Market Data

December 6, 2015

Net Job Creation by Industry through November 2015

Written by Peter Wright

The Bureau of Labor Statistics (BLS) analysis of non-farm employment reported on Friday that 211,000 jobs were added in November, which was in line with economist’s consensus expectations. Both September and October were revised up by a total of 38,000.

The three month moving (3MMA) of gains through November was 218,000. The unemployment rate, U3, calculated from a different survey, remained constant at 5.0 percent. Monthly job gains have averaged 210,000 per month in the eleven months of 2015 (Figure 1).

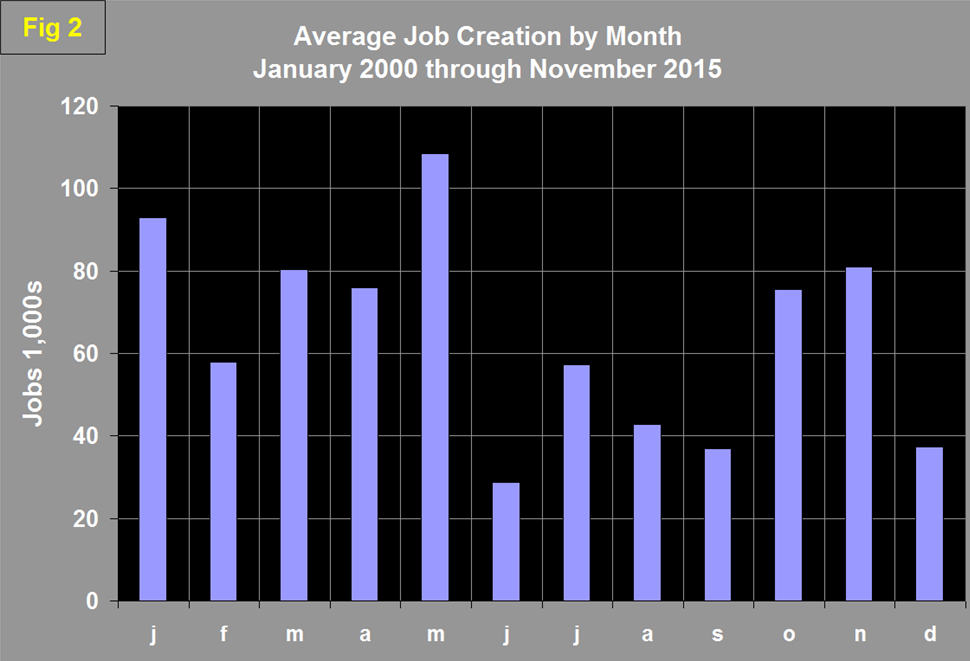

These numbers are seasonally adjusted by the BLS, so to examine if any seasonality is left in the data after adjustment we have developed Figure 2 which suggests that the adjustment is far from perfect. In 16 years the average gain from October to November has been 7 percent, this year the change was negative 29 percent.

If history is an accurate guide we can expect a job gain of about 114,000 in December. Total nonfarm payrolls are now 4,535,000 more than they were at the pre-recession high of January 2008. In November the average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.5 hours. Both the manufacturing workweek and factory overtime were unchanged at 40.7 hours and 3.2 hours, respectively. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was also unchanged at 33.7 hours. In November, average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents to $25.25, following a 9-cent gain in October. Over the year, average hourly earnings have risen by 2.3 percent. Average hourly earnings of private-sector production and nonsupervisory employees, at $21.19, changed little.

