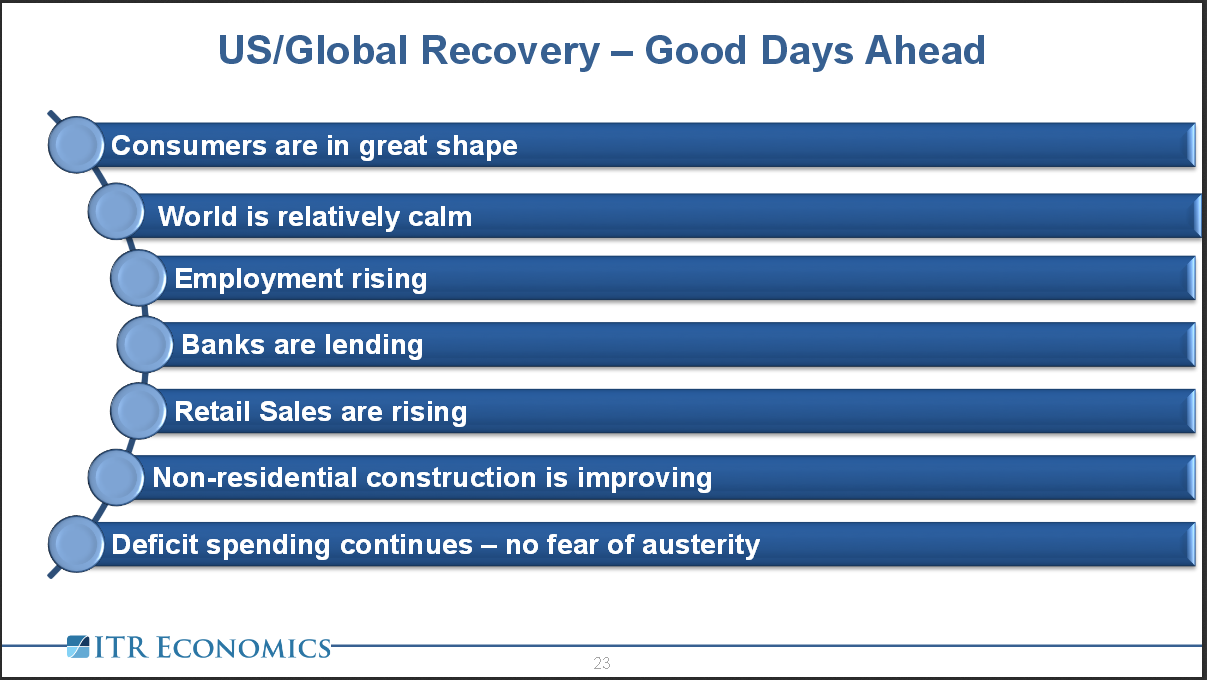

Mr. Beaulieu, who is the Chief Economist associated with HARDI, advised those attending that 2016 will be stronger than 2015 and 2017 will be even better than 2016. He told the group, “We have a nice healthy outlook.”

Beaulieu told the HARDI members that there would be “no major spiking in prices next year.” He said, “It will be moving up mostly in the 2nd Half of next year.” Beaulieu believes that commodity prices will rise next year as China gets a handle on their economy which is expected to improve as the year progresses.

Oil prices are forecast to reach $55-$60 per barrel with most of the movement being during the 2nd half 2016.

He told the group that they should expect some slowing of business through the first quarter and into Q2 2016. ITR has their forecast reflecting stronger growth beginning in May 2016.

One of the items affecting the wholesalers is the anticipation of a slowing in the rate of rise in new housing construction. Beaulieu reported commercial construction as “slowing” through the first half 2016 before bouncing back in the 2nd half.

However, most of the news was good for the HARDI wholesalers and their suppliers. Beaulieu told the group to expect 2016 HARDI business rates to increase by 7 percent over 2015.

He pointed to the rest of the business world is looking at the U.S. as the destination for business once again. He told the group the premium to manufacture in the U.S. versus China has been reduced to 5 percent and the U.S. has a much more productive workforce. There is a nice spend rate in office buildings which are forecast to grow by 15.7 percent in 2016 over 2015.

The wholesalers should also expect increases in Lodging construction (+21.3%) and Industrial construction (+9.7%).

Industrial production, which will end the year 2015 up 1.6 percent over 2014, is projected to grow by 2.5 percent in 2016 and another 2.9 percent in 2017.

Beaulieu told the wholesalers not to get to enamored with the stock market which he called “statistical noise.”

The next recession should be 2019 and the Great Depression (which he writes about in his book, Prosperity in the Age of Decline) will be approximately the year 2030.

You can learn more about the Institute for Trend Research on their website. You can also see Alan Beaulieu make his economic forecast during our next Steel Summit Conference in Atlanta on August 30-31, 2016.

Our Leadership Summit will include a learning experience from another one of the ITR economists: Alex Chausovsky. Come join us in Palm Beach Gardens, Florida on March 7-9, 2016.