Analysis

December 8, 2015

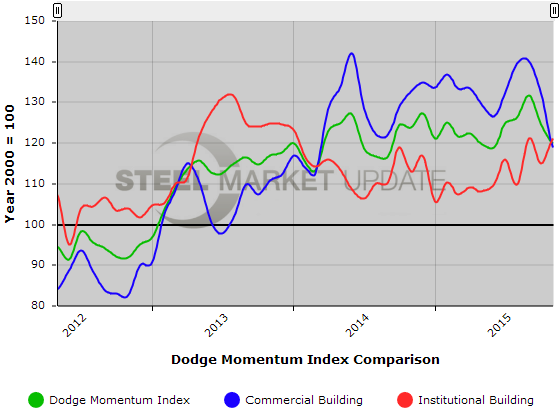

Dodge Momentum Index Drops in November

Written by Sandy Williams

The Dodge Momentum Index dropped 3.7 percent to 119.9 in the November report from Dodge Data and Analytics. The index spiked in July and September but lost construction planning momentum in October and November. The index is now more consistent with the “gentle upward trend in planning activity that began in 2012” says Dodge.

Commercial building planning fell 10.2 percent in November while planning for Institutional building increased 5.3 percent.

Seven projects in November, exceeding $100 million in value, entered the planning stage last month.

The Dodge Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.