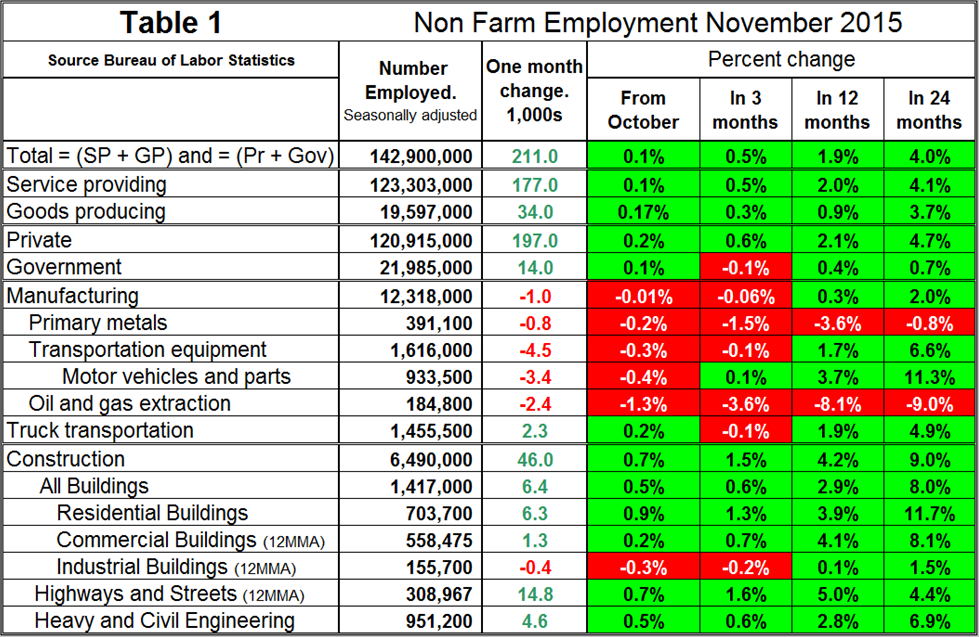

Table 1 slices total employment into service and goods producing industries and then into private and government employees.

Total employment equals the sum of private and government employees. It also equals the sum of goods producing and service employees. Most of the goods producing employees work in manufacturing and construction and the major components of these two sectors are also shown in Table 1. In November, 197,000 jobs were created in the private sector and 14,000 in government. The growth of government jobs was split, 6,000 Federal, 3,000 State and 5,000 Local. Since February 2010, the employment low point, private employers have added 13,742,000 as government has shed 491,000. In November service industries expanded by 177,000 as goods producing industries added 34,000 people. Since February 2010, service industries have added 11,281,000 and goods producing 1,970,000 positions. Table 1 shows that manufacturing lost 1,000 jobs in November. In all of 2015, manufacturing has had a zero change in total employment which seems to confirm the ISM survey released last week indicating that manufacturing growth has stalled.

Note the subcomponents of both manufacturing and construction shown don’t add up to the total because we have only included those that have most relevance to the steel industry. Primary metals lost 800 jobs in November, is down by 3.6 percent in the last 12 months and has not had a single positive growth month in 2015. Motor vehicles and parts lost 3,400 jobs in November, oil and gas extraction has had negative job creation in all four time periods examined in Table 1. Truck transportation gained 2,300 jobs in November and is up by 1.9 percent in 12 months. Construction added 46,000 jobs in November which was the best result since January 2014 and followed Octobers strong 34,000 gain. Some of the major construction sub categories are routinely reported one month in arrears which distorts the data in Table 1. These include, industrial buildings, commercial buildings and highways and streets. Much of the construction increase occurred in residential specialty trade contractors (+26,000). Over the past year, construction employment has grown by 259,000.

Since the bottom of the employment recession, construction has now moved ahead of manufacturing as a job creator. Having said that, it must be recognized that productivity increases in manufacturing are very much greater than they are in construction. As an example of this, employment in the manufacture of automotive vehicles and parts is down by 29 percent from early 2000 but auto assemblies in the US are only down by about 8 percent in the same time frame. Construction has added 990,000 jobs and manufacturing 865,000 since the recessionary employment low point in February 2010 (Figure 3).

Based on the total construction analysis that we report in our CPIP update, we assume that construction jobs will continue to expand assuming labor can be found. Construction has been holding back steel demand but that should increasingly not be the case.

