Prices

December 1, 2015

SMU Price Ranges & Indices: Are We at the Bottom Yet?

Written by John Packard

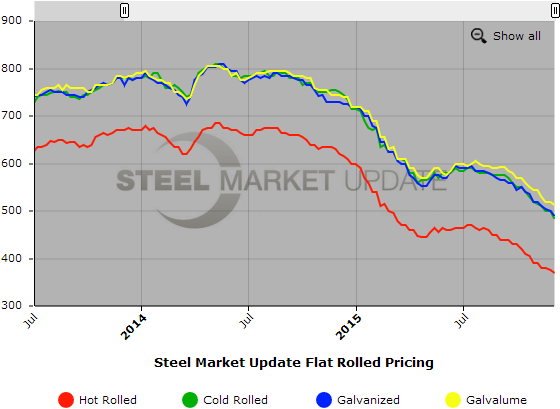

The frustration is beginning to build in the voices of some of the steel buyers as they deal with continuing depreciating flat rolled steel inventories. Prices have been falling since the middle of May 2015 when prices hit a cycle peak of $685 per ton ($34.25/cwt). With our latest adjustment to our hot rolled coil index the market has almost halved the value of HRC compared to where it was in May.

The question on everyone’s tongue is if the bottom is within view. SMU is hearing from some buyers that they can no longer wait for whatever the bottom will look like, it is time to buy. One manufacturing company told us in an email today that they were too busy placing steel orders and could not respond to our latest flat rolled steel market analysis invitation. A service center executive also told us that he was seeing their customers beginning to make commitments (although competition is tough and margins are being squeezed).

One more sign that we may be near a bottom. We have noticed that in the past the other indexes will sometimes drop their averages below ours. We saw some of that last week and we expect it will be the case again this week as our $370 hot rolled average is above prices being reported by a couple of the other indexes as of last week. Our new HRC number is $10 per ton lower than the lowest point achieved during the height of the Great Recession. This is truly amazing – especially when you consider the domestic auto industry announced light vehicle sales in the U.S. of 1.3 million units last month and the industry is challenging the sales record of 17.35 million vehicles set in 2001.

We also are watching lead times as US Steel and AK Steel take out capacity (Granite City and Ashland). We haven’t seen anything quite yet but we will report more on lead times in Thursday evening’s issue of SMU as we collect data from those responding to our invitation sent out earlier this week.

In the meantime, here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $350-$390 per ton ($17.50/cwt- $19.50/cwt) with an average of $370 per ton ($18.50/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago while the upper end remained the same. Our overall average is down $5 per ton compared to last week. SMU price momentum for hot rolled steel has prices moving lower over the coming days.

Hot Rolled Lead Times: 1-4 weeks.

Cold Rolled Coil: SMU Range is $465-$500 per ton ($23.25/cwt- $25.00/cwt) with an average of $482.50 per ton ($24.125/cwt) FOB mill, east of the Rockies. The lower end of our range declined $15 per ton compared to last week while the upper end declined $20 per ton. Our overall average is down $17.50 per ton compared to one week ago. SMU price momentum for cold rolled steel is for prices to slip over the coming days.

Cold Rolled Lead Times: 3-7 weeks.

Galvanized Coil: SMU Base Price Range is $23.50/cwt-$25.50/cwt ($470-$510 per ton) with an average of $24.50/cwt ($490 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to one week ago. Our overall average is down $10 per ton from last week. Our price momentum on galvanized steel is for prices to move lower over the coming days.

Galvanized .060” G90 Benchmark: SMU Range is $530-$570 per net ton with an average of $550 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $24.75/cwt-$26.50/cwt ($495-$530 per ton) with an average of $25.625/cwt ($512.50 per ton) FOB mill, east of the Rockies. The lower end of our range declined $5 per ton compared to last week while the upper end declined $10 per ton. Our overall average is down $7.50 per ton compared to one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards lower prices over the coming days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $786-$821 per net ton with an average of $803.50 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.