Analysis

December 2, 2015

November Auto Sales Reach 18M SAAR for 3rd Month

Written by Sandy Williams

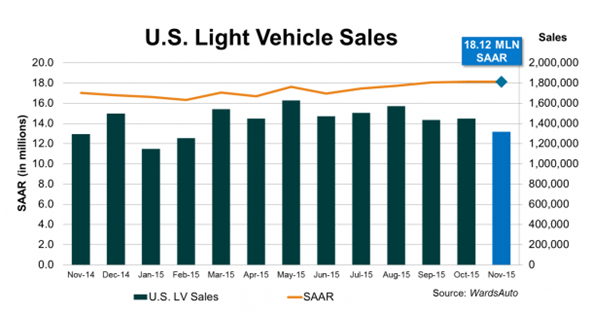

U.S. auto sales reached 1.32 million vehicles in November, a 1.4 percent increase. The seasonally adjusted annual rate according to WardsAuto, was 18.12 million vehicles, the third consecutive month above a SAAR of 18 million units. WardsAuto estimates that December sales will have to reach 1.7 million units to get a fourth consecutive month at 18 million SSAR.

Continued low gas prices, higher incentives and holiday marketing contributed to a strong November turnout by consumers.

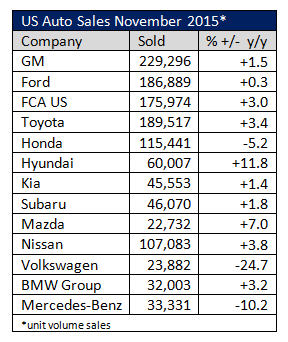

Ford sales lagged behind the other two Detroit automakers at a .3 percent increase year over year. General Motors increased sales by 1.5 percent and FCA US had a good showing with a 3 percent increase.

Volkswagen sales suffered from the recent diesel fuel scandal with sales sliding downward 24.7 percent.

Ford Motor Co. is investing $1.3 billion at the Kentucky Truck Plant in Louisville to build the new aluminum-body Super Duty truck. The facility upgrade will add 2000 jobs. The investment is part of a trend to keep high profit models manufactured in the U.S. while moving production for smaller vehicles to lower-wage countries like Mexico.