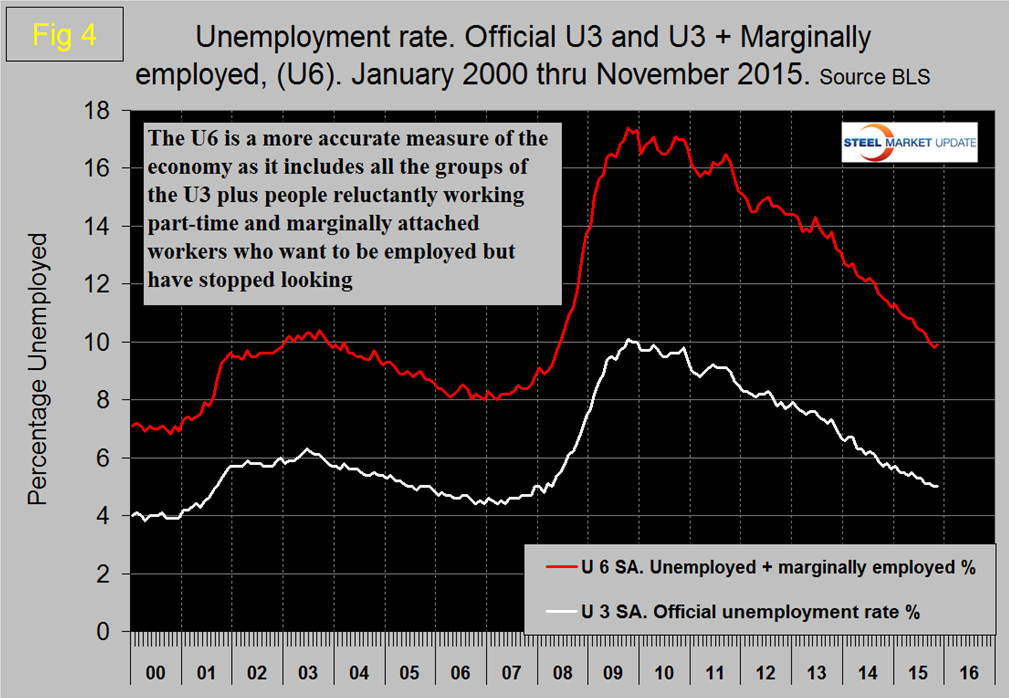

The official unemployment rate known as U3, has decreased from 5.5 percent in May to 5.0 percent in October where it remained in November. This number doesn’t take into consideration those who have stopped looking. The more comprehensive U6 unemployment rate decreased from 11.3 percent in January to 9.9 percent in November (Figure 4).

U6 includes workers working part time who desire full time work and people who want to work but are so discouraged that they have stopped looking. The differential between these rates was usually less than 4 percent before the recession but is still 4.9 percent. The good news is that the gap is slowly closing.

