Market Data

November 30, 2015

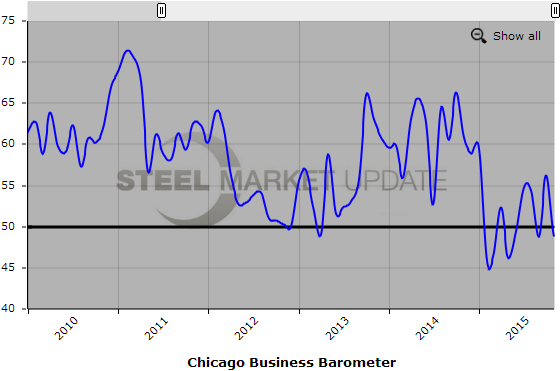

Chicago PMI Falls 7.5 Points

Written by Sandy Williams

The Chicago Business Barometer, or Chicago PMI as it is commonly called, fell 7.5 points in November to 48.7. A decline in new orders put the Index back into contraction for its sixth time this year.

The index, an indicator of business demand in the Chicago area, has been volatile throughout 2015 giving less credence to monthly declines or spikes. New orders fell 15.3 points to 44.1 after a reading of 54.9 in October.

Production fell sharply in November after soaring nearly 20 points in October. The production index settled just above contraction last month, reversing most of October’s gain.

Backlogs were relatively unchanged remaining in contraction for the tenth month. Employment and Supplier delivery indexes increased slightly and remained above the 50 neutral point.

Inventories dropped in November with the index falling sharply below 50 after increasing significantly in October. Of those surveyed, 44 percent still thought inventories were too high while 54 percent said they were about right.

Prices paid declined again in November, remaining in contraction for the fourth consecutive month.

Chief Economist of MNI Indicators Philip Uglow said, “That the Barometer was unable to hold on to the gain seen in October is a reflection of the erratic pattern of demand seen throughout 2015. The slowdown in the global economy, the strong dollar and decline in oil prices have all impacted businesses this year to varying degrees.”

“While it looks likely that the Fed will begin to raise rates in December, the latest setback supports the case for a gradualist approach to monetary tightening.

MNI says barring a bounceback in December, overall activity in fourth quarter has slowed.

The Chicago Business Barometer is an economic indicator based on surveys of purchasing/supply chain professionals in the Chicago area. A monthly publication of MNI Indicators and the Institute for Supply Management, the index is based on responses of manufacturing and non-manufacturing firms who primarily are members of ISM. An index reading above 50 indicates expansion while a number below 50 indicates contraction.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.