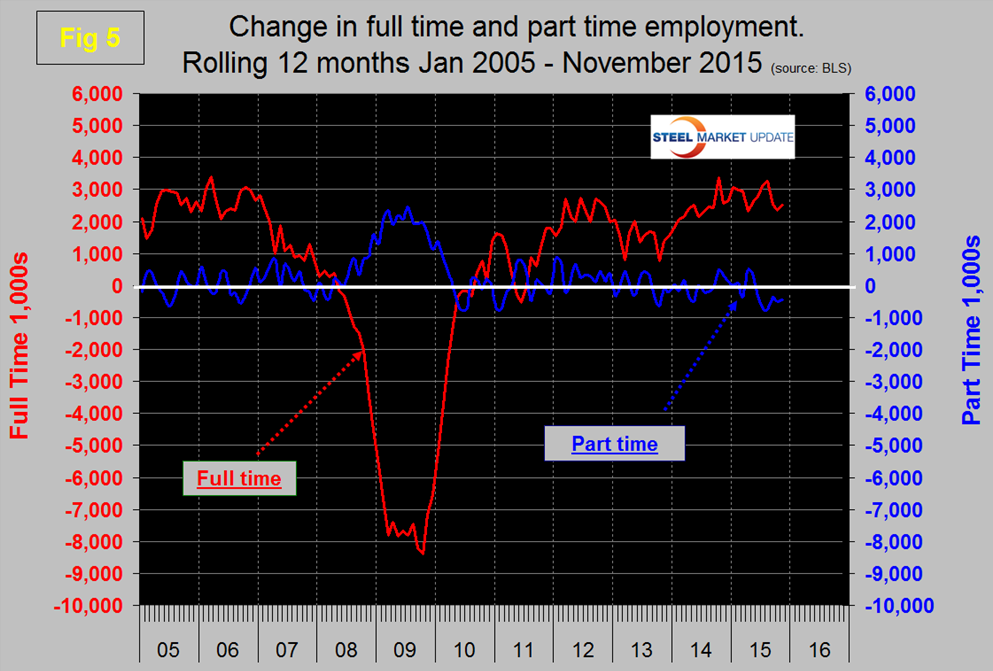

So far in 2015 there has been an increase of 2,093,000 full time jobs and a decrease of 186,000 part time jobs. Figure 5 shows the rolling 12 month total change in both part time and full time employment.

Frequently in the press we read that a large part of job creation is in part time employment. This is not the case but because the part-time numbers are extremely volatile we have to look at longer time periods than a month or even a quarter to get the picture.

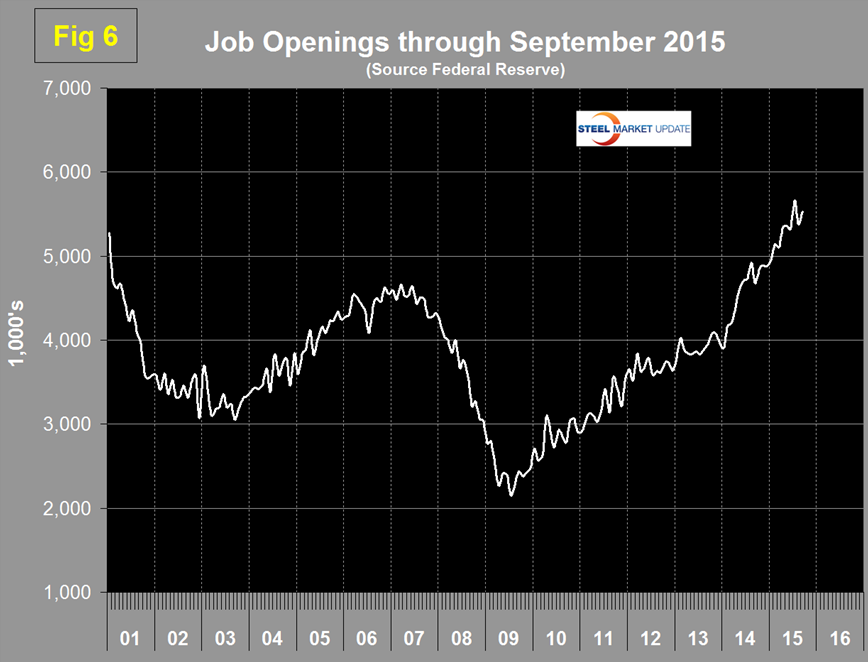

The job openings report known as JOLTS is reported on about the 10th of the month by the Federal Reserve and is over a month in arrears. Figure 6 shows the history of unfilled job openings which have skyrocketed this year to levels not seen since the data series was initiated in 2000.

The previous high was 5.25 million at the end of 2000; in 2015 we have seen a surge from 4.965 million in January to 5.526 million in the latest report.

SMU Comment: It’s inescapable that the rate of growth of manufacturing has slowed and according to the ISM survey reported last week has marginally entered a contraction phase. At this time based on October data this is not reflected in the Federal Reserve Industrial production Index. The surprising element of the November jobs report is the strength of construction employment. Construction has been holding steel consumption back but this effect should rapidly disappear. Unfortunately the AISI weekly steel production numbers are moving in the opposite direction with a capacity utilization of only 62.2 percent in week ending November 28th. Even when the import volumes are discounted, steel production is not where it should be based on our benchmark indicators. We can only assume that inventory reduction throughout the supply chain is the cause.